Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work Review SmartArt Formulas Charts Number Layout Tables XmUHULEN YT1FEX Algiment abc Wrap Text- Currency 14 -AA- ES Conditional Formatting Neutral FU Times

please show work

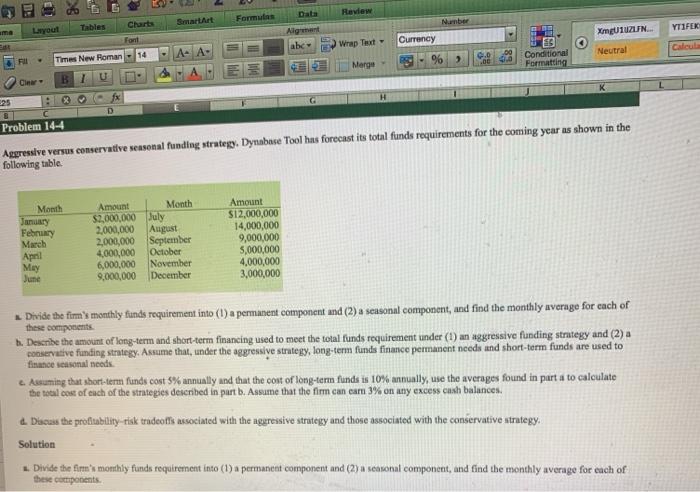

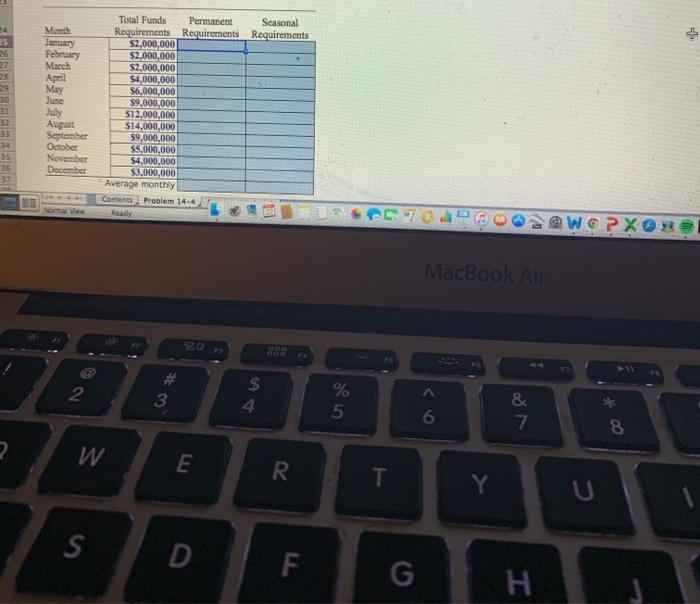

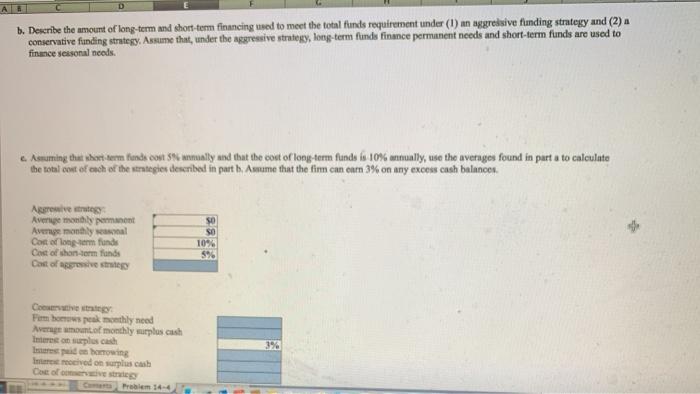

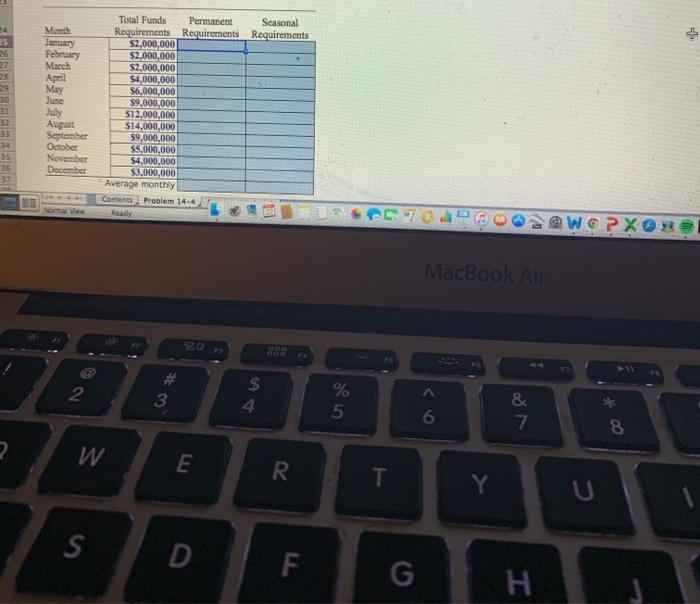

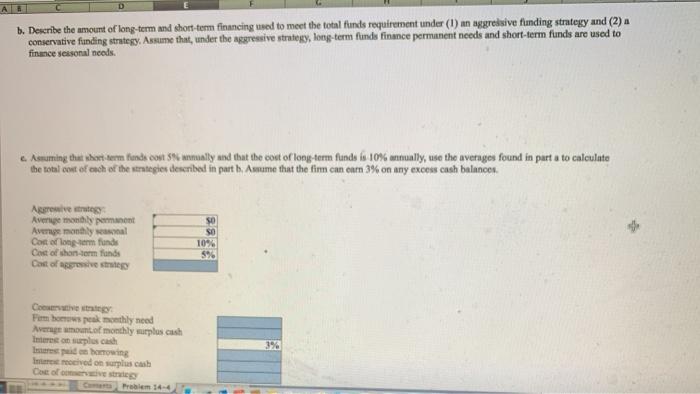

Review SmartArt Formulas Charts Number Layout Tables XmUHULEN YT1FEX Algiment abc Wrap Text- Currency 14 -AA- ES Conditional Formatting Neutral FU Times New Roman 2 96 Merge Claw B1 H 25 D Problem 144 Aggressive versus conservative seasonal funding strategy. Dynabase Tool has forecast its total funds requirements for the coming year as shown in the following table Month January February March April May Amount $2,000,000 2,000,000 2,000,000 4,000,000 6,000,000 9,000,000 Month July August September October November December Amount $12,000,000 14,000,000 9,000,000 5,000,000 4,000,000 3,000,000 June finance seasonal needs Divide the firm's monthly funds requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) conservative funding strategy. Assume that, under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to 2. Assuming that short-term funds cost 5% annually and that the cost of long-term funds is 10% annually, use the averages found in part a to calculate the total cost of each of the strategies described in part b. Assume that the firm can earn 3% on any excess cash balances 4. Dacus the profitability-risk tradeoffs associated with the aggressive strategy and those associated with the conservative strategy. Solution 1. Divide the firm's monthly funds requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components 26 2 29 30 31 Month January February March April May June July August September October November December Total Funds Permanent Seasonal Requirements Requirements Requirements $2,000,000 $2,000,000 $2,000,000 $4,000,000 $6,000,000 $9,000,000 $12,000,000 $14,000,000 $9,000,000 $5,000,000 54,000,000 $3,000,000 Average monthly Contents Problem 14-4 34 WOPXOR MacBook Air 2 3 $ 4 % 5 6 & 7 8 E R . S D F G H b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggresive finding strategy and (2) a conservative funding strategy. Assume that, under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finance seasonal needs. Asuming that short term fonds cout Smally and that the cost of long-term funds is 10% anually, use the averages found in part a to calculate the total cost of each of the strategies desenbed in part b. Aame that the fim can earn 3% on any excess cash balances Aggressive strategy Avenge only permanent Avenge monthly Cost of long-term funds Cost