Answered step by step

Verified Expert Solution

Question

1 Approved Answer

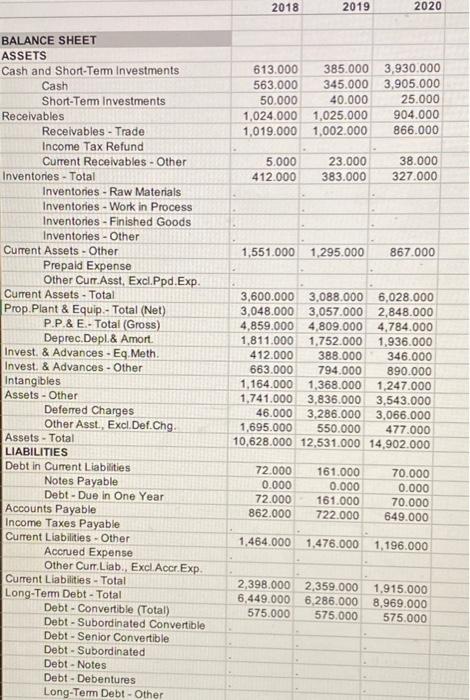

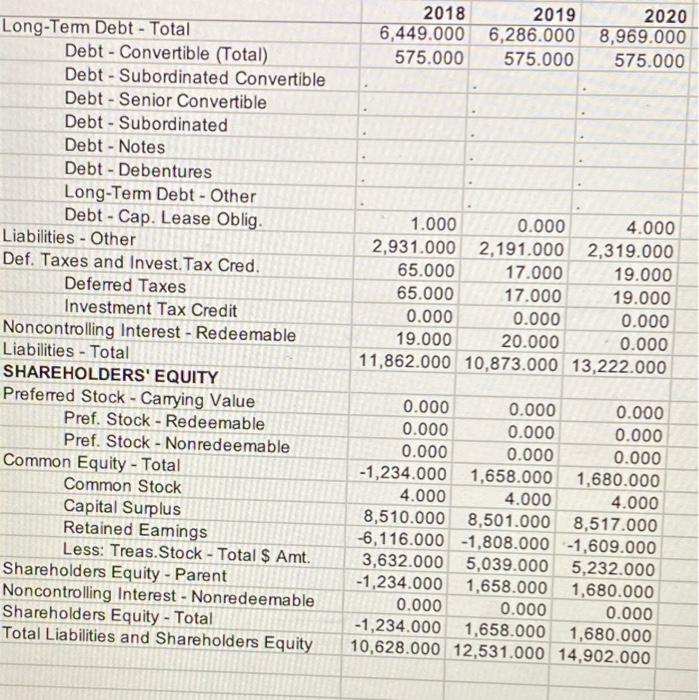

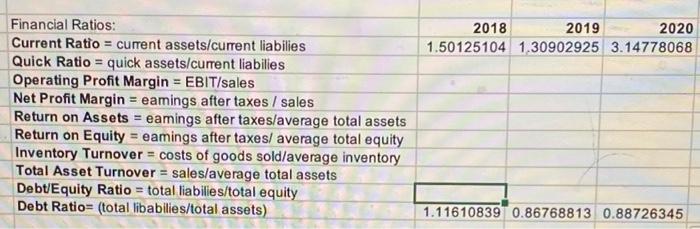

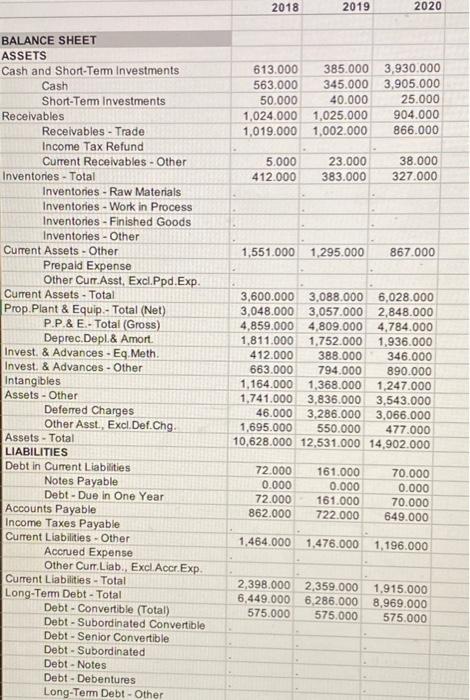

please show work on how to compute these ratios! 2018 2019 2020 613.000 385.000 3,930.000 563.000 345.000 3,905.000 50.000 40.000 25.000 1,024.000 1,025.000 904.000 1,019.000

please show work on how to compute these ratios!

