Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work. Problem One Mary Smith is worried she is going to be 15 days past due on a loan payment. If she is

Please show work.

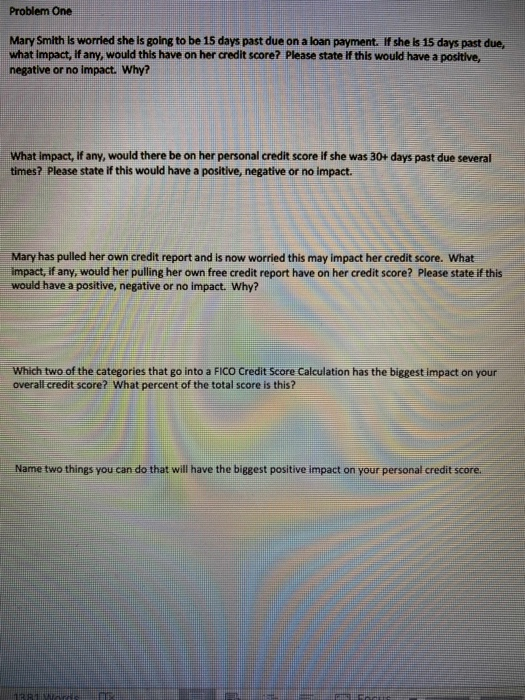

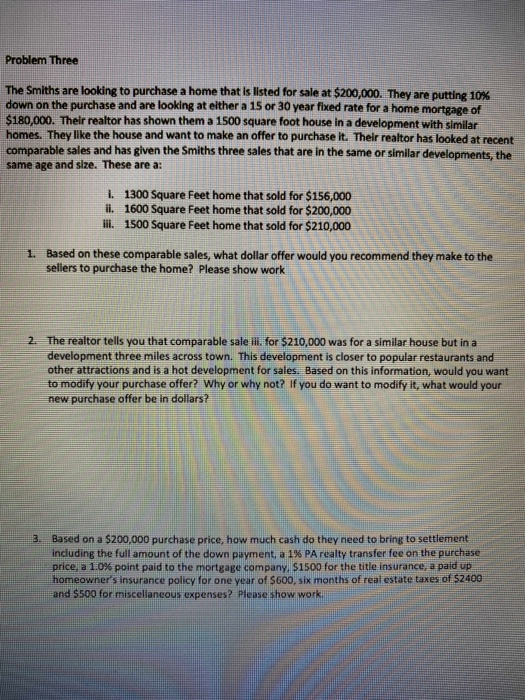

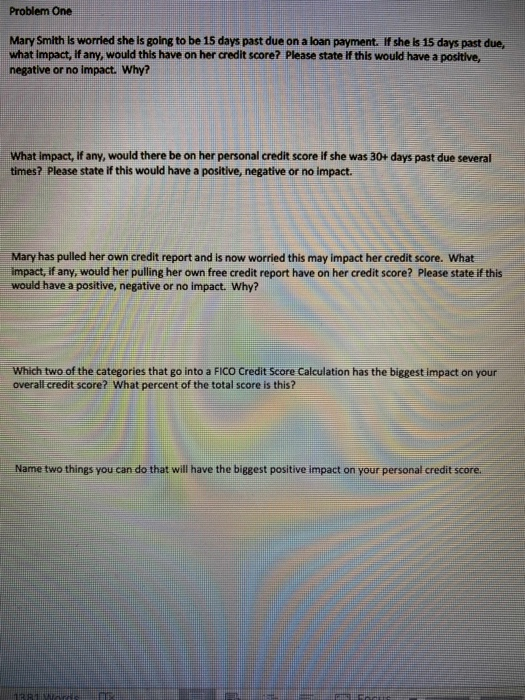

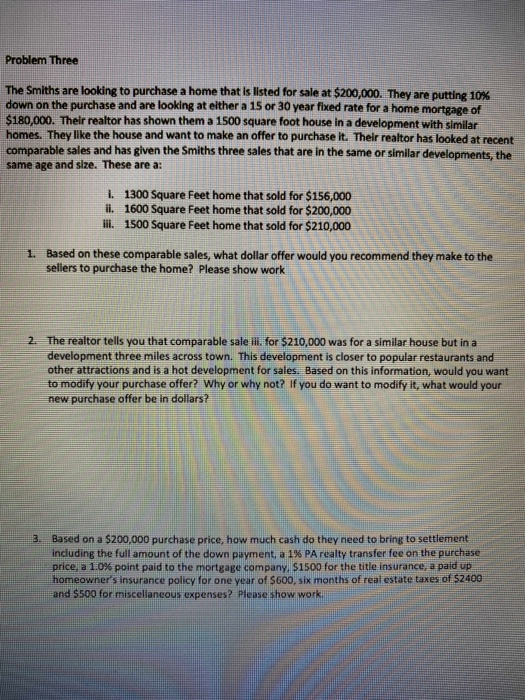

Problem One Mary Smith is worried she is going to be 15 days past due on a loan payment. If she is 15 days past due, what Impact, if any, would this have on her credit score? Please state if this would have a positive negative or no impact. Why? What impact, if any, would there be on her personal credit score If she was 30+ days past due several times? Please state if this would have a positive, negative or no impact. Mary has pulled her own credit report and is now worried this may impact her credit score. What Impact, if any, would her pulling her own free credit report have on her credit score? Please state if this would have a positive, negative or no impact. Why? Which two of the categories that go into a FICO Credit Score Calculation has the biggest impact on your overall credit score? What percent of the total score is this? Name two things you can do that will have the biggest positive impact on your personal credit score. Problem Three The Smiths are looking to purchase a home that is listed for sale at $200,000. They are putting 10% down on the purchase and are looking at either a 15 or 30 year fixed rate for a home mortgage of $180,000. Their realtor has shown them a 1500 square foot house in a development with similar homes. They like the house and want to make an offer to purchase it. Their realtor has looked at recent comparable sales and has given the Smiths three sales that are in the same or similar developments, the same age and size. These are a: 1 1300 Square Feet home that sold for $156,000 ii. 1600 Square Feet home that sold for $200,000 ill. 1500 square Feet home that sold for $210,000 1. Based on these comparable sales, what dollar offer would you recommend they make to the sellers to purchase the home? Please show work 2. The realtor tells you that comparable sale ill. for $210,000 was for a similar house but in a development three miles across town. This development is closer to popular restaurants and other attractions and is a hot development for sales. Based on this information, would you want to modify your purchase offer? Why or why not? If you do want to modify it, what would your new purchase offer be in dollars? 