please show work

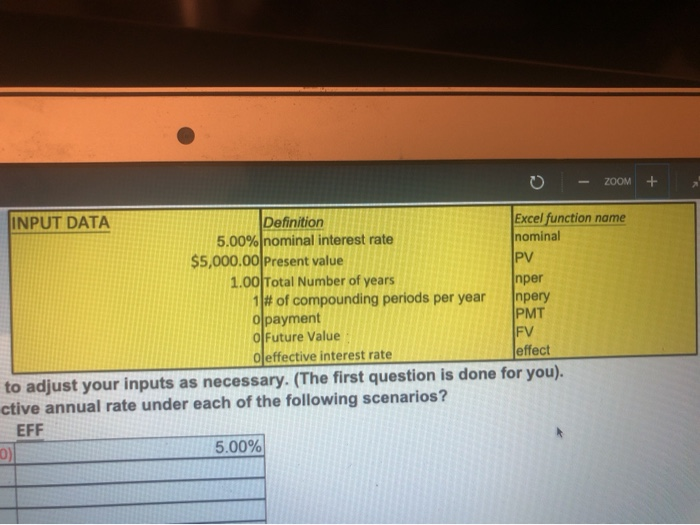

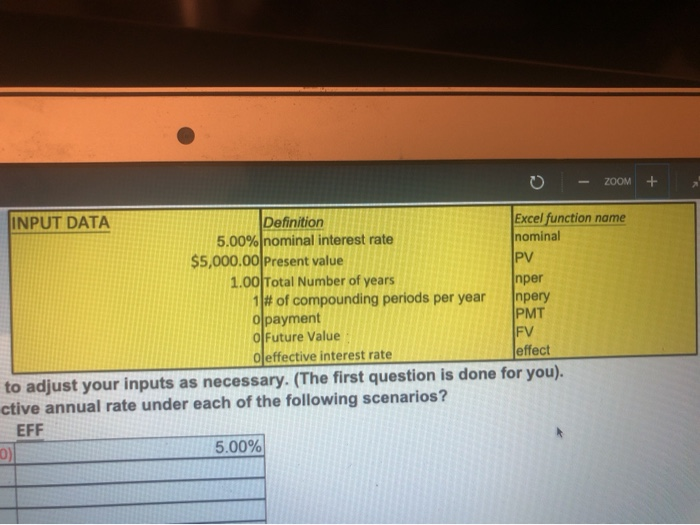

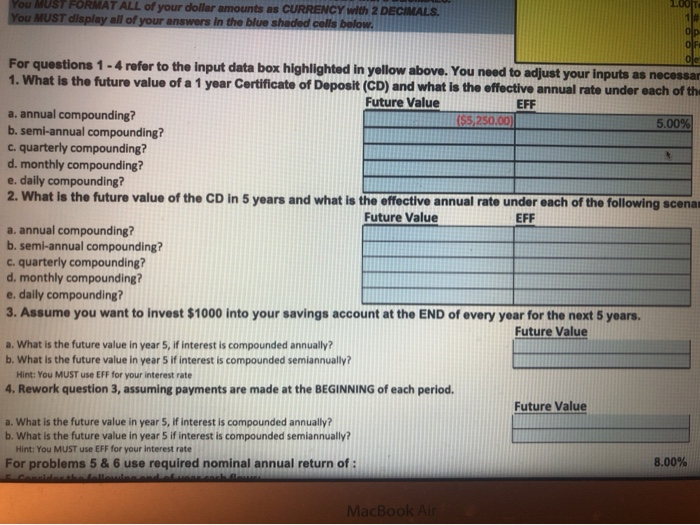

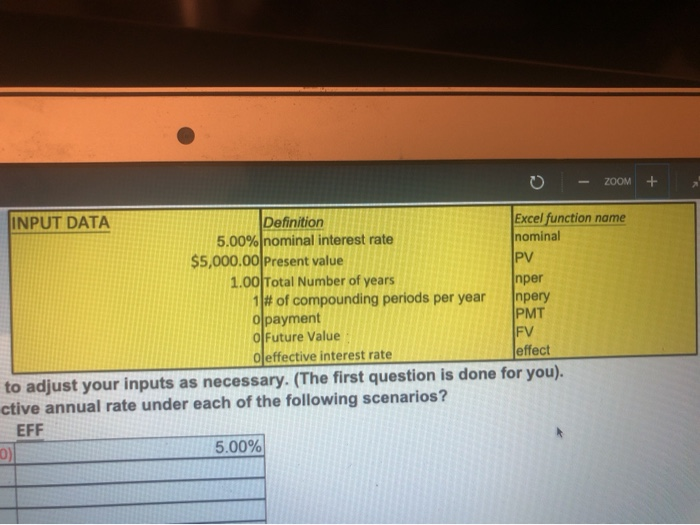

ZOOM + INPUT DATA Definition Excel function name 5.00% nominal interest rate nominal $5,000.00 Present value IPV 1.00 Total Number of years Inper 1 # of compounding periods per year Inpery O payment PMT O Future Value FV O effective interest rate effect to adjust your inputs as necessary. (The first question is done for you). ctive annual rate under each of the following scenarios? EFF 0) 5.00% You MUST FORMAT ALL of your dollar amounts as CURRENCY with 2 DECIMALS. You MUST display all of your answers in the blue shaded cells below. 1.00 1# OF Ole For questions 1 - 4 refer to the input data box highlighted in yellow above. You need to adjust your inputs as necessar 1. What is the future value of a 1 year Certificate of Deposit (CD) and what is the offective annual rate under each of the Future Value EFF a. annual compounding? ($5.250.00) 5.00% b. semi-annual compounding? c. quarterly compounding? d. monthly compounding? e daily compounding? 2. What is the future value of the CD in 5 years and what is the effective annual rate under each of the following scenam Future Value EFF a. annual compounding? b. semi-annual compounding? c. quarterly compounding? d. monthly compounding? e. daily compounding? 3. Assume you want to invest $1000 into your savings account at the END of every year for the next 5 years. Future Value a. What is the future value in year 5, if Interest is compounded annually? b. What is the future value in year 5 if interest is compounded semiannually? Hint: You MUST use EFF for your interest rate 4. Rework question 3, assuming payments are made at the BEGINNING of each period. Future Value a. What is the future value in year 5, if interest is compounded annually? b. What is the future value in year 5 if interest is compounded semiannually? Hint: You MUST use EFF for your interest