Answered step by step

Verified Expert Solution

Question

1 Approved Answer

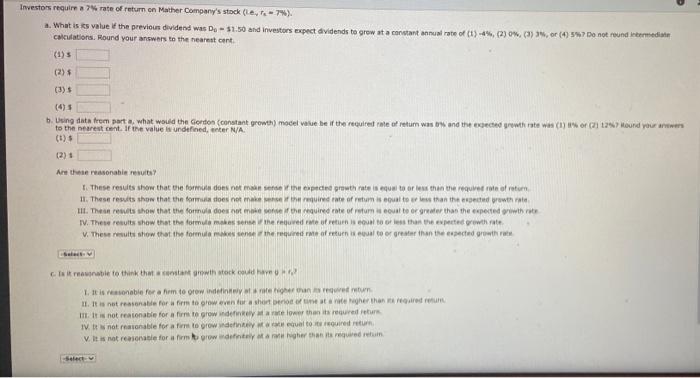

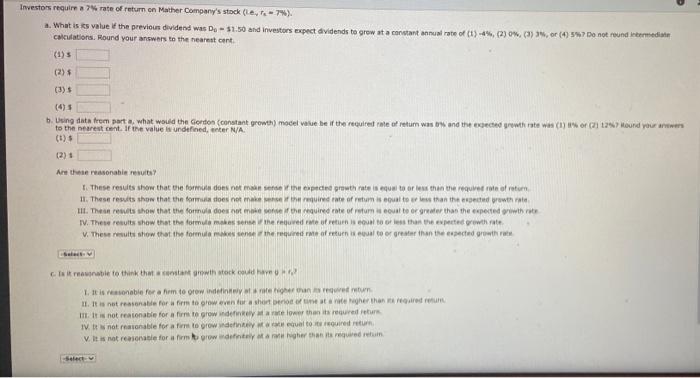

please show work Investors require a rate of return on Mather Company's stock (1-7). a. What is ts value the previous dividend was De -

please show work

Investors require a rate of return on Mather Company's stock (1-7). a. What is ts value the previous dividend was De - 51.50 and investors expect a vidends to grow at constant annual rate of (t)-4% (2) 0%, %, or (4)597 Do not round immediate calculations. Round your answers to the nearest cont (1) (2) (3) () 1. Using data from parts, what would the Gordon (constant growth) model value be if the required to retum was and the bed with rate was (1) or 127 Hound your newers to the nearest cont. If the value wundefined, enter N/A (1) (2) Are the reasonable results 1. These results show that the formule does not meeded growth rate is equal to or less than the required in a return 11. These results show that the formulasies not make the required rate of returns out to be than the growth rate III. These results show that the formula does not the required rate of returns out to er ger than the expected white IV. These results show that the formula makes sense roved to return is out or less than the growth rate V. These results show that the formule the required me ofreuen un to or greater than the rected growth Select Is it rainable to think that work It is able for arm to grow inden wyntegeretur II. It is not reasonable for aim to grow even for a short este her than red IT It is not reasonable for fun to grow we lower than roured retur IV. It notable for a furto grow any equal to required V It is not reasonable for amorowy a higher than its required return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started