Please show working out

Please show working out

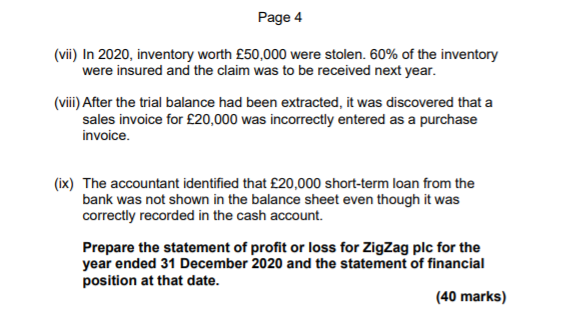

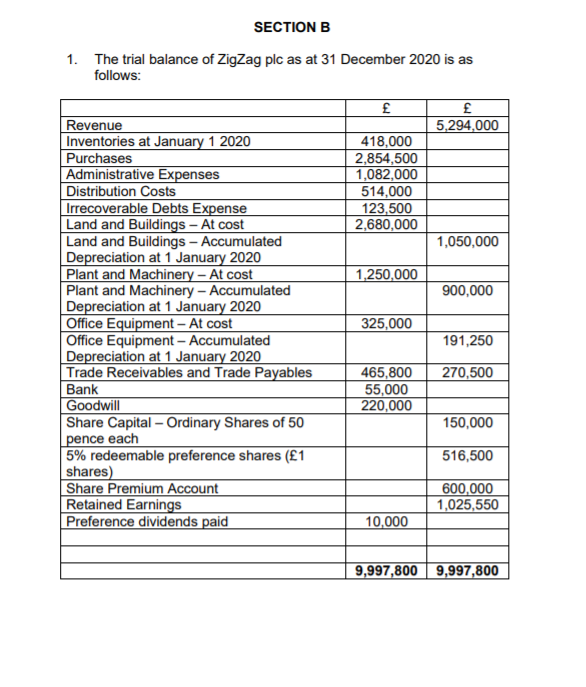

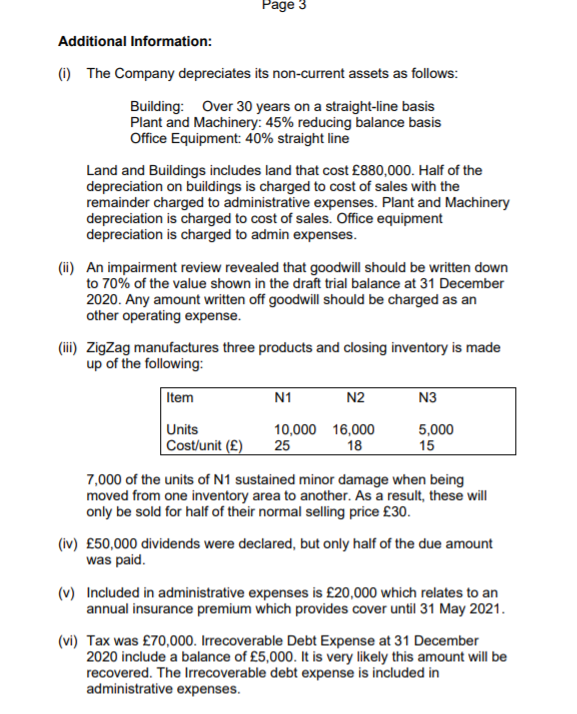

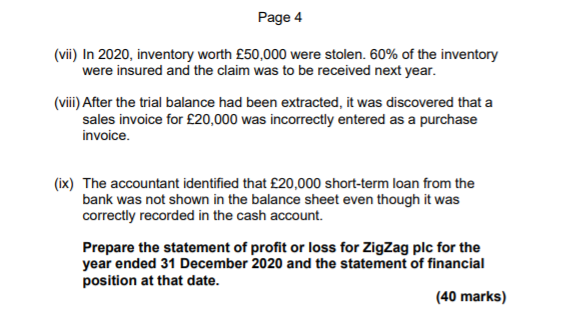

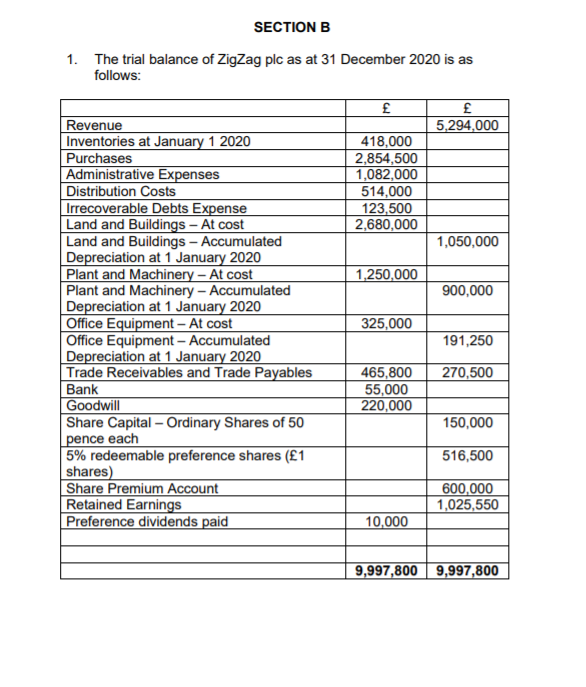

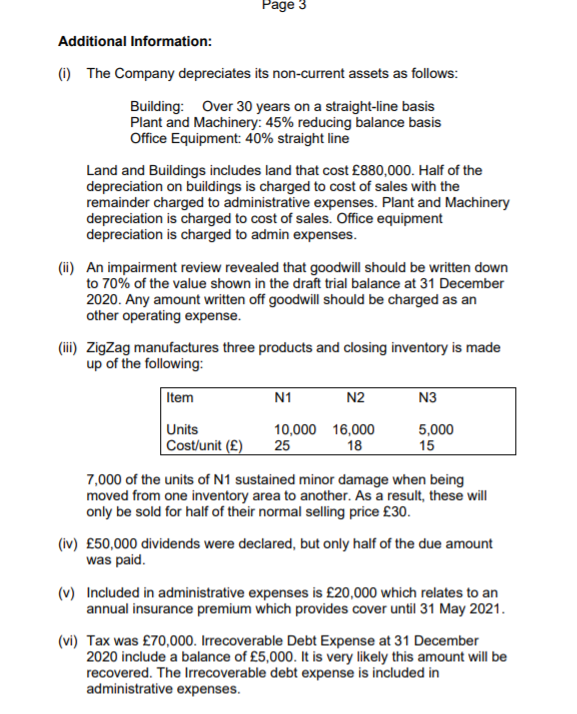

SECTION B 1. The trial balance of ZigZag plc as at 31 December 2020 is as follows: 5,294,000 418,000 2,854,500 1,082,000 514,000 123,500 2,680,000 1,050,000 1,250,000 900,000 Revenue Inventories at January 1 2020 Purchases Administrative Expenses Distribution Costs Irrecoverable Debts Expense Land and Buildings - At cost Land and Buildings - Accumulated Depreciation at 1 January 2020 Plant and Machinery - At cost Plant and Machinery - Accumulated Depreciation at 1 January 2020 Office Equipment - At cost Office Equipment - Accumulated Depreciation at 1 January 2020 Trade Receivables and Trade Payables Bank Goodwill Share Capital - Ordinary Shares of 50 pence each 5% redeemable preference shares (1 shares) Share Premium Account Retained Earnings Preference dividends paid 325,000 191,250 270,500 465,800 55,000 220,000 150,000 516,500 600,000 1,025,550 10,000 9,997,800 9,997,800 Page 3 Additional Information: (1) The Company depreciates its non-current assets as follows: Building: Over 30 years on a straight-line basis Plant and Machinery: 45% reducing balance basis Office Equipment: 40% straight line Land and Buildings includes land that cost 880,000. Half of the depreciation on buildings is charged to cost of sales with the remainder charged to administrative expenses. Plant and Machinery depreciation is charged to cost of sales. Office equipment depreciation