PLEASE SOLUTION TO THIS:

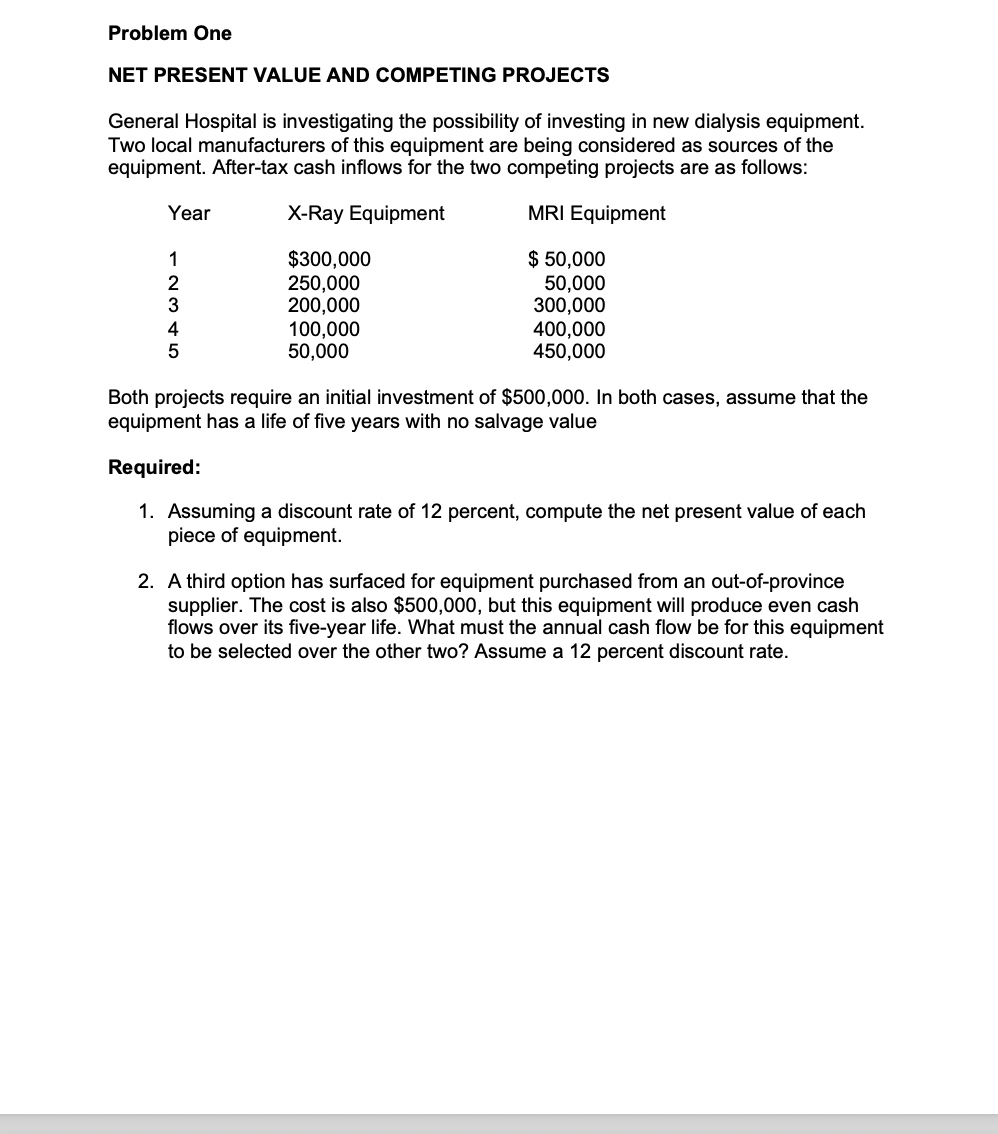

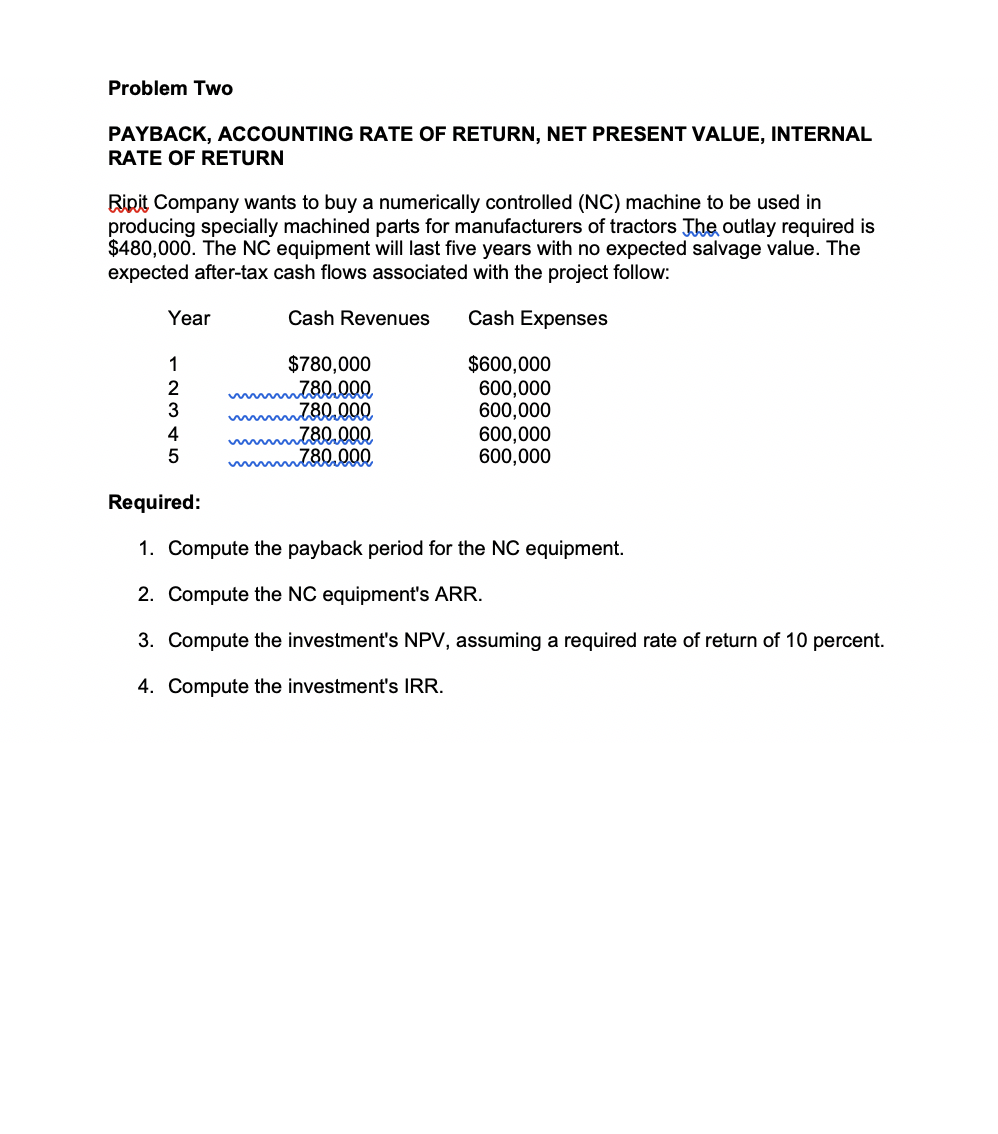

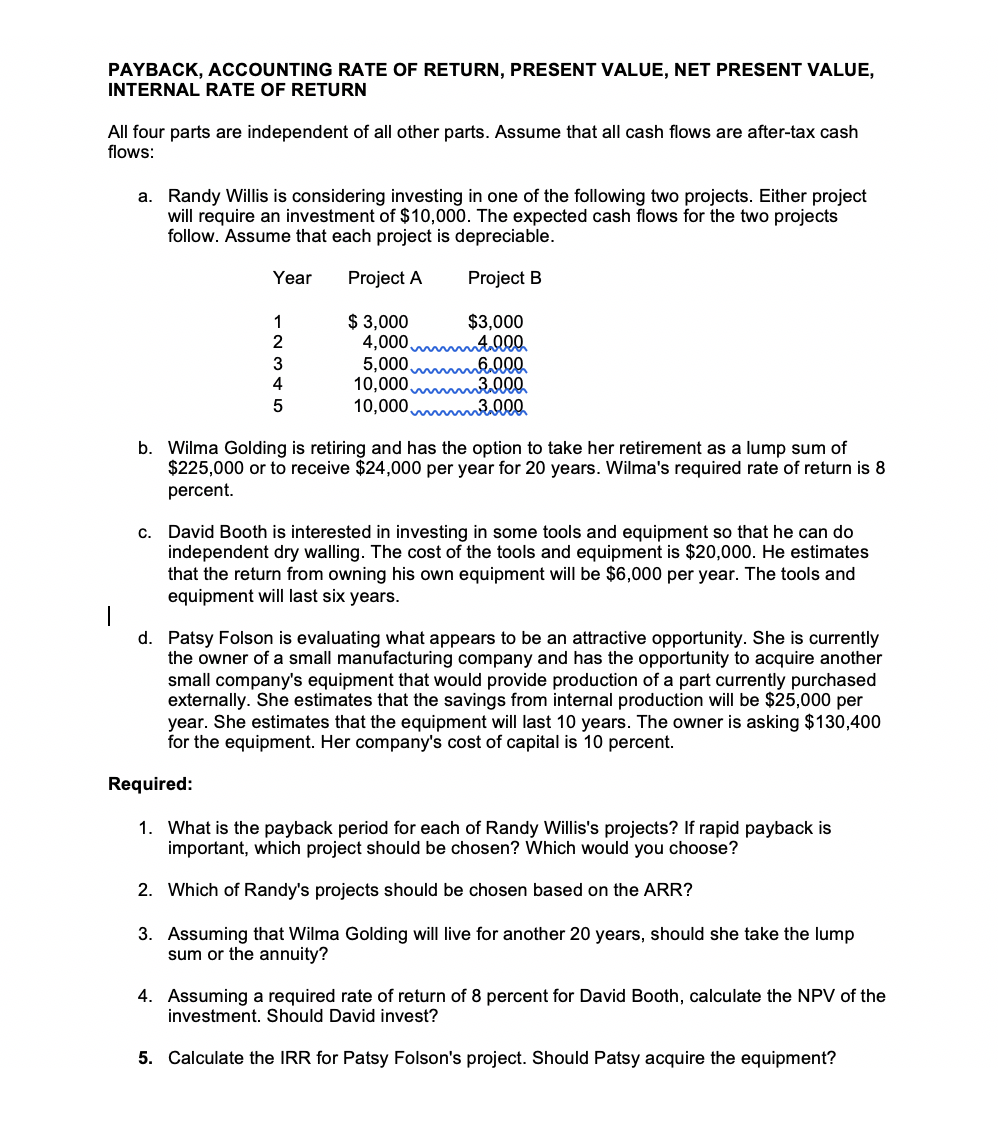

Problem One NET PRESENT VALUE AND COMPETING PROJECTS General Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash inows for the two competing projects are as follows: Year X-Ray Equipment MRI Equipment 1 $300,000 $ 50,000 2 250,000 50,000 3 200,000 300,000 4 100,000 400,000 5 50,000 450,000 Both projects require an initial investment of $500,000. In both cases, assume that the equipment has a life of ve years with no salvage value Required: 1. Assuming a discount rate of 12 percent, compute the net present value of each piece of equipment. 2. Athird option has surfaced for equipment purchased from an out-of-province supplier. The cost is also $500,000, but this