Please show your workings

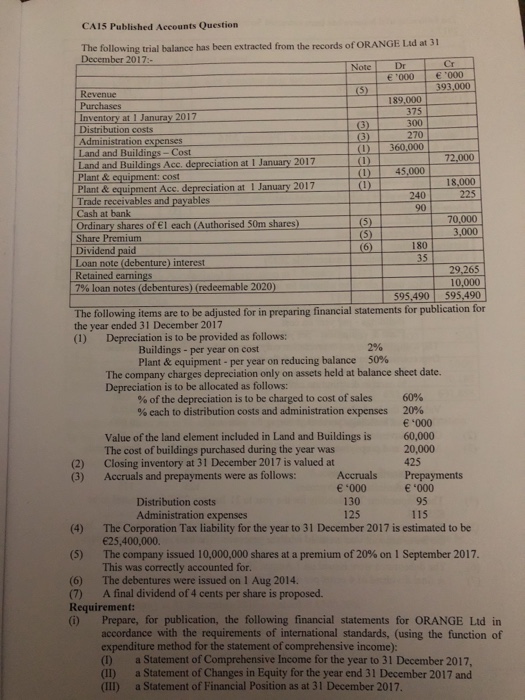

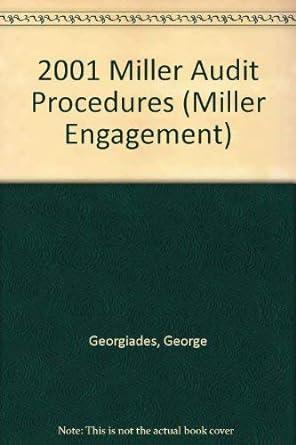

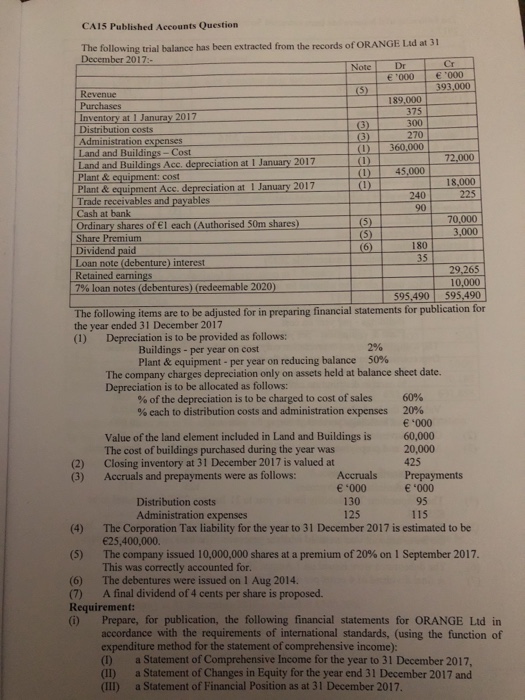

CA15 Published Accounts Question The following trial balance has been extracted from the records of ORANGE Lad at 31 December 2017 Dr Cr 393,000 189,000 375 300 270 2017 Inventory at 1 Januray Distribution costs Administration expenses 360,0001 Land and Buildings-Cost Land and Buildings Acc. depreciation at I January 2017 Plant & equipment: cost Plant & equipment Acc.depreciation at I January Trade receivables and payables Cash at bank 72,000 18,000 225 2017 240 90 Ordinary shares of l each (Authorised 50m shares) Share Premium 70,000 3,000 Dividend paid Loan note (debenture) interest 180 35 Retained earnings 7% loan notes (debentures) (redeemable 2020) 10,000 595,490595,490 The following tems are to be adjusted for in preparing financial statements for publication for the year ended 31 December 2017 (1) Depreciation is to be provided as follows: 296 Buildings per year on cost Plant & equipment-per year on reducing balance 50% The company charges depreciation only on assets held at balance sheet date. Depreciation is to be allocated as follows: % of the depreciation is to be charged to cost of sales % each to distribution costs and administration expenses 60% 20% Value of the land element included in Land and Buildings is The cost of buildings purchased during the year was Closing inventory at 31 December 2017 is valued at Accruals and prepayments were as follows: 60,000 20,000 425 (2) (3) Accruals Prepayments '000 Distribution costs Administration expenses 130 125 115 The Corporation Tax liability for the year to 31 December 2017 is estimated to be 25,400,000. The company issued 10,000,000 shares at a premium of 20% on 1 September 2017. This was correctly accounted for. (4) (5) (6) The debentures were issued on 1 Aug 2014. (7) A final dividend of 4 cents per share is proposed. Requirement (i) Prepare, for publication, the following financial statements for ORANGE Ltd in accordance with the requirements of international standards, (using the function of expenditure method for the statement of comprehensive income): (I) a Statement of Comprehensive Income for the year to 31 December 2017, (II) a Statement of Changes in Equity for the year end 31 December 2017 and (III) a Statement of Financial Position as at 31 December 2017