Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please shows formula thanks for your help 2-6 Two alternatives are being considered to finance the acquisition of a new vehicle. The purchase price is

please shows formula thanks for your help

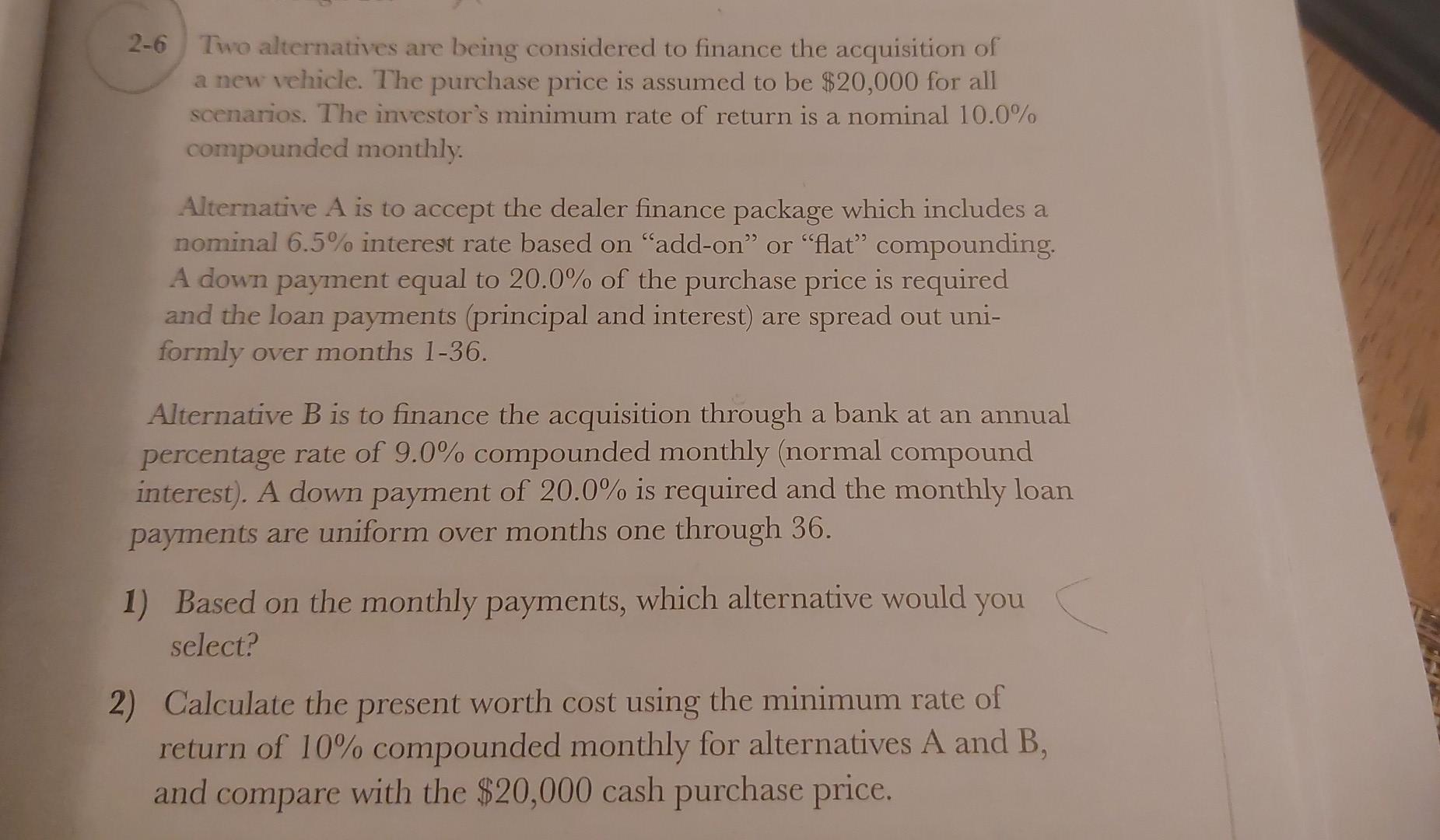

2-6 Two alternatives are being considered to finance the acquisition of a new vehicle. The purchase price is assumed to be $20,000 for all scenarios. The investor's minimum rate of return is a nominal 10.0% compounded monthly. Alternative A is to accept the dealer finance package which includes a nominal 6.5% interest rate based on "add-on" or "flat" compounding. A down payment equal to 20.0% of the purchase price is required and the loan payments (principal and interest) are spread out uniformly over months 136. Alternative B is to finance the acquisition through a bank at an annual percentage rate of 9.0% compounded monthly (normal compound interest). A down payment of 20.0% is required and the monthly loan payments are uniform over months one through 36. 1) Based on the monthly payments, which alternative would you select? 2) Calculate the present worth cost using the minimum rate of return of 10% compounded monthly for alternatives A and B, and compare with the $20,000 cash purchase priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started