Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show/explain how my professor got these answers. I need all the help I can get, so please feel free to over-explain and show every

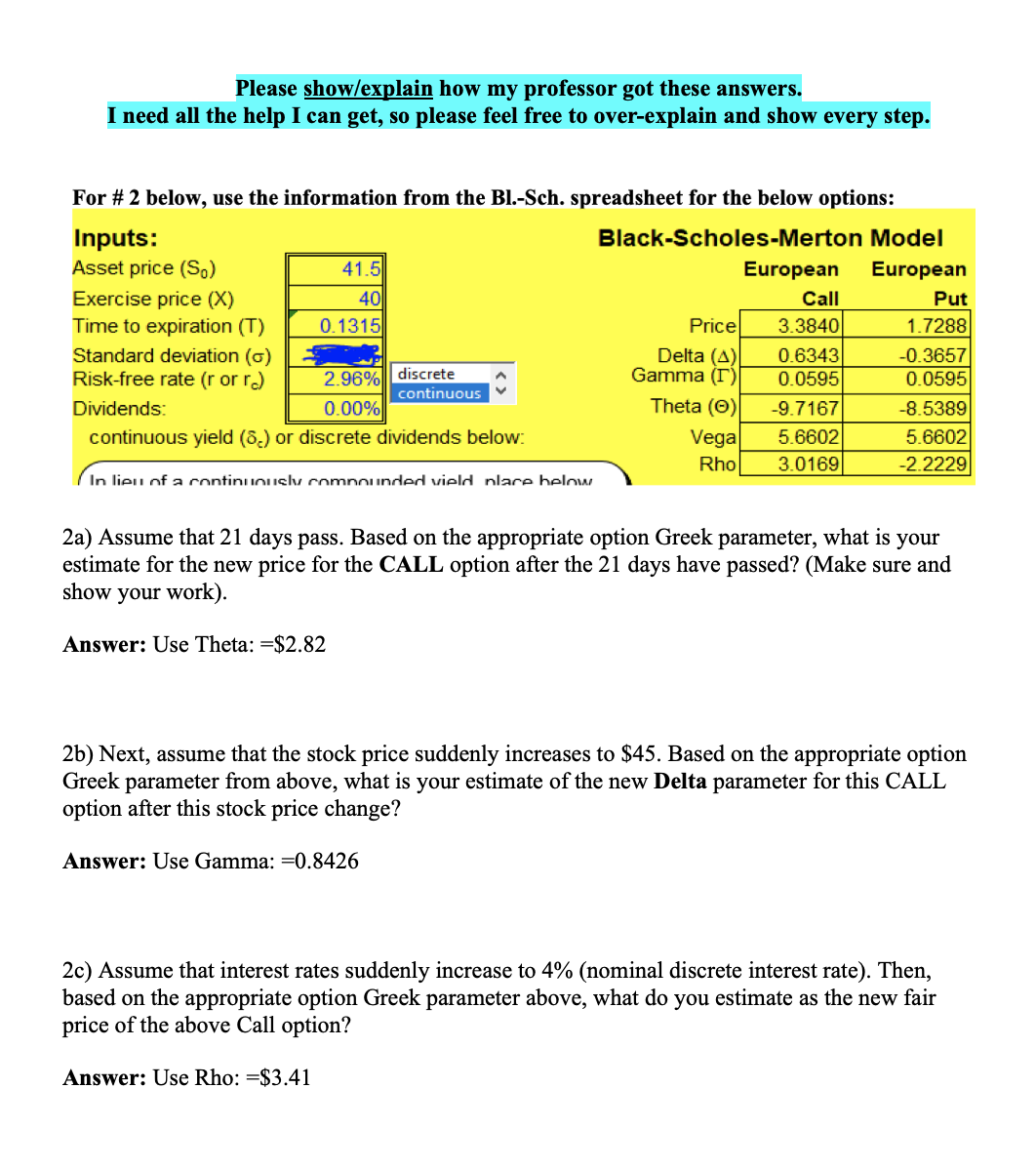

Please show/explain how my professor got these answers. I need all the help I can get, so please feel free to over-explain and show every step. For \# 2 below, use the information from the Bl.-Sch. spreadsheet for the below options: 2a) Assume that 21 days pass. Based on the appropriate option Greek parameter, what is your estimate for the new price for the CALL option after the 21 days have passed? (Make sure and show your work). Answer: Use Theta: =$2.82 2b) Next, assume that the stock price suddenly increases to $45. Based on the appropriate option Greek parameter from above, what is your estimate of the new Delta parameter for this CALL option after this stock price change? Answer: Use Gamma: =0.8426 2c) Assume that interest rates suddenly increase to 4% (nominal discrete interest rate). Then, based on the appropriate option Greek parameter above, what do you estimate as the new fair price of the above Call option? Answer: Use Rho: =$3.41 Please show/explain how my professor got these answers. I need all the help I can get, so please feel free to over-explain and show every step. For \# 2 below, use the information from the Bl.-Sch. spreadsheet for the below options: 2a) Assume that 21 days pass. Based on the appropriate option Greek parameter, what is your estimate for the new price for the CALL option after the 21 days have passed? (Make sure and show your work). Answer: Use Theta: =$2.82 2b) Next, assume that the stock price suddenly increases to $45. Based on the appropriate option Greek parameter from above, what is your estimate of the new Delta parameter for this CALL option after this stock price change? Answer: Use Gamma: =0.8426 2c) Assume that interest rates suddenly increase to 4% (nominal discrete interest rate). Then, based on the appropriate option Greek parameter above, what do you estimate as the new fair price of the above Call option? Answer: Use Rho: =$3.41

Please show/explain how my professor got these answers. I need all the help I can get, so please feel free to over-explain and show every step. For \# 2 below, use the information from the Bl.-Sch. spreadsheet for the below options: 2a) Assume that 21 days pass. Based on the appropriate option Greek parameter, what is your estimate for the new price for the CALL option after the 21 days have passed? (Make sure and show your work). Answer: Use Theta: =$2.82 2b) Next, assume that the stock price suddenly increases to $45. Based on the appropriate option Greek parameter from above, what is your estimate of the new Delta parameter for this CALL option after this stock price change? Answer: Use Gamma: =0.8426 2c) Assume that interest rates suddenly increase to 4% (nominal discrete interest rate). Then, based on the appropriate option Greek parameter above, what do you estimate as the new fair price of the above Call option? Answer: Use Rho: =$3.41 Please show/explain how my professor got these answers. I need all the help I can get, so please feel free to over-explain and show every step. For \# 2 below, use the information from the Bl.-Sch. spreadsheet for the below options: 2a) Assume that 21 days pass. Based on the appropriate option Greek parameter, what is your estimate for the new price for the CALL option after the 21 days have passed? (Make sure and show your work). Answer: Use Theta: =$2.82 2b) Next, assume that the stock price suddenly increases to $45. Based on the appropriate option Greek parameter from above, what is your estimate of the new Delta parameter for this CALL option after this stock price change? Answer: Use Gamma: =0.8426 2c) Assume that interest rates suddenly increase to 4% (nominal discrete interest rate). Then, based on the appropriate option Greek parameter above, what do you estimate as the new fair price of the above Call option? Answer: Use Rho: =$3.41 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started