Answered step by step

Verified Expert Solution

Question

1 Approved Answer

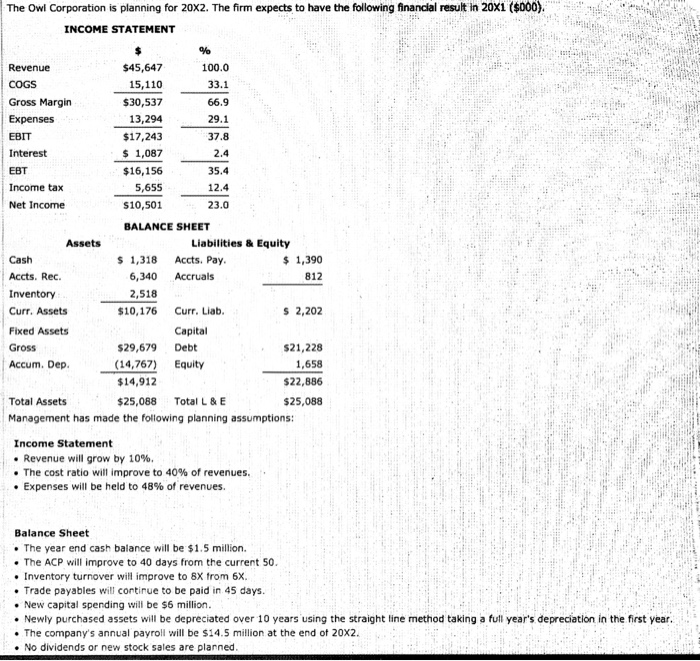

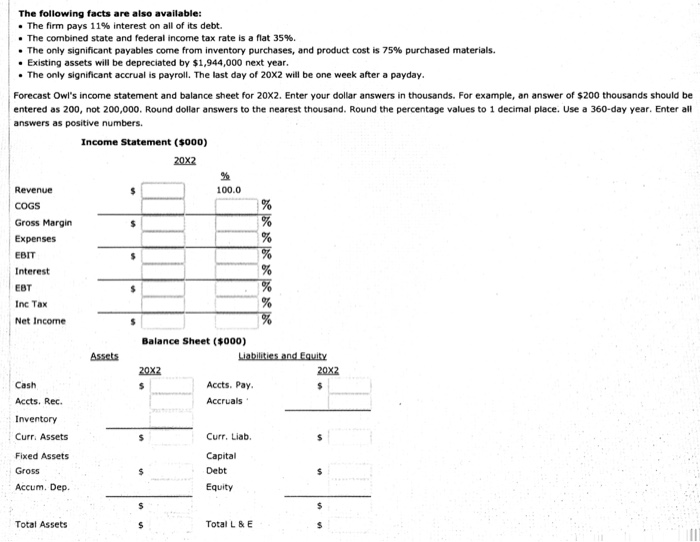

Please show work. The Owl Corporation is planning for 20x2. The firm expects to have the following finandial result in 20x1 ($000) INCOME STATEMENT Revenue

Please show work.

