Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work On January 1, Year 1, Entity A acquired assets and liabilities on that date equals their of $37,500. Entity A and Entity

please show work

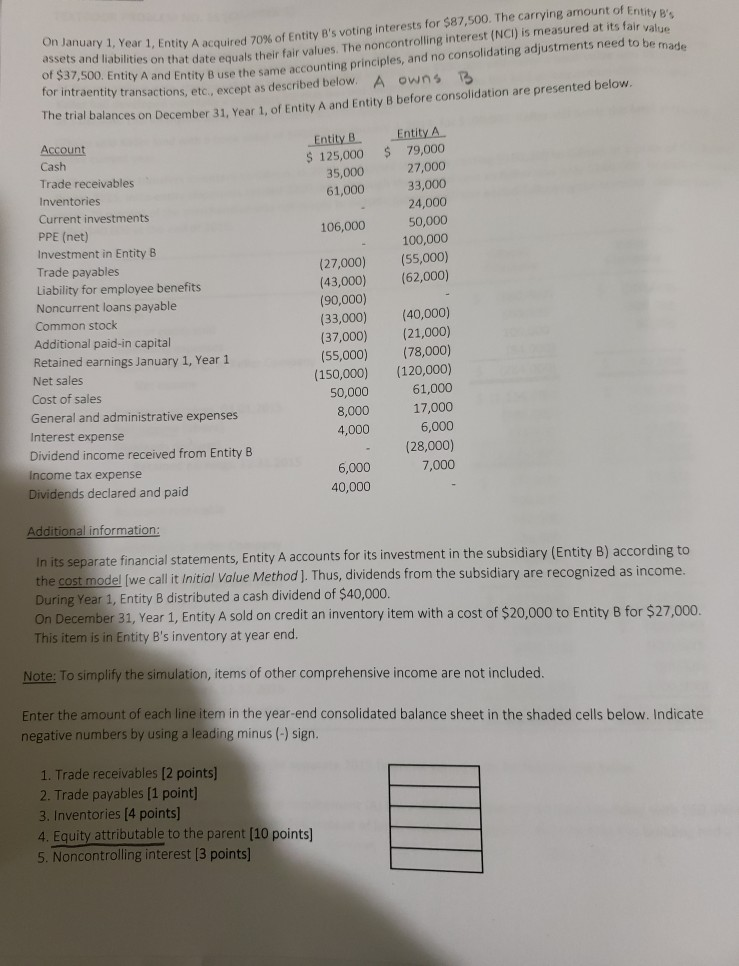

On January 1, Year 1, Entity A acquired assets and liabilities on that date equals their of $37,500. Entity A and Entity B use the same for intraentity transactions, etc., except as described below. Year 1, Entity A acquired 70% of Entity B's voting interests for $87,500. The carrying amount of Entity son that date equals their fair values. The noncontrolling interest (NCT) is measured at its fair valu Entity A and Entity B use the same accounting principles, and no consolidating adjustments need to be ma A owns B trial balances on December 31. Year 1. of Entity A and Entity before consolidation are presented below $ Entity B $ 125,000 35,000 61,000 Entity A 79,000 27,000 33,000 24,000 50,000 106,000 100,000 (55,000) (62,000) Account Cash Trade receivables Inventories Current investments PPE (net) Investment in Entity B Trade payables Liability for employee benefits Noncurrent loans payable Common stock Additional paid-in capital Retained earnings January 1, Year 1 Net sales Cost of sales General and administrative expenses Interest expense Dividend income received from Entity B Income tax expense Dividends declared and paid (27,000) (43,000) (90,000) (33,000) (37,000) (55,000) (150,000) 50,000 8,000 4,000 (40,000) (21,000) (78,000) (120,000) 61,000 17,000 6,000 (28,000) 7,000 6,000 40,000 Additional information: In its separate financial statements, Entity A accounts for its investment in the subsidiary (Entity B) according to the cost model (we call it Initial Value Method ]. Thus, dividends from the subsidiary are recognized as income. During Year 1, Entity B distributed a cash dividend of $40,000 On December 31, Year 1, Entity A sold on credit an inventory item with a cost of $20,000 to Entity B for $27,000. This item is in Entity B's inventory at year end. Note: To simplify the simulation, items of other comprehensive income are not included. Enter the amount of each line item in the year-end consolidated balance sheet in the shaded cells below. Indicate negative numbers by using a leading minus (-) sign. 1. Trade receivables (2 points) 2. Trade payables (1 point] 3. Inventories (4 points) 4. Equity attributable to the parent (10 points) 5. Noncontrolling interest [3 points) On January 1, Year 1, Entity A acquired assets and liabilities on that date equals their of $37,500. Entity A and Entity B use the same for intraentity transactions, etc., except as described below. Year 1, Entity A acquired 70% of Entity B's voting interests for $87,500. The carrying amount of Entity son that date equals their fair values. The noncontrolling interest (NCT) is measured at its fair valu Entity A and Entity B use the same accounting principles, and no consolidating adjustments need to be ma A owns B trial balances on December 31. Year 1. of Entity A and Entity before consolidation are presented below $ Entity B $ 125,000 35,000 61,000 Entity A 79,000 27,000 33,000 24,000 50,000 106,000 100,000 (55,000) (62,000) Account Cash Trade receivables Inventories Current investments PPE (net) Investment in Entity B Trade payables Liability for employee benefits Noncurrent loans payable Common stock Additional paid-in capital Retained earnings January 1, Year 1 Net sales Cost of sales General and administrative expenses Interest expense Dividend income received from Entity B Income tax expense Dividends declared and paid (27,000) (43,000) (90,000) (33,000) (37,000) (55,000) (150,000) 50,000 8,000 4,000 (40,000) (21,000) (78,000) (120,000) 61,000 17,000 6,000 (28,000) 7,000 6,000 40,000 Additional information: In its separate financial statements, Entity A accounts for its investment in the subsidiary (Entity B) according to the cost model (we call it Initial Value Method ]. Thus, dividends from the subsidiary are recognized as income. During Year 1, Entity B distributed a cash dividend of $40,000 On December 31, Year 1, Entity A sold on credit an inventory item with a cost of $20,000 to Entity B for $27,000. This item is in Entity B's inventory at year end. Note: To simplify the simulation, items of other comprehensive income are not included. Enter the amount of each line item in the year-end consolidated balance sheet in the shaded cells below. Indicate negative numbers by using a leading minus (-) sign. 1. Trade receivables (2 points) 2. Trade payables (1 point] 3. Inventories (4 points) 4. Equity attributable to the parent (10 points) 5. Noncontrolling interest [3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started