Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work in excel, thank you! SM.61 A small but growing online retailer, Nile Corporation, has shown impressive growth in sales over the

Please show your work in excel, thank you!

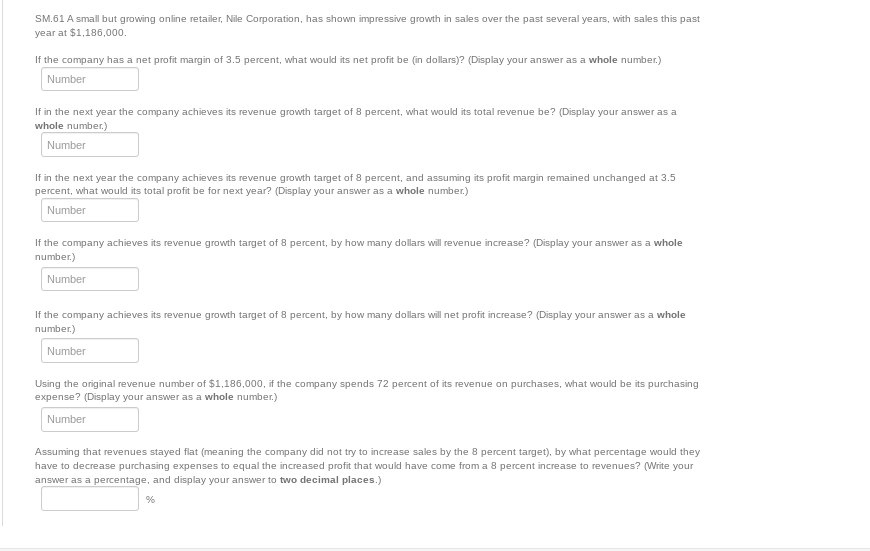

SM.61 A small but growing online retailer, Nile Corporation, has shown impressive growth in sales over the past several years, with sales this past year at $1,186,000. If the company has a net profit margin of 3.5 percent, what would its net profit be (in dollars)? (Display your answer as a whole number.) Number If in the next year the company achieves its revenue growth target of 8 percent, what would its total revenue be? (Display your answer as a whole number.) Number If in the next year the company achieves its revenue growth target of 8 percent, and assuming its profit margin remained unchanged at 3.5 percent, what would its total profit be for next year? (Display your answer as a whole number.) Number If the company achieves its revenue growth target of 8 percent, by how many dollars will revenue increase? (Display your answer as a whole number.) Number If the company achieves its revenue growth target of 8 percent, by how many dollars will net profit increase? (Display your answer as a whole number.) Number Using the original revenue number of $1,186,000, if the company spends 72 percent of its revenue on purchases, what would be its purchasing expense? (Display your answer as a whole number.) Number Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 8 percent target), by what percentage would they have to decrease purchasing expenses to equal the increased profit that would have come from a 8 percent increase to revenues? (Write your answer as a percentage, and display your answer to two decimal places.) %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started