Please show work/ how you calculated each entry! Thanks

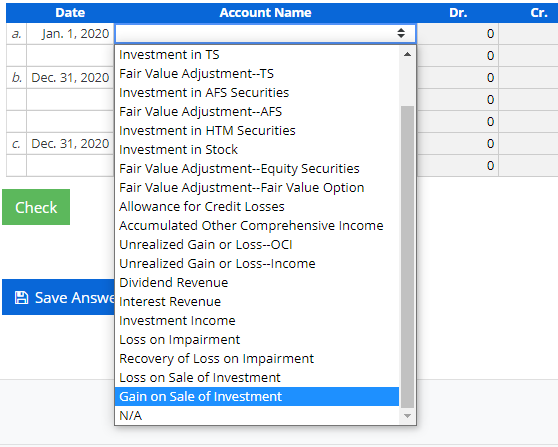

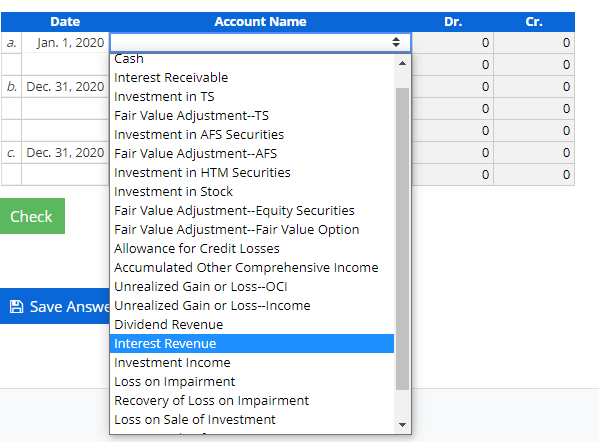

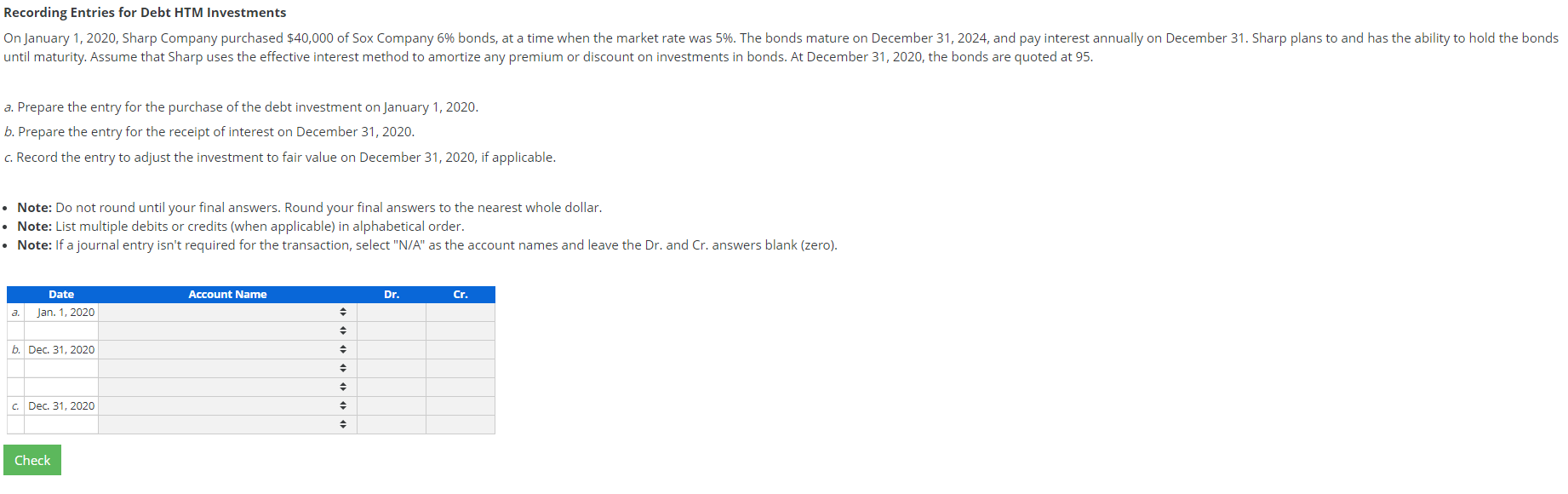

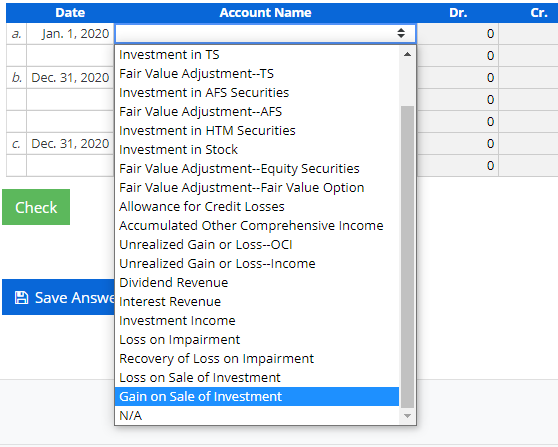

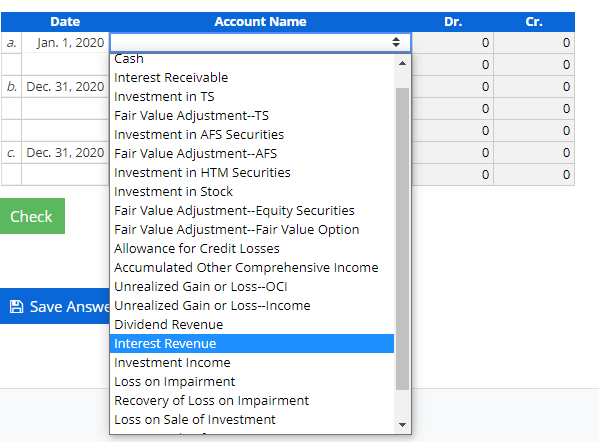

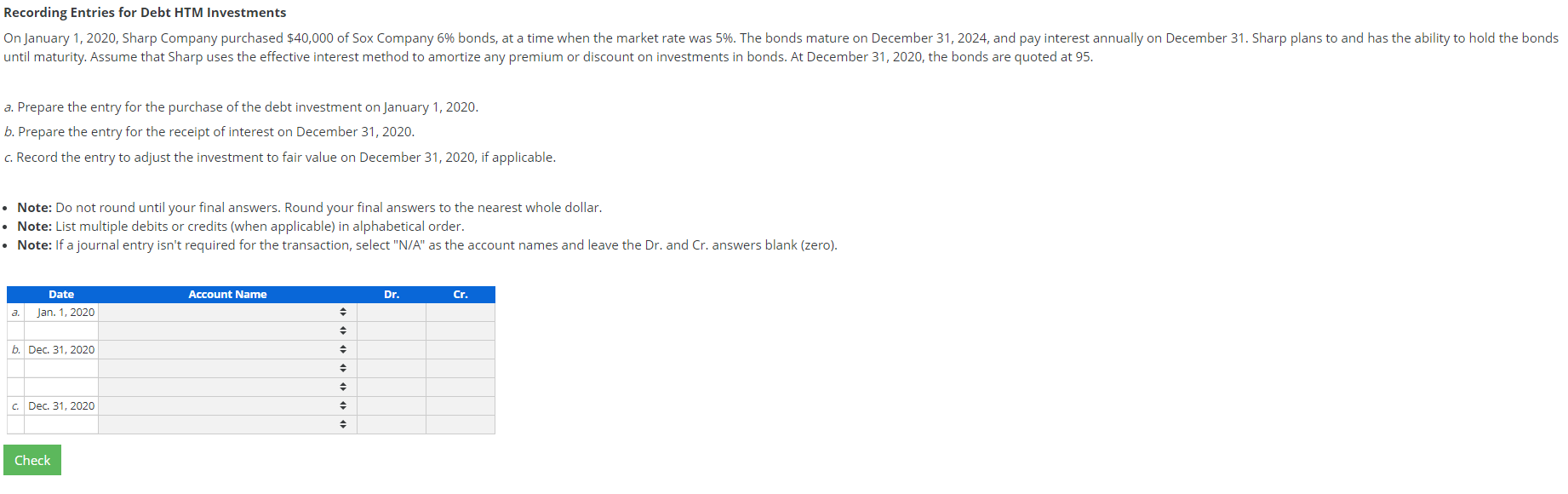

Dr. Cr. a. 0 0 0 0 0 0 0 Date Account Name Jan. 1, 2020 Investment in TS b. Dec 31, 2020 Fair Value Adjustment--TS Investment in AFS Securities Fair Value Adjustment--AFS Investment in HTM Securities C Dec 31, 2020 Investment in Stock Fair Value Adjustment--Equity Securities Fair Value Adjustment--Fair Value Option Check Allowance for Credit Losses Accumulated Other Comprehensive Income Unrealized Gain or Loss-OCI Unrealized Gain or Loss--Income Dividend Revenue Save Answe Interest Revenue Investment Income Loss on Impairment Recovery of Loss on Impairment Loss on Sale of Investment Gain on Sale of Investment N/A Dr. Cr. . 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Date Account Name Jan. 1, 2020 Cash Interest Receivable b. Dec 31, 2020 Investment in TS Fair Value Adjustment--TS Investment in AFS Securities c Dec 31, 2020 Fair Value Adjustment--AFS Investment in HTM Securities Investment in Stock Check Fair Value Adjustment--Equity Securities Fair Value Adjustment--Fair Value Option Allowance for Credit Losses Accumulated Other Comprehensive Income Unrealized Gain or Loss--OCI Save Answe Unrealized Gain or Loss--Income Dividend Revenue Interest Revenue Investment Income Loss on Impairment Recovery of Loss on Impairment Loss on Sale of Investment Recording Entries for Debt HTM Investments On January 1, 2020, Sharp Company purchased $40,000 of Sox Company 6% bonds, at a time when the market rate was 5%. The bonds mature on December 31, 2024, and pay interest annually on December 31. Sharp plans to and has the ability to hold the bonds until maturity. Assume that Sharp uses the effective interest method to amortize any premium or discount on investments in bonds. At December 31, 2020, the bonds are quoted at 95. a. Prepare the entry for the purchase of the debt investment on January 1, 2020. b. Prepare the entry for the receipt of interest on December 31, 2020. c. Record the entry to adjust the investment to fair value on December 31, 2020, if applicable. Note: Do not round until your final answers. Round your final answers to the nearest whole dollar. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Account Name Dr. Cr. Date Jan. 1, 2020 a. b. Dec. 31, 2020 c Dec. 31, 2020 Check