Answered step by step

Verified Expert Solution

Question

1 Approved Answer

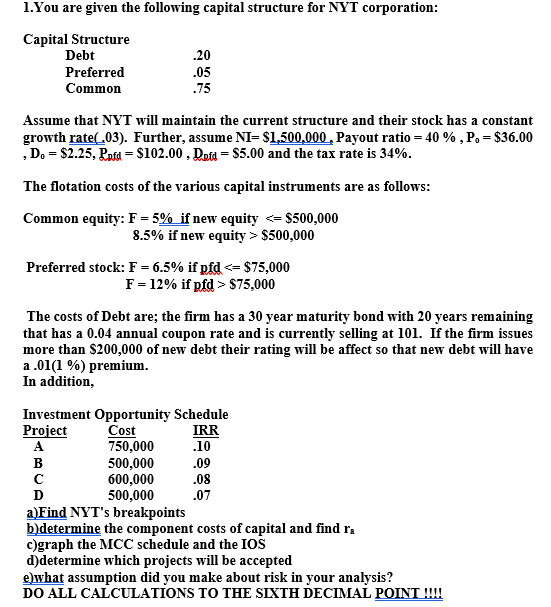

Please show work. Thank you 1.You are given the following capital structure for NYT corporation: Capital Structure Debt Preferred Common .20 05 .75 Assume that

Please show work. Thank you

1.You are given the following capital structure for NYT corporation: Capital Structure Debt Preferred Common .20 05 .75 Assume that NYT will maintain the current structure and their stock has a constant growth rate403). Further, assume NI-$1,500,000, Payout ratio-40 % , P,-$36.00 , D,-$2.25, Rpfd-$102.00 , Dpfd-S5.00 and the tax rate is 34% The flotation costs of the various capital instruments are as follows: Common equity: F-5% if new equity $500,000 Preferred stock: F-6.5% if pt $75,000 8.5% if new equity > $500,000 F-1290 if pfd > $75,000 The costs of Debt are; the firm has a 30 year maturity bond with 20 years remaining that has a 0.04 annual coupon rate and is currently selling at 101. If the firm issues more than S200,000 of new debt their rating will be affect so that new debt will have a .01(1%) premium In addition, Investment Opportunity Schedule Project Cost 750,000 500,000 600,000 500,000 IRR 10 09 08 07 a)Find NYT's breakpoints b)determine the component costs of capital and find ra c)graph the MCC schedule and the IOS d)determine which projects will be accepted ewhat assumption did you make about risk in your analysis? DO ALL CALCULATIONS TO THE SIXTH DECIMAL POINT III 1.You are given the following capital structure for NYT corporation: Capital Structure Debt Preferred Common .20 05 .75 Assume that NYT will maintain the current structure and their stock has a constant growth rate403). Further, assume NI-$1,500,000, Payout ratio-40 % , P,-$36.00 , D,-$2.25, Rpfd-$102.00 , Dpfd-S5.00 and the tax rate is 34% The flotation costs of the various capital instruments are as follows: Common equity: F-5% if new equity $500,000 Preferred stock: F-6.5% if pt $75,000 8.5% if new equity > $500,000 F-1290 if pfd > $75,000 The costs of Debt are; the firm has a 30 year maturity bond with 20 years remaining that has a 0.04 annual coupon rate and is currently selling at 101. If the firm issues more than S200,000 of new debt their rating will be affect so that new debt will have a .01(1%) premium In addition, Investment Opportunity Schedule Project Cost 750,000 500,000 600,000 500,000 IRR 10 09 08 07 a)Find NYT's breakpoints b)determine the component costs of capital and find ra c)graph the MCC schedule and the IOS d)determine which projects will be accepted ewhat assumption did you make about risk in your analysis? DO ALL CALCULATIONS TO THE SIXTH DECIMAL POINTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started