Answered step by step

Verified Expert Solution

Question

1 Approved Answer

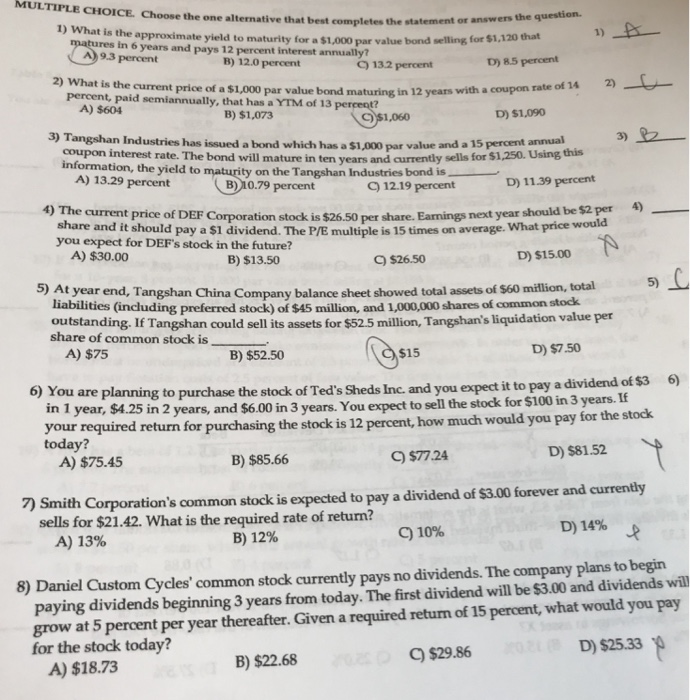

Please show your work in excel for each question. Thank you. MULTIPLE CHOICE Choose the one alternative that best completes the statement or 1) What

Please show your work in excel for each question. Thank you.

MULTIPLE CHOICE Choose the one alternative that best completes the statement or 1) What is the approximate yield to maturity for a $1,000 par value bond selling for $1,120 that in 6 years and pays 12 percent interest annually A9.3 percent B) 12.0 percent 2) What is the current price of a $1,000 par value bond maturing in 12 years with C) 13.2 percent a coupon percent, paid semiannually, that has a YTM of 13 percent? A) $604 B) $1,073 D) $1,090 3) T angshan Industries has issued a bond which has a $1,000 par value and a 15 percent annual coupon interest rate. The bond will mature in ten years and currently sells for $1,250. Using this Information, the yield to maturity on the Tangshan Industries bondnt ) 11.39 percent A) 13.29 percent B)10.79 percent 4) 4 The current price of DEF Corporation stock is $26.50 per share. Eamings next year should be $2 per share and it should pay a $1 dividend. The P/E multiple is 15 times on average. What price wou you expect for DEF's stock in the future? A) $30.00 B) $13.50 $26.50 D) $15.00 5) 5) At year end, Tangshan China Company balance sheet showed total assets of s60 mifllion, total liabilities (including preferred stock) of $45 million, and 1,000,000 shares of common outstanding. If Tangshan could sell its assets for $52.5 million, Tangshan's liquidation value per share of common stock is A) $75 B) $52.50 $15 6) You are planning to purchase the stock of Ted's Sheds Inc. and you expect it to pay a dividend of $3 6) in 3 years. If in 1 year, $A4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 your required return for purchasing today? the stock is 12 percent, how much would you pay for the stodk C) $77.24 D) $81.52 A) $75.45 B) $85.66 7) Smith Co rporation's common stock is expected to pay a dividend of $3.00 forever and currently sells for $21.42. What is the required rate of return? D) 14% A) 13% B) 12% C) 10% 8) Daniel Custom Cycles' common stock currently pays no dividends. The company plans to begin grow at 5 percent per year thereafter. Given a required return of 15 percent, what would you pay for the stock today? paying dividends beginning 3 years from today. The first dividend will be $3.00 and dividends will $29.86 D) $25.33 B) $22.68 A) $18.73

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started