is charged to admin expenses. (ii) An impairment review revealed that goodwill should be written down to 70% of the value shown in the draft trial balance at 31 December 2020. Any amount written off goodwill should be charged as an other operating expense. (ii) ZigZag manufactures three products and closing inventory is made up of the following: Item N1 N3 Units Cost/unit () N2 10,000 16,000 25 18 5,000 15 7,000 of the units of N1 sustained minor damage when being moved from one inventory area to another. As a result, these will only be sold for half of their normal selling price 30. (iv) 50,000 dividends were declared, but only half of the due amount was paid. (v) Included in administrative expenses is 20,000 which relates to an annual insurance premium which provides cover until 31 May 2021. (vi) Tax was 70,000. Irrecoverable Debt Expense at 31 December 2020 include a balance of 5,000. It is very likely this amount will be recovered. The Irrecoverable debt expense is included in administrative expenses. Page 4 (vii) In 2020, inventory worth 50,000 were stolen. 60% of the inventory were insured and the claim was to be received next year. (viii) After the trial balance had been extracted, it was discovered that a sales invoice for 20,000 was incorrectly entered as a purchase invoice. (ix) The accountant identified that 20,000 short-term loan from the bank was not shown in the balance sheet even though it was correctly recorded in the cash account. Prepare the statement of profit or loss for ZigZag plc for the year ended 31 December 2020 and the statement of financial position at that date. (40 marks)

Please show working out

Please show working out