Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work notes, thank you and stay safe! Problem 4-1 On January 1, 2011, Perelli Company purchased 90,000 of the 100,000 outstanding shares of

Please show work notes, thank you and stay safe!

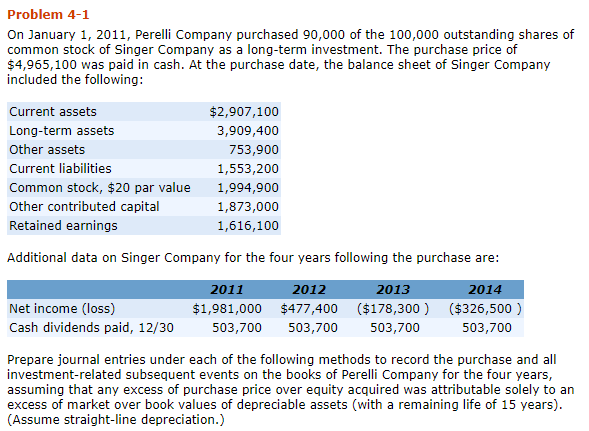

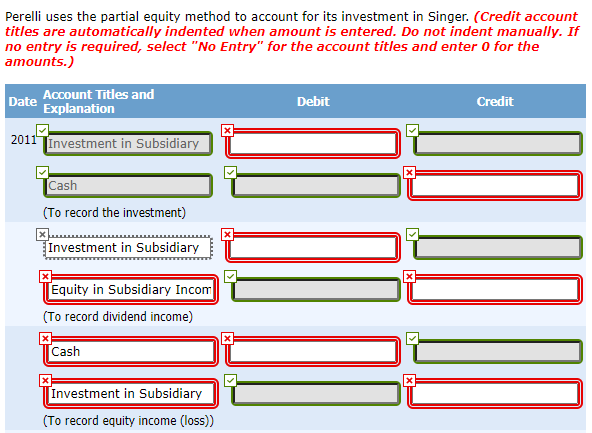

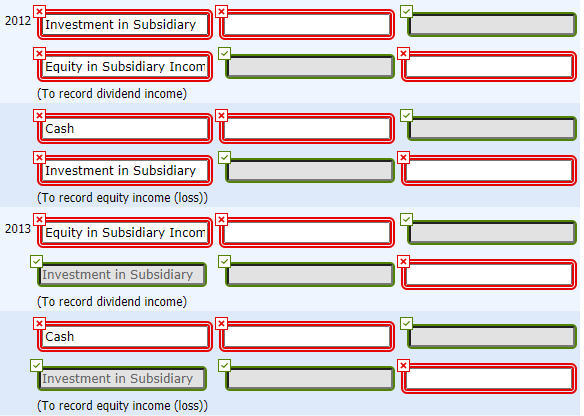

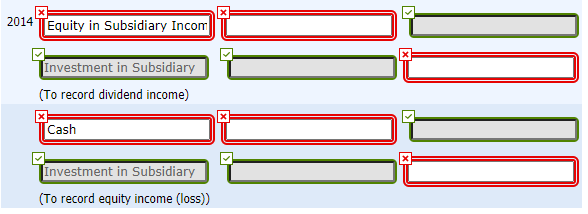

Problem 4-1 On January 1, 2011, Perelli Company purchased 90,000 of the 100,000 outstanding shares of common stock of Singer Company as a long-term investment. The purchase price of $4,965,100 was paid in cash. At the purchase date, the balance sheet of Singer Company included the following: Current assets Long-term assets Other assets Current liabilities Common stock, $20 par value Other contributed capital Retained earnings $2,907,100 3,909,400 753,900 1,553,200 1,994,900 1,873,000 1,616,100 Additional data on Singer Company for the four years following the purchase are: Net income (loss) Cash dividends paid, 12/30 2011 2012 2013 2014 $1,981,000 $477,400 ($178,300) ($326,500) 503,700 503,700 503,700 503,700 Prepare journal entries under each of the following methods to record the purchase and all investment-related subsequent events on the books of Perelli Company for the four years, assuming that any excess of purchase price over equity acquired was attributable solely to an excess of market over book values of depreciable assets (with a remaining life of 15 years). (Assume straight-line depreciation.) Perelli uses the partial equity method to account for its investment in Singer. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 2011 Investment in Subsidiary Cash (To record the investment) Investment in Subsidiary X Equity in Subsidiary Incom (To record dividend income) X Cash X Investment in Subsidiary (To record equity income (loss)) 2012 Investment in Subsidiary X X Equity in Subsidiary Incom (To record dividend income) Cash X Investment in Subsidiary (To record equity income (loss)) 2013 Equity in Subsidiary Incom (Investment in Subsidiary (To record dividend income) X Cash Investment in Subsidiary (To record equity income (loss)) 2014 TEquity in Subsidiary Incom Investment in Subsidiary (To record dividend income) Cash Investment in Subsidiary (To record equity income (loss))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started