Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work, Thank you!! 5*.[3 Points) Today is December 2011, where a gold producer expects to sell 35,000 oz of gold before the end

Please show work, Thank you!!

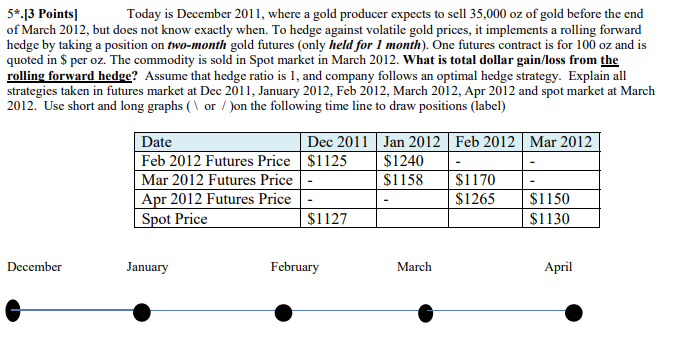

5*.[3 Points) Today is December 2011, where a gold producer expects to sell 35,000 oz of gold before the end of March 2012, but does not know exactly when. To hedge against volatile gold prices, it implements a rolling forward hedge by taking a position on two-month gold futures (only held for 1 month). One futures contract is for 100 oz and is quoted in $ per oz. The commodity is sold in Spot market in March 2012. What is total dollar gain/loss from the rolling forward hedge? Assume that hedge ratio is 1, and company follows an optimal hedge strategy. Explain all strategies taken in futures market at Dec 2011, January 2012. Feb 2012 March 2012, Apr 2012 and spot market at March 2012. Use short and long graphs (1 or /)on the following time line to draw positions (label) Date Dec 2011 Jan 2012 Feb 2012 Mar 2012 Feb 2012 Futures Price $1125 $1240 Mar 2012 Futures Price $1158 $1170 Apr 2012 Futures Price $1265 $1150 Spot Price $1127 $1130 December January February March AprilStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started