Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work The Petermann Trust incurs the following items. Taxable interest income Taxable dividend income $100,000 80,000 Long-term capital gains (allocable to income) Fiduciary's

Please show work

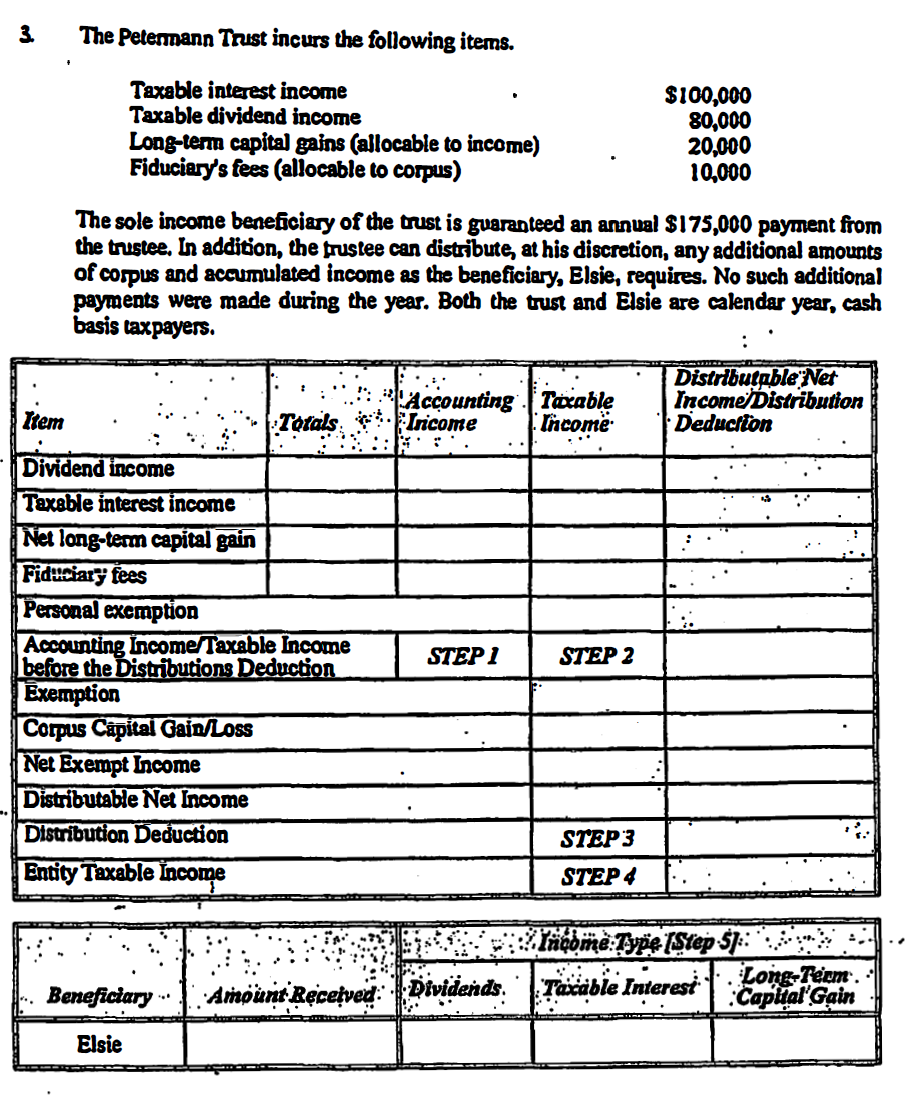

The Petermann Trust incurs the following items. Taxable interest income Taxable dividend income $100,000 80,000 Long-term capital gains (allocable to income) Fiduciary's fees (allocable to corpus) 20,000 10,000 The sole income beneficiary of the trust is guaranteed an annual $175,000 payment from the trustee. In addition, the trustee can distribute, at his discretion, any additional amounts of corpus and accumulated income as the beneficiary, Elsie, requires. No such additional payments were made during the year. Both the trust and Elsie are calendar year, cash basis taxpayers. : Accounting Taxable Inicome Income Distributable Net Income/Distribution Deduction Item Totals Dividend income Taxable interest income Net long-term capital gain Fiduciary fees Personal exemption STEP 1 STEP 2 Accounting Income/Taxable Income before the Distributions Deduction Exemption Corpus Capital Gain/Loss Net Exempt Income Distributable Net Income Distribution Deduction STEP 3 Entity Taxable income STEP 4 Income Type (Step S] Beneficiary. Amount Received: Dividends. Taxable Interest Elsie 3. Long-Term Capital GainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started