Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work so I can see how and where you got the numbers from. Thank you. E12-7 (Algo) Preparing and Evaluating a Simple

Please show your work so I can see how and where you got the numbers from. Thank you.

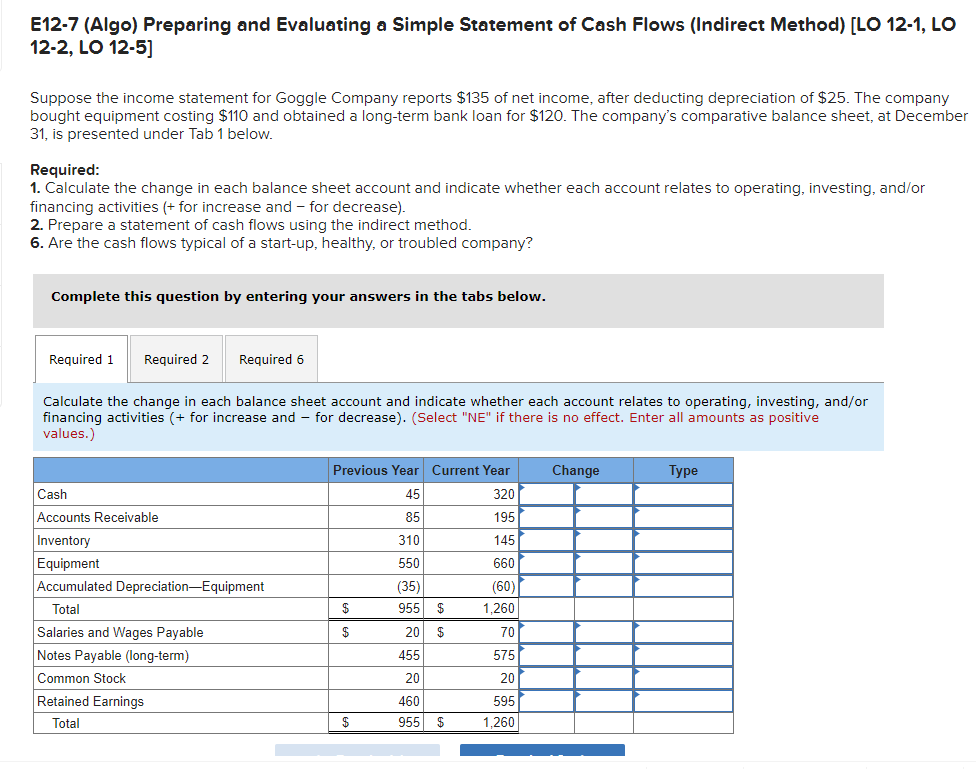

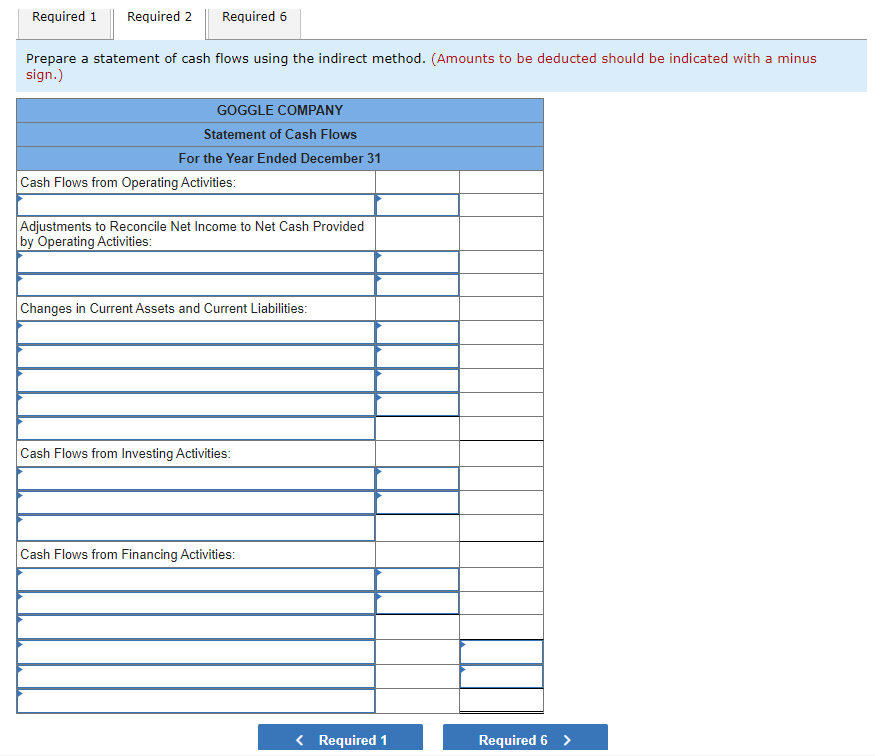

E12-7 (Algo) Preparing and Evaluating a Simple Statement of Cash Flows (Indirect Method) [LO 12-1, LO 12-2, LO 12-5] Suppose the income statement for Goggle Company reports $135 of net income, after deducting depreciation of $25. The company bought equipment costing $110 and obtained a long-term bank loan for $120. The company's comparative balance sheet, at December 31, is presented under Tab 1 below. Required: 1. Calculate the change in each balance sheet account and indicate whether each account relates to operating, investing, and/or financing activities (+ for increase and - for decrease). 2. Prepare a statement of cash flows using the indirect method. 6. Are the cash flows typical of a start-up, healthy, or troubled company? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 6 Calculate the change in each balance sheet account and indicate whether each account relates to operating, investing, and/or financing activities (+ for increase and for decrease). (Select "NE" if there is no effect. Enter all amounts as positive values.) Previous Year Current Year Change Type 45 320 195 Cash Accounts Receivable Inventory Equipment Accumulated Depreciation-Equipment Total 85 310 550 145 660 (60) 1,260 $ (35) 955 $ 20 $ 455 $ 70 575 Salaries and Wages Payable Notes Payable (long-term) Common Stock Retained Earnings Total 20 20 460 955 $ 595 1,260 $ Required 1 Required 2 Required 6 Prepare a statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) GOGGLE COMPANY Statement of Cash Flows For the Year Ended December 31 Cash Flows from Operating Activities: Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Changes in Current Assets and Current Liabilities: Cash Flows from Investing Activities: Cash Flows from Financing Activities: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 6 Are the cash flows typical of a start-up, healthy, or troubled company? Start-Up Company Healthy Company Troubled CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started