Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work. Thank you! 12*) Alan just bought 100 shares of Global, Inc. (GLO) at $45 per share and as protection he also bought

Please show work. Thank you!

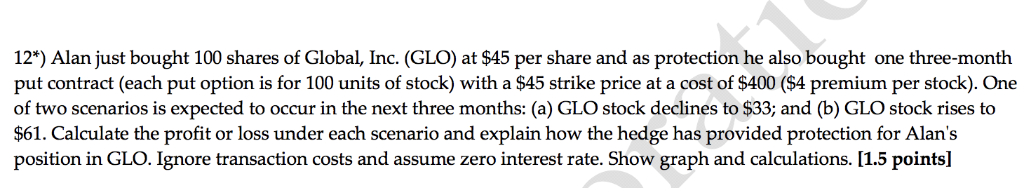

12*) Alan just bought 100 shares of Global, Inc. (GLO) at $45 per share and as protection he also bought one three-month put contract (each put option is for 100 units of stock) with a $45 strike price at a cost of $400 ($4 premium per stock). One of two scenarios is expected to occur in the next three months: (a) GLO stock declines to $33; and (b) GLO stock rises to $61. Calculate the profit or loss under each scenario and explain how the hedge has provided protection for Alan's position in GLO. Ignore transaction costs and assume zero interest rate. Show graph and calculations. [1.5 points]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started