of shon-term finds Cost of agressive SO 10% 59 Cog Formes pothly need Average amount of monthly surplus cash Interest on plus cash son borowing I moved on surplus cash Coco Problem 14-4 3% Review SmartArt Formulas Charts Number Layout Tables XmUHULEN YT1FEX Algiment abc Wrap Text- Currency 14 -AA- ES Conditional Formatting Neutral FU Times New Roman 2 96 Merge Claw B1 H 25 D Problem 144 Aggressive versus conservative seasonal funding strategy. Dynabase Tool has forecast its total funds requirements for the coming year as shown in the following table Month January February March April May Amount $2,000,000 2,000,000 2,000,000 4,000,000 6,000,000 9,000,000 Month July August September October November December Amount $12,000,000 14,000,000 9,000,000 5,000,000 4,000,000 3,000,000 June finance seasonal needs Divide the firm's monthly funds requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) conservative funding strategy. Assume that, under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to 2. Assuming that short-term funds cost 5% annually and that the cost of long-term funds is 10% annually, use the averages found in part a to calculate the total cost of each of the strategies described in part b. Assume that the firm can earn 3% on any excess cash balances 4. Dacus the profitability-risk tradeoffs associated with the aggressive strategy and those associated with the conservative strategy. Solution 1. Divide the firm's monthly funds requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components 26 2 29 30 31 Month January February March April May June July August September October November December Total Funds Permanent Seasonal Requirements Requirements Requirements $2,000,000 $2,000,000 $2,000,000 $4,000,000 $6,000,000 $9,000,000 $12,000,000 $14,000,000 $9,000,000 $5,000,000 54,000,000 $3,000,000 Average monthly Contents Problem 14-4 34 WOPXOR MacBook Air 2 3 $ 4 % 5 6 & 7 8 E R . S D F G H b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggresive finding strategy and (2) a conservative funding strategy. Assume that, under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finance seasonal needs. Asuming that short term fonds cout Smally and that the cost of long-term funds is 10% anually, use the averages found in part a to calculate the total cost of each of the strategies desenbed in part b. Aame that the fim can earn 3% on any excess cash balances Aggressive strategy Avenge only permanent Avenge monthly Cost of long-term funds Cost of shon-term finds Cost of agressive SO 10% 59 Cog Formes pothly need Average amount of monthly surplus cash Interest on plus cash son borowing I moved on surplus cash Coco Problem 14-4 3%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started