Please show your full steps even if you are using a financial calculator.

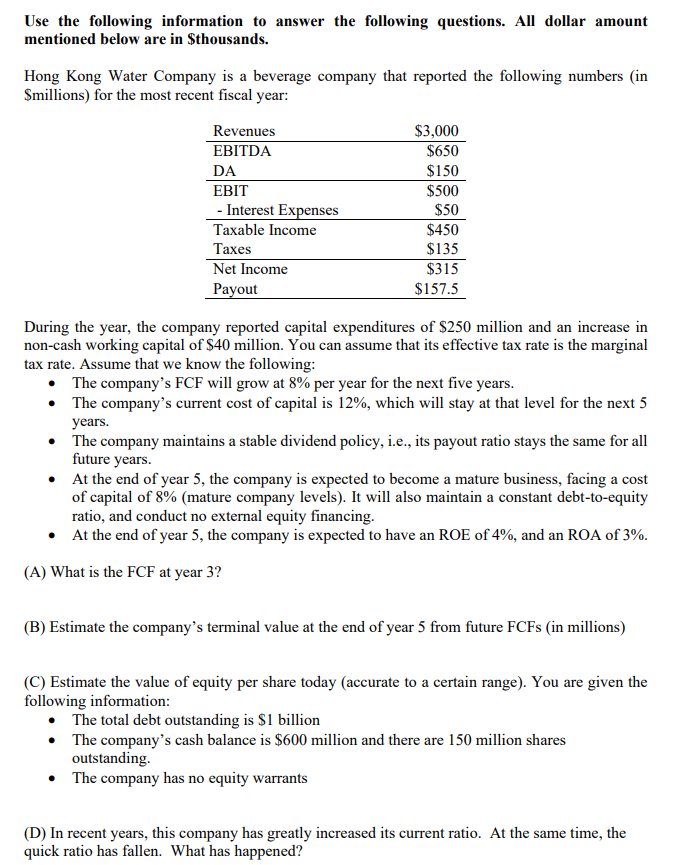

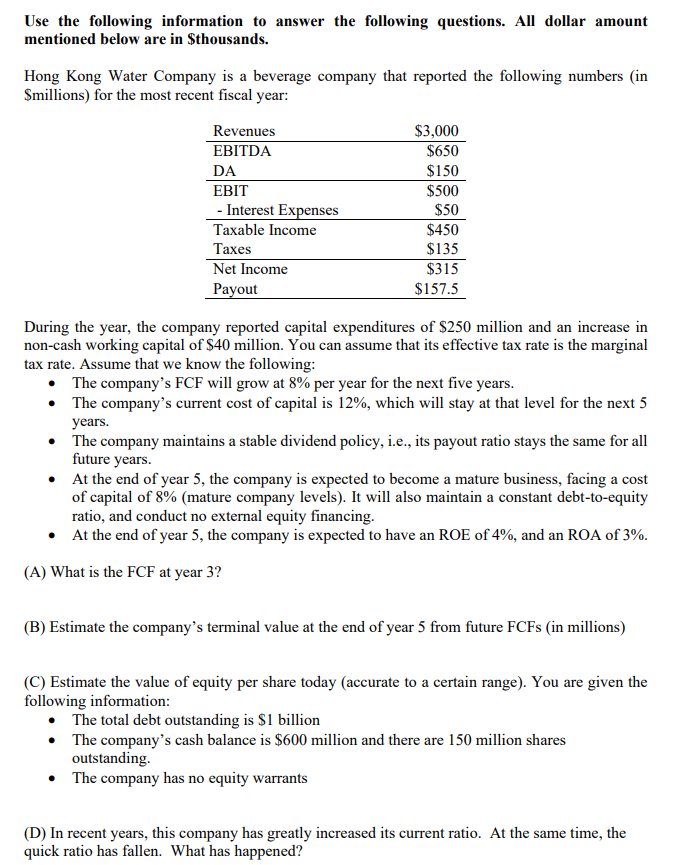

Use the following information to answer the following questions. All dollar amount mentioned below are in $thousands. Hong Kong Water Company is a beverage company that reported the following numbers in Smillions) for the most recent fiscal year: Revenues EBITDA DA EBIT - Interest Expenses Taxable Income Taxes Net Income Payout $3,000 $650 $150 $500 $50 $450 $135 $315 $157.5 During the year, the company reported capital expenditures of $250 million and an increase in non-cash working capital of $40 million. You can assume that its effective tax rate is the marginal tax rate. Assume that we know the following: The company's FCF will grow at 8% per year for the next five years. The company's current cost of capital is 12%, which will stay at that level for the next 5 years. The company maintains a stable dividend policy, i.e., its payout ratio stays the same for all future years. At the end of year 5, the company is expected to become a mature business, facing a cost of capital of 8% (mature company levels). It will also maintain a constant debt-to-equity ratio, and conduct no external equity financing. At the end of year 5, the company is expected to have an ROE of 4%, and an ROA of 3%. (A) What is the FCF at year 3? (B) Estimate the company's terminal value at the end of year 5 from future FCFs (in millions) (C) Estimate the value of equity per share today accurate to a certain range). You are given the following information: The total debt outstanding is $1 billion The company's cash balance is $600 million and there are 150 million shares outstanding. The company has no equity warrants (D) In recent years, this company has greatly increased its current ratio. At the same time, the quick ratio has fallen. What has happened? Use the following information to answer the following questions. All dollar amount mentioned below are in $thousands. Hong Kong Water Company is a beverage company that reported the following numbers in Smillions) for the most recent fiscal year: Revenues EBITDA DA EBIT - Interest Expenses Taxable Income Taxes Net Income Payout $3,000 $650 $150 $500 $50 $450 $135 $315 $157.5 During the year, the company reported capital expenditures of $250 million and an increase in non-cash working capital of $40 million. You can assume that its effective tax rate is the marginal tax rate. Assume that we know the following: The company's FCF will grow at 8% per year for the next five years. The company's current cost of capital is 12%, which will stay at that level for the next 5 years. The company maintains a stable dividend policy, i.e., its payout ratio stays the same for all future years. At the end of year 5, the company is expected to become a mature business, facing a cost of capital of 8% (mature company levels). It will also maintain a constant debt-to-equity ratio, and conduct no external equity financing. At the end of year 5, the company is expected to have an ROE of 4%, and an ROA of 3%. (A) What is the FCF at year 3? (B) Estimate the company's terminal value at the end of year 5 from future FCFs (in millions) (C) Estimate the value of equity per share today accurate to a certain range). You are given the following information: The total debt outstanding is $1 billion The company's cash balance is $600 million and there are 150 million shares outstanding. The company has no equity warrants (D) In recent years, this company has greatly increased its current ratio. At the same time, the quick ratio has fallen. What has happened