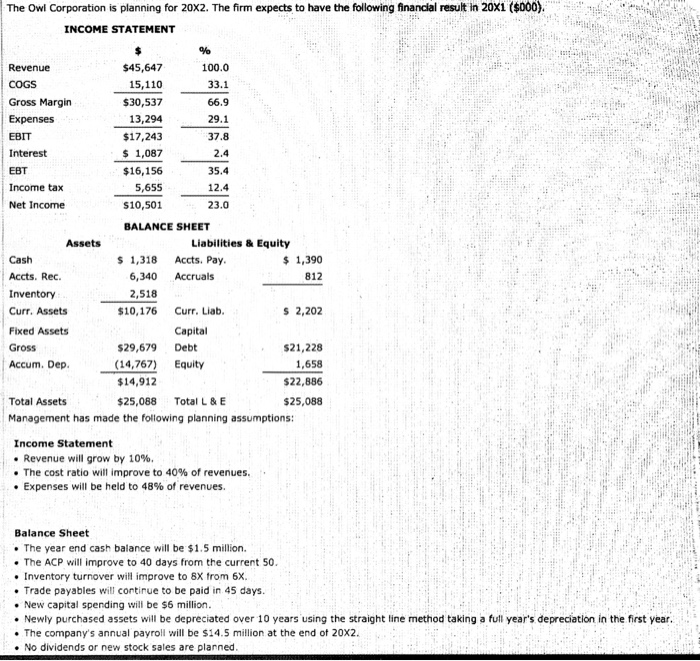

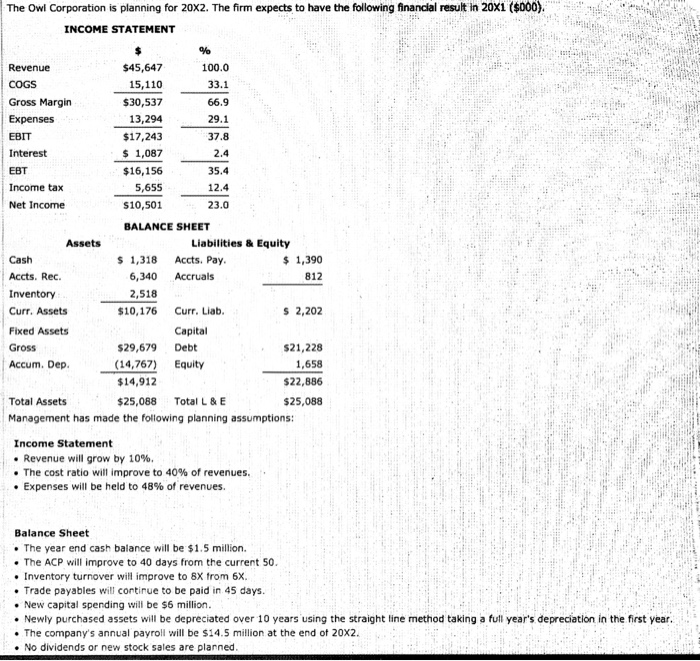

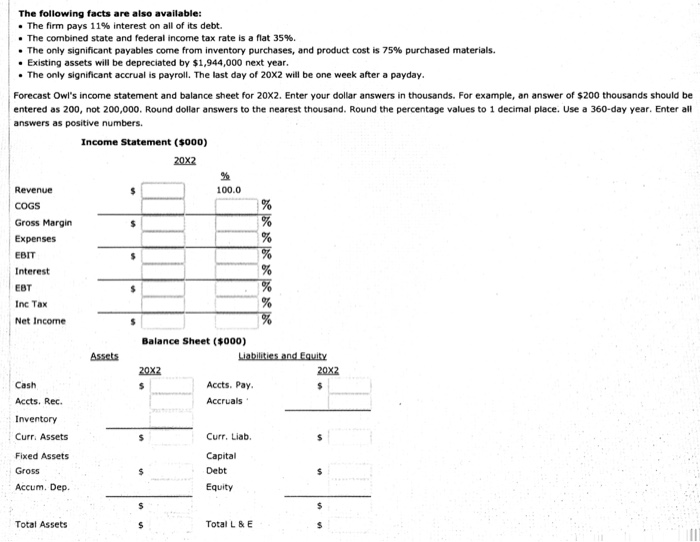

The Owl Corporation is planning for 20x2. The firm expects to have the following finandial result in 20x1 ($000) INCOME STATEMENT Revenue COGS Gross Margin Expenses EBIT Interest EBT Income tax Net Income $45,647 15,110 $30,537 13,294 $17,243 1,087 16,156 5,655 $10,501 100.0 33.1 66.9 29.1 37.8 2.4 35.4 12.4 23.0 BALANCE SHEET Assets Liabilities & Equity 1,31 Accts. Pay. 6,340 Accruals 2,518 Cash Accts. Rec. Inventory Curr. Assets Fixed Assets Gross 1,390 812 10,176 Crr. Liab. s 2,202 Capital 21,228 1,658 22,886 25,088 $29,679 Debt Accum. Dep. (1476 Equity $14,912 $25,088 Total Assets Management has made the following planning assumptions Total L & E Income Statement * Revenue will grow by 10%, The cost ratio will improve to 40% of revenues. * Expenses will be held to 48% of revenues. Balance Sheet . The year end cash balance will be $1.5 million. The ACP will improve to 40 days from the current 50. . Inventory turnover will improve to 8X from 6X Trade payables will contirue to be paid in 45 days New capital spending will be $6 million. Newly purchased assets will be depreciated over 10 years using the straight line method taking a full year's depreciation in the first year. The company's annual payroll will be $14.5 million at the end ot 20X2. . No dividends or new stock sales are plarned

The Owl Corporation is planning for 20x2. The firm expects to have the following finandial result in 20x1 ($000) INCOME STATEMENT Revenue COGS Gross Margin Expenses EBIT Interest EBT Income tax Net Income $45,647 15,110 $30,537 13,294 $17,243 1,087 16,156 5,655 $10,501 100.0 33.1 66.9 29.1 37.8 2.4 35.4 12.4 23.0 BALANCE SHEET Assets Liabilities & Equity 1,31 Accts. Pay. 6,340 Accruals 2,518 Cash Accts. Rec. Inventory Curr. Assets Fixed Assets Gross 1,390 812 10,176 Crr. Liab. s 2,202 Capital 21,228 1,658 22,886 25,088 $29,679 Debt Accum. Dep. (1476 Equity $14,912 $25,088 Total Assets Management has made the following planning assumptions Total L & E Income Statement * Revenue will grow by 10%, The cost ratio will improve to 40% of revenues. * Expenses will be held to 48% of revenues. Balance Sheet . The year end cash balance will be $1.5 million. The ACP will improve to 40 days from the current 50. . Inventory turnover will improve to 8X from 6X Trade payables will contirue to be paid in 45 days New capital spending will be $6 million. Newly purchased assets will be depreciated over 10 years using the straight line method taking a full year's depreciation in the first year. The company's annual payroll will be $14.5 million at the end ot 20X2. . No dividends or new stock sales are plarned

Please show work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started