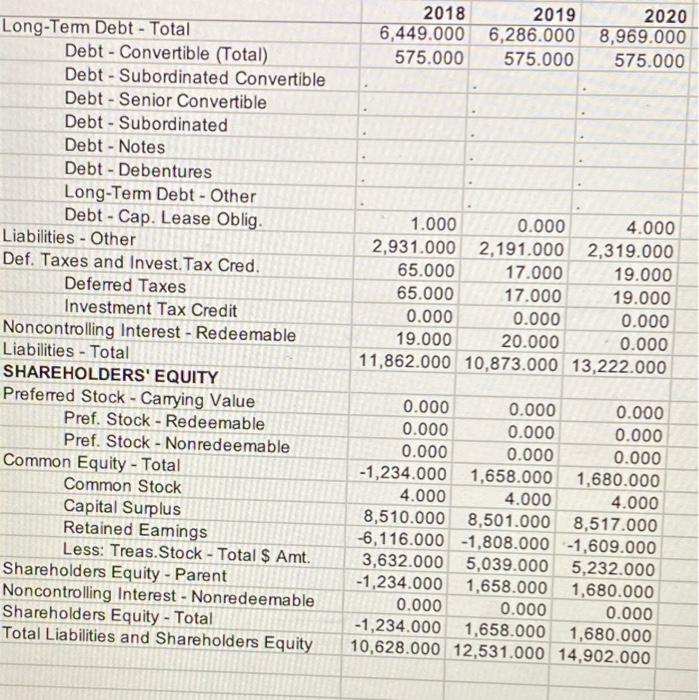

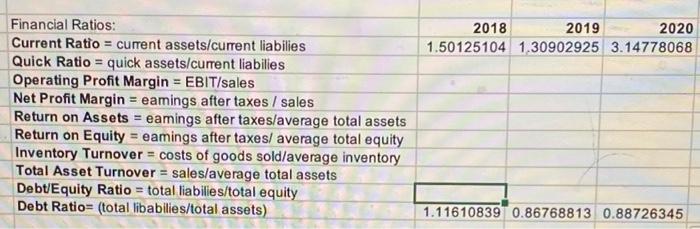

2018 2019 2020 613.000 385.000 3,930.000 563.000 345.000 3,905.000 50.000 40.000 25.000 1,024.000 1,025.000 904.000 1,019.000 1.002.000 866.000 5.000 412.000 23.000 383.000 38.000 327.000 1,551.000 1,295.000 867.000 BALANCE SHEET ASSETS Cash and Short-Term Investments Cash Short-Term Investments Receivables Receivables - Trade Income Tax Refund Current Receivables - Other Inventories - Total Inventories - Raw Materials Inventories - Work in Process Inventories - Finished Goods Inventories - Other Current Assets - Other Prepaid Expense Other Curr.Asst, Excl.Ppd. Exp. Current Assets - Total Prop. Plant & Equip-Total (Net) P.P.& E-Total (Gross) Deprec. Depl.& Amort Invest. & Advances - Eq. Meth. Invest. & Advances - Other Intangibles Assets - Other Deferred Charges Other Asst., Excl. Def.Chg. Assets - Total LIABILITIES Debt in Current Liabilities Notes Payable Debt-Due in One Year Accounts Payable Income Taxes Payable Current Liabilities - Other Accued Expense Other Curr. Liab. Excl. Accr.Exp Current Liabilities - Total Long-Term Debt - Total Debt - Convertible (Total) Debt - Subordinated Convertible Debt - Senior Convertible Debt - Subordinated Debt-Notes Debt - Debentures Long-Term Debt - Other 3,600.000 3,088.000 6,028.000 3,048.000 3,057.000 2,848.000 4,859.000 4,809.000 4,784.000 1,811.000 1,752.000 1,936.000 412.000 388.000 346.000 663.000 794.000 890.000 1,164.000 1,368.000 1,247.000 1,741.000 3,836.000 3,543.000 46.000 3,286.000 3.066.000 1,695.000 550.000 477.000 10,628.000 12,531.000 14,902.000 72.000 0.000 72.000 862.000 161.000 0.000 161.000 722.000 70.000 0.000 70.000 649.000 1.464.000 1.476.000 1.196.000 2,398.000 2,359.000 6,449.000 6,286.000 575.000 575.000 1.915.000 8,969.000 575.000 2018 2019 2020 6,449.000 6,286.000 6,286.000 8,969.000 575.000 575.000 575.000 - Long-Term Debt - Total Debt - Convertible (Total) Debt - Subordinated Convertible Debt - Senior Convertible Debt - Subordinated Debt - Notes Debt - Debentures Long-Term Debt - Other Debt - Cap. Lease Oblig. Liabilities - Other Def. Taxes and Invest. Tax Cred. Deferred Taxes Investment Tax Credit Noncontrolling Interest - Redeemable Liabilities - Total SHAREHOLDERS' EQUITY Preferred Stock - Carying Value Pref. Stock - Redeemable Pref. Stock - Nonredeemable Common Equity - Total Common Stock Capital Surplus Retained Eamings Less: Treas. Stock - Total $ Amt. Shareholders Equity - Parent Noncontrolling Interest - Nonredeemable Shareholders Equity - Total Total Liabilities and Shareholders Equity 1.000 0.000 4.000 2,931.000 2,191.000 2,319.000 65.000 17.000 19.000 65.000 17.000 19.000 0.000 0.000 0.000 19.000 20.000 0.000 11,862.000 10,873.000 13,222.