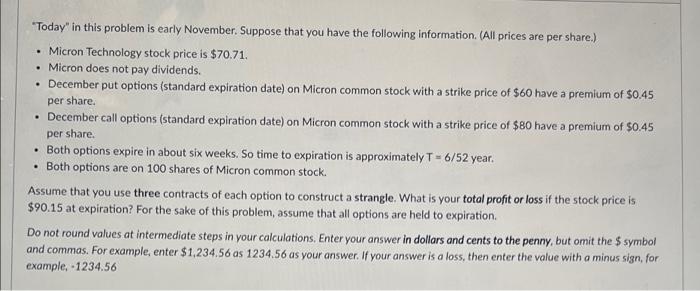

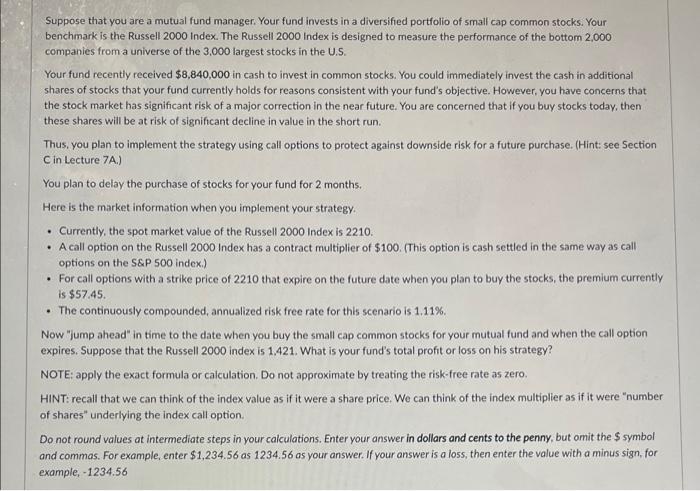

. "Today" in this problem is early November. Suppose that you have the following information. All prices are per share.) Micron Technology stock price is $70.71. Micron does not pay dividends. December put options (standard expiration date) on Micron common stock with a strike price of $60 have a premium of $0.45 per share. December call options (standard expiration date) on Micron common stock with a strike price of $80 have a premium of $0.45 per share. . Both options expire in about six weeks. So time to expiration is approximately T = 6/52 year. . Both options are on 100 shares of Micron common stock Assume that you use three contracts of each option to construct a strangle. What is your total profit or loss if the stock price is $90.15 at expiration? For the sake of this problem, assume that all options are held to expiration. Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents to the penny, but omit the $ symbol and commas. For example, enter $1,234,56 as 1234.56 as your answer. If your answer is a loss, then enter the value with a minus sign, for example-1234.56 . Suppose that you are a mutual fund manager. Your fund invests in a diversified portfolio of small cap common stocks. Your benchmark is the Russell 2000 Index. The Russell 2000 Index is designed to measure the performance of the bottom 2,000 companies from a universe of the 3,000 largest stocks in the U.S. Your fund recently received $8,840,000 in cash to invest in common stocks. You could immediately invest the cash in additional shares of stocks that your fund currently holds for reasons consistent with your fund's objective. However, you have concerns that the stock market has significant risk of a major correction in the near future. You are concerned that if you buy stocks today, then these shares will be at risk of significant decline in value in the short run. Thus, you plan to implement the strategy using call options to protect against downside risk for a future purchase. (Hint: see Section C in Lecture 7A) You plan to delay the purchase of stocks for your fund for 2 months. Here is the market information when you implement your strategy Currently, the spot market value of the Russell 2000 Index is 2210. A call option on the Russell 2000 Index has a contract multiplier of $100. (This option is cash settled in the same way as call options on the S&P 500 index.) For call options with a strike price of 2210 that expire on the future date when you plan to buy the stocks, the premium currently is $57.45. The continuously compounded annualized risk free rate for this scenario is 1.11%. Now "jump ahead" in time to the date when you buy the small cap common stocks for your mutual fund and when the call option expires. Suppose that the Russell 2000 index is 1.421. What is your fund's total profit or loss on his strategy? NOTE: apply the exact formula or calculation. Do not approximate by treating the risk-free rate as zero HINT: recall that we can think of the index value as if it were a share price. We can think of the index multiplier as if it were "number of shares underlying the index call option Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents to the penny, but omit the $ symbol and commas. For example, enter $1,234.56 as 1234.56 as your answer. If your answer is a loss, then enter the value with a minus sign, for example, -1234.56 a . "Today" in this problem is early November. Suppose that you have the following information. All prices are per share.) Micron Technology stock price is $70.71. Micron does not pay dividends. December put options (standard expiration date) on Micron common stock with a strike price of $60 have a premium of $0.45 per share. December call options (standard expiration date) on Micron common stock with a strike price of $80 have a premium of $0.45 per share. . Both options expire in about six weeks. So time to expiration is approximately T = 6/52 year. . Both options are on 100 shares of Micron common stock Assume that you use three contracts of each option to construct a strangle. What is your total profit or loss if the stock price is $90.15 at expiration? For the sake of this problem, assume that all options are held to expiration. Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents to the penny, but omit the $ symbol and commas. For example, enter $1,234,56 as 1234.56 as your answer. If your answer is a loss, then enter the value with a minus sign, for example-1234.56 . Suppose that you are a mutual fund manager. Your fund invests in a diversified portfolio of small cap common stocks. Your benchmark is the Russell 2000 Index. The Russell 2000 Index is designed to measure the performance of the bottom 2,000 companies from a universe of the 3,000 largest stocks in the U.S. Your fund recently received $8,840,000 in cash to invest in common stocks. You could immediately invest the cash in additional shares of stocks that your fund currently holds for reasons consistent with your fund's objective. However, you have concerns that the stock market has significant risk of a major correction in the near future. You are concerned that if you buy stocks today, then these shares will be at risk of significant decline in value in the short run. Thus, you plan to implement the strategy using call options to protect against downside risk for a future purchase. (Hint: see Section C in Lecture 7A) You plan to delay the purchase of stocks for your fund for 2 months. Here is the market information when you implement your strategy Currently, the spot market value of the Russell 2000 Index is 2210. A call option on the Russell 2000 Index has a contract multiplier of $100. (This option is cash settled in the same way as call options on the S&P 500 index.) For call options with a strike price of 2210 that expire on the future date when you plan to buy the stocks, the premium currently is $57.45. The continuously compounded annualized risk free rate for this scenario is 1.11%. Now "jump ahead" in time to the date when you buy the small cap common stocks for your mutual fund and when the call option expires. Suppose that the Russell 2000 index is 1.421. What is your fund's total profit or loss on his strategy? NOTE: apply the exact formula or calculation. Do not approximate by treating the risk-free rate as zero HINT: recall that we can think of the index value as if it were a share price. We can think of the index multiplier as if it were "number of shares underlying the index call option Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents to the penny, but omit the $ symbol and commas. For example, enter $1,234.56 as 1234.56 as your answer. If your answer is a loss, then enter the value with a minus sign, for example, -1234.56 a