Answered step by step

Verified Expert Solution

Question

1 Approved Answer

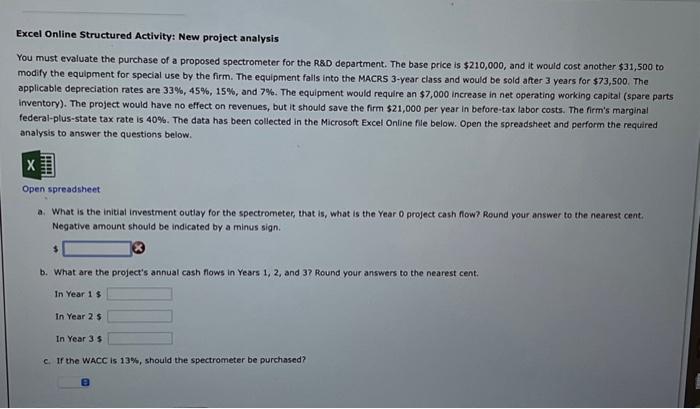

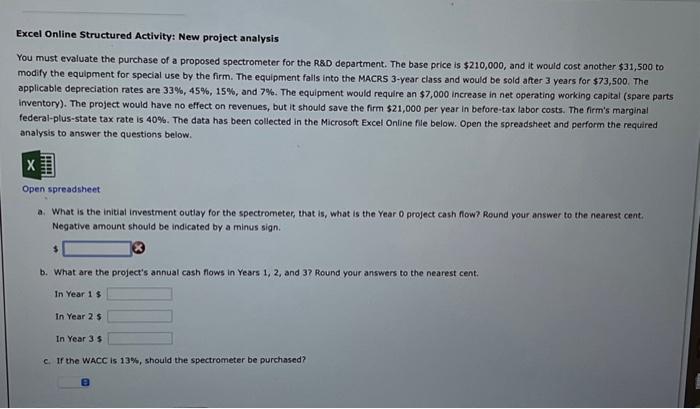

Please show work in excel if possible. Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the

Please show work in excel if possible.

Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the R 80 department. The base price is $210,000, and it would cost another $31,500 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3 -year class and would be sold after 3 years for $73,500. The applicable depreciation rates are 33%,45%,15%, and 7%. The equipment would require an $7,000 increase in net operating working capital ( $ pare parts inventory). The project would have no effect on revenues, but it should save the firm $21,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%. The data has been collected in the Microsoft Excel Oniline file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year o project cash fiow? Round your answer to the nearest cent, Negative amount should be indicated by a minus sign. $ b. What are the project's annual cash flows in Years 1,2 , and 3 ? Round your answers to the nearest cent. In Year 1$ In Year 25 In Year 3 s c. If the WACC is 13%, should the spectrometer be purchased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started