Answered step by step

Verified Expert Solution

Question

1 Approved Answer

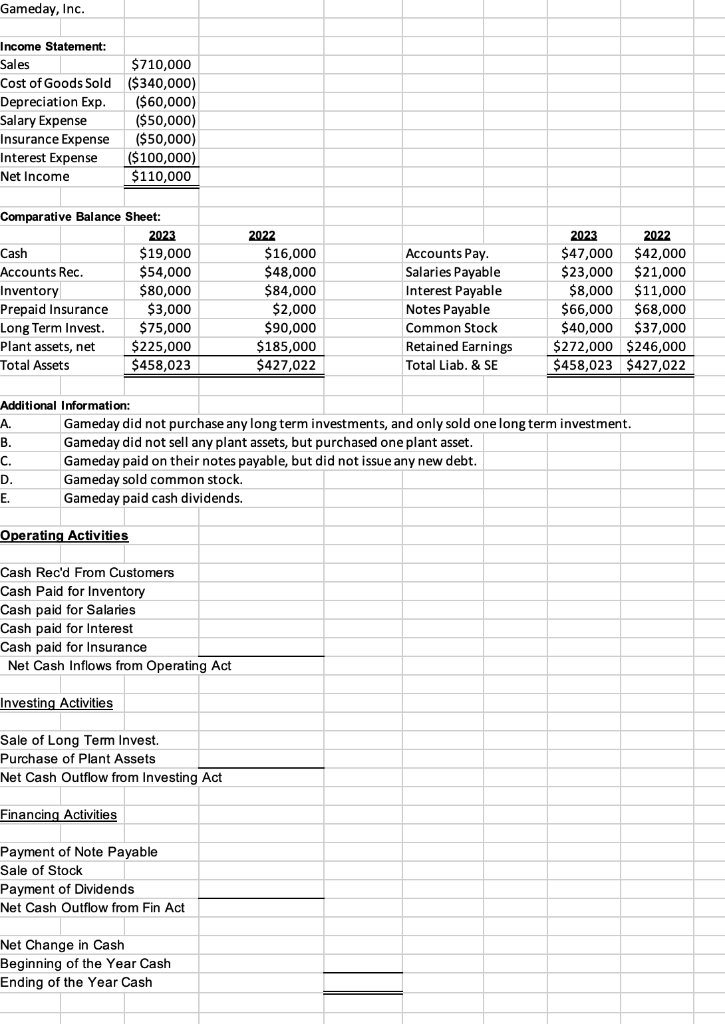

Please show work Gameday, Inc. Income Statement: Sales $710,000 Cost of Goods Sold ($340,000) Depreciation Exp. ($60,000) Salary Expense ($50,000) Insurance Expense ($50,000) Interest Expense

Please show work

Gameday, Inc. Income Statement: Sales $710,000 Cost of Goods Sold ($340,000) Depreciation Exp. ($60,000) Salary Expense ($50,000) Insurance Expense ($50,000) Interest Expense ($100,000) Net Income $110,000 Comparative Balance Sheet: 2023 Cash $19,000 Accounts Rec. $54,000 Inventory $80,000 Prepaid Insurance $3,000 Long Term Invest. $75,000 Plant assets, net $225,000 Total Assets $458,023 2022 $ 16,000 $48,000 $84,000 $2,000 $90,000 $185,000 $427,022 Accounts Pay. Salaries Payable Interest Payable Notes Payable Common Stock Retained Earnings Total Liab. & SE 2023 2022 $ 47,000 $42,000 $23,000 $21,000 $8,000 $11,000 $66,000 $68,000 $40,000 $37,000 $272,000 $246,000 $458,023 $427,022 Additional Information: A. Gameday did not purchase any long term investments, and only sold one long term investment. B. Gameday did not sell any plant assets, but purchased one plant asset. C. Gameday paid on their notes payable, but did not issue any new debt. D. Gameday sold common stock. E. Gameday paid cash dividends. Operating Activities Cash Rec'd From Customers Cash Paid for Inventory Cash paid for Salaries Cash paid for Interest Cash paid for Insurance Net Cash Inflows from Operating Act Investing Activities Sale of Long Term Invest. Purchase of Plant Assets Net Cash Outflow from Investing Act Financing Activities Payment of Note Payable Sale of Stock Payment of Dividends Net Cash Outflow from Fin Act Net Change in Cash Beginning of the Year Cash Ending of the Year CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started