Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work on how to get the following. - Net income - Total Assets - Current Liabilities - Retained Earnings - External financing

Please show your work on how to get the following.

- Net income

- Total Assets

- Current Liabilities

- Retained Earnings

- External financing needed

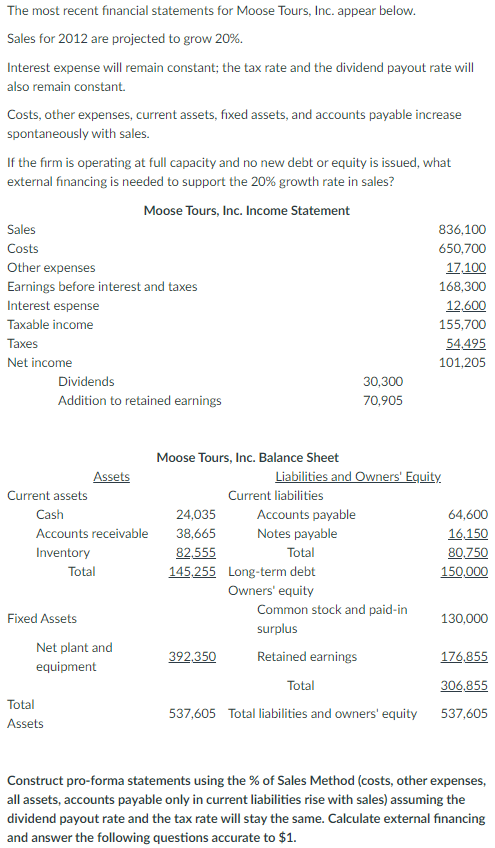

The most recent financial statements for Moose Tours, Inc. appear below. Sales for 2012 are projected to grow 20%. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the form is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20% growth rate in sales? Moose Tours, Inc. Income Statement Sales 836,100 Costs 650,700 Other expenses 17.100 Earnings before interest and taxes 168,300 Interest espense 12.600 Taxable income 155,700 Taxes 54.495 Net income 101,205 Dividends 30,300 Addition to retained earnings 70,905 Assets Current assets Cash Accounts receivable Inventory Total Moose Tours, Inc. Balance Sheet Liabilities and Owners' Equity. Current liabilities 24,035 Accounts payable 64,600 38,665 Notes payable 16.150 82.555 Total 80.750 145.255 Long-term debt 150.000 Owners' equity Common stock and paid-in 130,000 surplus 392.350 Retained earnings 176.855 Total 306.855 Fixed Assets Net plant and equipment Total Assets 537,605 Total liabilities and owners' equity 537,605 Construct pro-forma statements using the % of Sales Method (costs, other expenses, all assets, accounts payable only in current liabilities rise with sales) assuming the dividend payout rate and the tax rate will stay the same. Calculate external financing and answer the following questions accurate to $1. The most recent financial statements for Moose Tours, Inc. appear below. Sales for 2012 are projected to grow 20%. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the form is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20% growth rate in sales? Moose Tours, Inc. Income Statement Sales 836,100 Costs 650,700 Other expenses 17.100 Earnings before interest and taxes 168,300 Interest espense 12.600 Taxable income 155,700 Taxes 54.495 Net income 101,205 Dividends 30,300 Addition to retained earnings 70,905 Assets Current assets Cash Accounts receivable Inventory Total Moose Tours, Inc. Balance Sheet Liabilities and Owners' Equity. Current liabilities 24,035 Accounts payable 64,600 38,665 Notes payable 16.150 82.555 Total 80.750 145.255 Long-term debt 150.000 Owners' equity Common stock and paid-in 130,000 surplus 392.350 Retained earnings 176.855 Total 306.855 Fixed Assets Net plant and equipment Total Assets 537,605 Total liabilities and owners' equity 537,605 Construct pro-forma statements using the % of Sales Method (costs, other expenses, all assets, accounts payable only in current liabilities rise with sales) assuming the dividend payout rate and the tax rate will stay the same. Calculate external financing and answer the following questions accurate to $1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started