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 -1,234.000 1,658.000 1,680.000 4.000 4.000 4.000 8,510.000 8,501.000 8,517.000 -6,116.000 -1,808.000 -1,609.000 3,632.000 5,039.000 5,232.000 -1,234.000 1,658.000 1,680.000 0.000 0.000 0.000 -1,234.000 1,658.000 1,680.000 10,628.000 12,531.000 14,902.000 2018 2019 2020 1.50125104 1.30902925 3.14778068 Financial Ratios: Current Ratio = current assets/current liabilies Quick Ratio = quick assets/current liabilies Operating Profit Margin = EBIT/sales Net Profit Margin = eamings after taxes / sales Return on Assets = eamings after taxes/average total assets Return on Equity = eamings after taxes/ average total equity Inventory Turnover = costs of goods sold/average inventory Total Asset Turnover = sales/average total assets Debt/Equity Ratio = total liabilies/total equity Debt Ratio= (total libabilies/total assets) 1.11610839 0.86768813 0.88726345 2018 2019 2020 613.000 385.000 3,930.000 563.000 345.000 3,905.000 50.000 40.000 25.000 1,024.000 1,025.000 904.000 1,019.000 1.002.000 866.000 5.000 412.000 23.000 383.000 38.000 327.000 1,551.000 1,295.000 867.000 BALANCE SHEET ASSETS Cash and Short-Term Investments Cash Short-Term Investments Receivables Receivables - Trade Income Tax Refund Current Receivables - Other Inventories - Total Inventories - Raw Materials Inventories - Work in Process Inventories - Finished Goods Inventories - Other Current Assets - Other Prepaid Expense Other Curr.Asst, Excl.Ppd. Exp. Current Assets - Total Prop. Plant & Equip-Total (Net) P.P.& E-Total (Gross) Deprec. Depl.& Amort Invest. & Advances - Eq. Meth. Invest. & Advances - Other Intangibles Assets - Other Deferred Charges Other Asst., Excl. Def.Chg. Assets - Total LIABILITIES Debt in Current Liabilities Notes Payable Debt-Due in One Year Accounts Payable Income Taxes Payable Current Liabilities - Other Accued Expense Other Curr. Liab. Excl. Accr.Exp Current Liabilities - Total Long-Term Debt - Total Debt - Convertible (Total) Debt - Subordinated Convertible Debt - Senior Convertible Debt - Subordinated Debt-Notes Debt - Debentures Long-Term Debt - Other 3,600.000 3,088.000 6,028.000 3,048.000 3,057.000 2,848.000 4,859.000 4,809.000 4,784.000 1,811.000 1,752.000 1,936.000 412.000 388.000 346.000 663.000 794.000 890.000 1,164.000 1,368.000 1,247.000 1,741.000 3,836.000 3,543.000 46.000 3,286.000 3.066.000 1,695.000 550.000 477.000 10,628.000 12,531.000 14,902.000 72.000 0.000 72.000 862.000 161.000 0.000 161.000 722.000 70.000 0.000 70.000 649.000 1.464.000 1.476.000 1.196.000 2,398.000 2,359.000 6,449.000 6,286.000 575.000 575.000 1.915.000 8,969.000 575.000 2018 2019 2020 6,449.000 6,286.000 6,286.000 8,969.000 575.000 575.000 575.000 - Long-Term Debt - Total Debt - Convertible (Total) Debt - Subordinated Convertible Debt - Senior Convertible Debt - Subordinated Debt - Notes Debt - Debentures Long-Term Debt - Other Debt - Cap. Lease Oblig. Liabilities - Other Def. Taxes and Invest. Tax Cred. Deferred Taxes Investment Tax Credit Noncontrolling Interest - Redeemable Liabilities - Total SHAREHOLDERS' EQUITY Preferred Stock - Carying Value Pref. Stock - Redeemable Pref. Stock - Nonredeemable Common Equity - Total Common Stock Capital Surplus Retained Eamings Less: Treas. Stock - Total $ Amt. Shareholders Equity - Parent Noncontrolling Interest - Nonredeemable Shareholders Equity - Total Total Liabilities and Shareholders Equity 1.000 0.000 4.000 2,931.000 2,191.000 2,319.000 65.000 17.000 19.000 65.000 17.000 19.000 0.000 0.000 0.000 19.000 20.000 0.000 11,862.000 10,873.000 13,222.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 -1,234.000 1,658.000 1,680.000 4.000 4.000 4.000 8,510.000 8,501.000 8,517.000 -6,116.000 -1,808.000 -1,609.000 3,632.000 5,039.000 5,232.000 -1,234.000 1,658.000 1,680.000 0.000 0.000 0.000 -1,234.000 1,658.000 1,680.000 10,628.000 12,531.000 14,902.000 2018 2019 2020 1.50125104 1.30902925 3.14778068 Financial Ratios: Current Ratio = current assets/current liabilies Quick Ratio = quick assets/current liabilies Operating Profit Margin = EBIT/sales Net Profit Margin = eamings after taxes / sales Return on Assets = eamings after taxes/average total assets Return on Equity = eamings after taxes/ average total equity Inventory Turnover = costs of goods sold/average inventory Total Asset Turnover = sales/average total assets Debt/Equity Ratio = total liabilies/total equity Debt Ratio= (total libabilies/total assets) 1.11610839 0.86768813 0.88726345

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started