please show work thank you

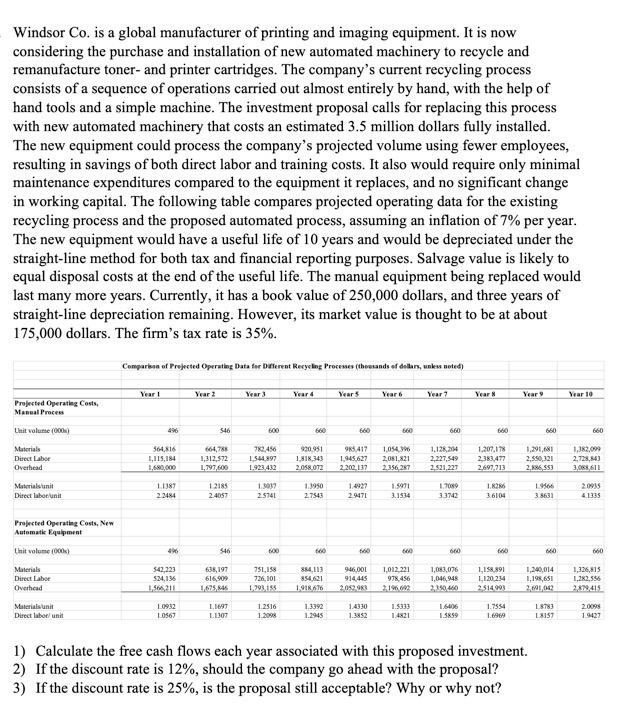

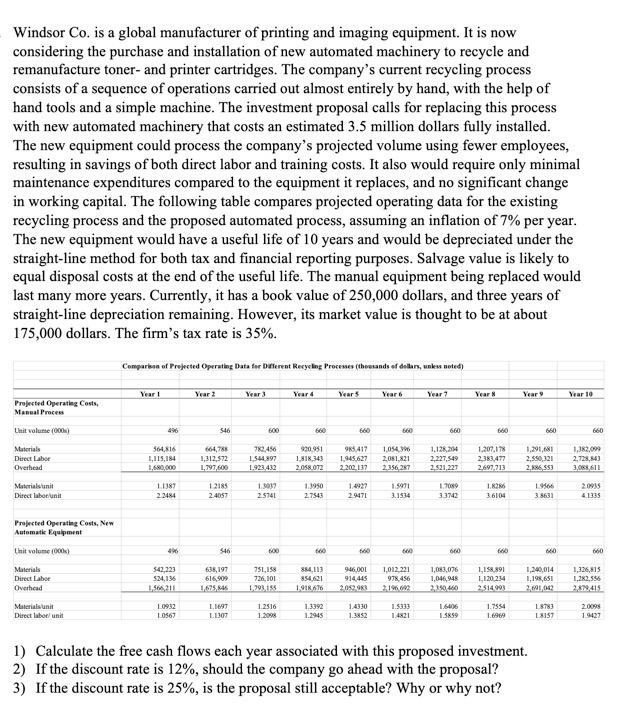

Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The company's current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully installed. The new equipment could process the company's projected volume using fewer employees, resulting in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compared to the equipment it replaces, and no significant change in working capital. The following table compares projected operating data for the existing recycling process and the proposed automated process, assuming an inflation of 7% per year. The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. Salvage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firm's tax rate is 35%. Comparison of Prejected Operating Data for Different Recycling Processes (theesands of dollars, unless noted) Year! Year 2 Year Yeard Years Year 2 Year Year Year 19 Projected Operating Costs, Manual Process Unit volunte (0001) 546 600 660 660 660 660 660 660 Materials Direct Labor Overhead 561.816 1,115,184 1.680.000 1,312,522 1,797,600 78.4% 1.597 1.923,432 920.951 1.K.143 2.058.012 985417 1,945.627 2.202.1:37 1,054 2.081.821 2.356,257 1,1264 2,227,549 2.521,227 1,207,178 2.383.477 2.697,713 1.291,481 2.550, 121 2,186,553 1,382,000 2.725,543 3.065, SIL Material unit Direct laborunt 11387 2.3484 1.2185 2.4057 1.9012 2.5741 1.1950 2.7543 1.4927 29471 1.5971 3.1534 1.700 33742 1966 3 5631 20935 4.1335 3.6104 Projected Operating Costs, New Automatik Equipment Unit volume 000) 546 00 00 600 60 Materials Direct Labor Overhead $42,223 524,136 638,197 61609 751,158 726, 101 1.293.195 884,113 854,621 1.9676 946,00 914.445 1,012.221 978.456 1,043,076 1,046, 948 1,158891 L120.234 2514993 1,240,014 1,198,651 2.91 012 1,336,815 1,282,356 2,429415 1.0932 187 Materials unit Direct labor/ unit 10567 L.169 L.1307 1.2516 1.2008 1.3392 1.2945 1.4330 1.3852 1.5833 1.4821 1.6406 1.5839 1.7554 1.6969 INS 2009 19427 1) Calculate the free cash flows each year associated with this proposed investment. 2) If the discount rate is 12%, should the company go ahead with the proposal? 3) If the discount rate is 25%, is the proposal still acceptable? Why or why not