Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work! Thanks Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London

please show work! Thanks

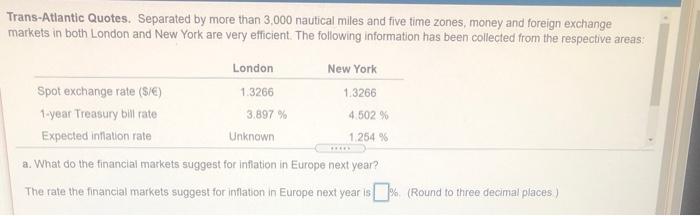

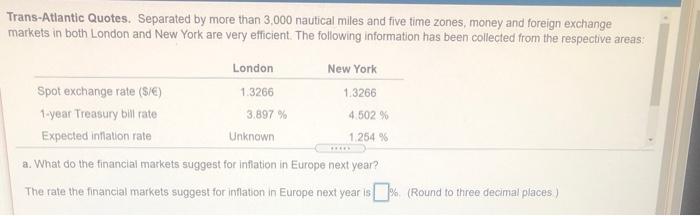

Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London and New York are very efficient. The following information has been collected from the respective areas: London New York Spot exchange rate (S/E) 1.3266 1.3266 1 year Treasury bill rate 3.897 % 4.502 % Expected inflation rate Unknown 1.254 % a. What do the financial markets suggest for inflation in Europe next year? The rate the financial markets suggest for inflation in Europe next year is % (Round to three decimal places) Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London and New York are very efficient. The following information has been collected from the respective areas: London New York Spot exchange rate (S/E) 1.3266 1.3266 1 year Treasury bill rate 3.897 % 4.502 % Expected inflation rate Unknown 1.254 % a. What do the financial markets suggest for inflation in Europe next year? The rate the financial markets suggest for inflation in Europe next year is % (Round to three decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started