Please show work. I previously posted this question yesterday and was told it was unclear. I asked the professor and this was his reply. Esther,

Please show work. I previously posted this question yesterday and was told it was unclear. I asked the professor and this was his reply.

Esther, Think about this way. Value of a firm = Value of Debt + Value of Equity Equity holders have a call option on the firm. What that means is that as Value increases above debt all that value goes to the equity owners. If instead the value drops below zero (firm goes bankrupt) equity holders get nothing or in other words they would let the option expire worthless (premium paid here is the price they paid for the stock which they cannot recover). So the payoff graph looks similar to a call option payoff On the hand for debt holder's their value increases as long as V is increasing but when V=D any increase in value beyond that point the debt holders do not get anything (all that value goes to shareholders). So the graph should go up as value increases and payoff to debt holders increase and at V=D it reaches maximum (flat curve). Hope fully that will help with your graph!

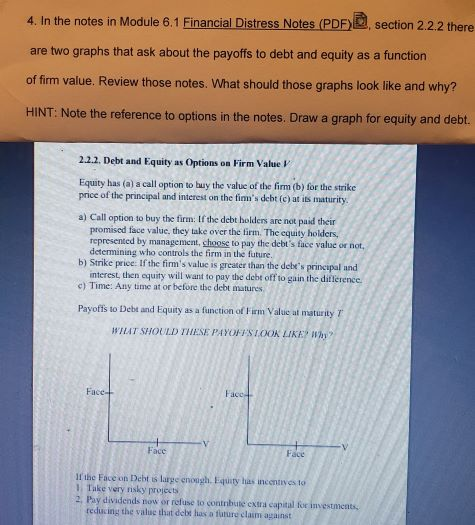

4. In the notes in Module 6.1 Financial Distress Notes (PDF) section 2.2.2 there are two graphs that ask about the payoffs to debt and equity as a function of firm value. Review those notes. What should those graphs look like and why? HINT: Note the reference to options in the notes. Draw a graph for equity and debt. 2.2.2. Debt and Equity as Options on Firm Value Equity has (a) a call option to buy the value of the firm (b) for the strike price of the principal and interest on the tim's debt (c) at its maturity. a) Call option to buy the firm: If the debt holders are not paid their promised face value, they take over the firm. The equity holders, represented by management, choose to pay the debt's face value or not, determining who controls the firm in the future, b) Strike price. If the firm's value is greater than the dele's principal and interest, then equity will want to pay the debt off to gain the difference. c) Time: Any time at or before the debt matures Payoffs to Debt and Equity as a function of Firm Value al maturity WHAT SHOULD THESE PAYOFFSTOOK LIKE Why Face- Facet Face Face If the Face on Debt is large enough. Equity has incentives to 1 Take very risky project 2. Pay dividends now or refuse to contribute extra capital for investments reducing the value that debt has a future claim againstStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started