Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work. I do not understand these from the notes. This homework is not making any sense to me please help assume only one

Please show work. I do not understand these from the notes. This homework is not making any sense to me please help

assume only one year has passed for interim growth

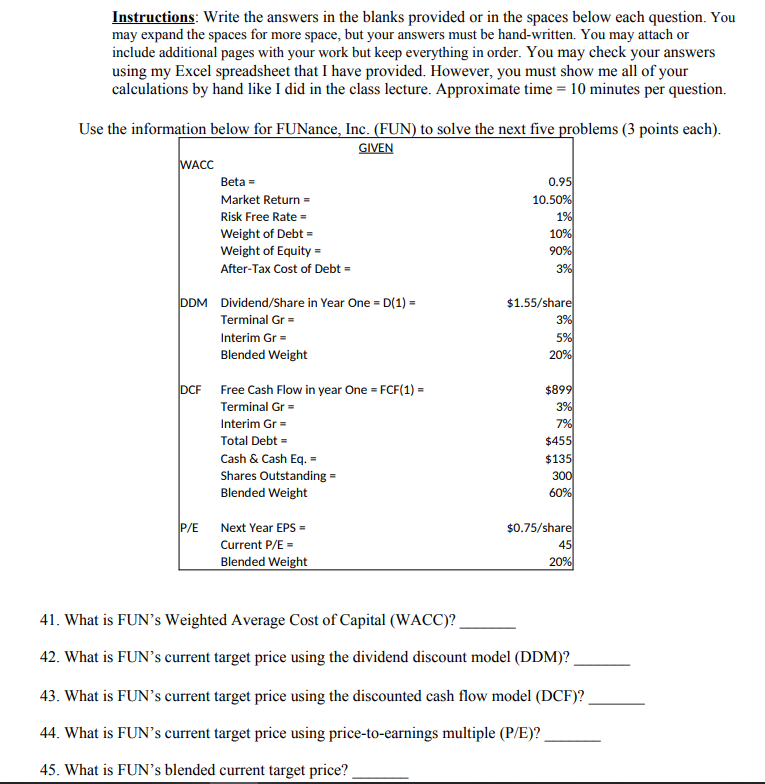

Instructions: Write the answers in the blanks provided or in the spaces below each question. You may expand the spaces for more space, but your answers must be hand-written. You may attach or include additional pages with your work but keep everything in order. You may check your answers using my Excel spreadsheet that I have provided. However, you must show me all of your calculations by hand like I did in the class lecture. Approximate time = 10 minutes per question. Use the information below for FUNance, Inc. (FUN) to solve the next five problems (3 points each). GIVEN WACC Beta - 0.95 Market Return 10.50% Risk Free Rate = 196 Weight of Debt - Weight of Equity = 90% After-Tax Cost of Debt = 3% 10% $1.55/share 3% DDM Dividend/Share in Year One = D(1) = Terminal Gr = Interim Gr - Blended Weight 590 20% PCF Free Cash Flow in year One = FCF(1) = Terminal Gr - Interim Gr= Total Debt = Cash & Cash Eq. = Shares Outstanding = Blended Weight $899 3% 7% $455 $135 300 60% P/E Next Year EPS - Current P/E = Blended Weight $0.75/share 45 20% 41. What is FUNs Weighted Average Cost of Capital (WACC)? 42. What is FUN's current target price using the dividend discount model (DDM)? 43. What is FUN's current target price using the discounted cash flow model (DCF)? 44. What is FUN's current target price using price-to-earnings multiple (P/E)? 45. What is FUN's blended current target price? Instructions: Write the answers in the blanks provided or in the spaces below each question. You may expand the spaces for more space, but your answers must be hand-written. You may attach or include additional pages with your work but keep everything in order. You may check your answers using my Excel spreadsheet that I have provided. However, you must show me all of your calculations by hand like I did in the class lecture. Approximate time = 10 minutes per question. Use the information below for FUNance, Inc. (FUN) to solve the next five problems (3 points each). GIVEN WACC Beta - 0.95 Market Return 10.50% Risk Free Rate = 196 Weight of Debt - Weight of Equity = 90% After-Tax Cost of Debt = 3% 10% $1.55/share 3% DDM Dividend/Share in Year One = D(1) = Terminal Gr = Interim Gr - Blended Weight 590 20% PCF Free Cash Flow in year One = FCF(1) = Terminal Gr - Interim Gr= Total Debt = Cash & Cash Eq. = Shares Outstanding = Blended Weight $899 3% 7% $455 $135 300 60% P/E Next Year EPS - Current P/E = Blended Weight $0.75/share 45 20% 41. What is FUNs Weighted Average Cost of Capital (WACC)? 42. What is FUN's current target price using the dividend discount model (DDM)? 43. What is FUN's current target price using the discounted cash flow model (DCF)? 44. What is FUN's current target price using price-to-earnings multiple (P/E)? 45. What is FUN's blended current target priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started