rate For problems 5 & 6 use required nominal annual return of : 8.00% Carthalle MacBook Air ZOOM + INPUT DATA Definition Excel function name 5.00% nominal interest rate nominal $5,000.00 Present value IPV 1.00 Total Number of years Inper 1 # of compounding periods per year Inpery O payment PMT O Future Value FV O effective interest rate effect to adjust your inputs as necessary. (The first question is done for you). ctive annual rate under each of the following scenarios? EFF 0) 5.00% You MUST FORMAT ALL of your dollar amounts as CURRENCY with 2 DECIMALS. You MUST display all of your answers in the blue shaded cells below. 1.00 1# OF Ole For questions 1 - 4 refer to the input data box highlighted in yellow above. You need to adjust your inputs as necessar 1. What is the future value of a 1 year Certificate of Deposit (CD) and what is the offective annual rate under each of the Future Value EFF a. annual compounding? ($5.250.00) 5.00% b. semi-annual compounding? c. quarterly compounding? d. monthly compounding? e daily compounding? 2. What is the future value of the CD in 5 years and what is the effective annual rate under each of the following scenam Future Value EFF a. annual compounding? b. semi-annual compounding? c. quarterly compounding? d. monthly compounding? e. daily compounding? 3. Assume you want to invest $1000 into your savings account at the END of every year for the next 5 years. Future Value a. What is the future value in year 5, if Interest is compounded annually? b. What is the future value in year 5 if interest is compounded semiannually? Hint: You MUST use EFF for your interest rate 4. Rework question 3, assuming payments are made at the BEGINNING of each period. Future Value a. What is the future value in year 5, if interest is compounded annually? b. What is the future value in year 5 if interest is compounded semiannually? Hint: You MUST use EFF for your interest rate For problems 5 & 6 use required nominal annual return of : 8.00% Carthalle MacBook Air