3. Based on a $200,000 purchase price, how much cash do they need to bring to settlement including the full amount of the down payment, a 1% PA realty transfer fee on the purchase price, a 1.0% point paid to the mortgage company, $1500 for the title insurance, a paid up homeowner's insurance policy for one year of $600, Six months of real estate taxes of $2400 and $500 for miscellaneous expenses? Please show work. Problem One Mary Smith is worried she is going to be 15 days past due on a loan payment. If she is 15 days past due, what Impact, if any, would this have on her credit score? Please state if this would have a positive negative or no impact. Why? What impact, if any, would there be on her personal credit score If she was 30+ days past due several times? Please state if this would have a positive, negative or no impact. Mary has pulled her own credit report and is now worried this may impact her credit score. What Impact, if any, would her pulling her own free credit report have on her credit score? Please state if this would have a positive, negative or no impact. Why? Which two of the categories that go into a FICO Credit Score Calculation has the biggest impact on your overall credit score? What percent of the total score is this? Name two things you can do that will have the biggest positive impact on your personal credit score. Problem Three The Smiths are looking to purchase a home that is listed for sale at $200,000. They are putting 10% down on the purchase and are looking at either a 15 or 30 year fixed rate for a home mortgage of $180,000. Their realtor has shown them a 1500 square foot house in a development with similar homes. They like the house and want to make an offer to purchase it. Their realtor has looked at recent comparable sales and has given the Smiths three sales that are in the same or similar developments, the same age and size. These are a: 1 1300 Square Feet home that sold for $156,000 ii. 1600 Square Feet home that sold for $200,000 ill. 1500 square Feet home that sold for $210,000 1. Based on these comparable sales, what dollar offer would you recommend they make to the sellers to purchase the home? Please show work 2. The realtor tells you that comparable sale ill. for $210,000 was for a similar house but in a development three miles across town. This development is closer to popular restaurants and other attractions and is a hot development for sales. Based on this information, would you want to modify your purchase offer? Why or why not? If you do want to modify it, what would your new purchase offer be in dollars? 3. Based on a $200,000 purchase price, how much cash do they need to bring to settlement including the full amount of the down payment, a 1% PA realty transfer fee on the purchase price, a 1.0% point paid to the mortgage company, $1500 for the title insurance, a paid up homeowner's insurance policy for one year of $600, Six months of real estate taxes of $2400 and $500 for miscellaneous expenses? Please show work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started