equipment will produce even cash ows over its ve-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume a 12 percent discount rate. Problem Two PAYBACK, ACCOUNTING RATE OF RETURN, NET PRESENT VALUE, INTERNAL RATE OF RETURN Ripit Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors The outlay required is $480,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses UI A WN - $780,000 $600,000 780,000, 600,000 600,000 280 090 600,000 600,000 Required: 1. Compute the payback period for the NC equipment. 2. Compute the NC equipment's ARR. 3. Compute the investment's NPV, assuming a required rate of return of 10 percent. 4. Compute the investment's IRR.PAYBACK, ACCOUNTING RATE OF RETURN, PRESENT VALUE, NET PRESENT VALUE, INTERNAL RATE OF RETURN All four parts are independent of all other parts. Assume that all cash ows are after-tax cash flows: a. Randy Willis is considering investing in one of the following two projects. Either project will require an investment of $10,000. The expected cash flows for the two projects follow. Assume that each project is depreciable. Year Project A Project B $ 3,000 $3,000 4000mm 5.000M5100 10.000W 10.000W Wilma Golding is retiring and has the option to take her retirement as a lump sum of $225,000 or to receive $24,000 per year for 20 years. Wilma's required rate of return is 0 percent. U'l-h-WMl David Booth is interested in investing in some tools and equipment so that he can do independent dry walling. The cost of the tools and equipment is $20,000. He estimates that the return from owning his own equipment will be $6,000 per year. The tools and equipment will last six years. Patsy Folson is evaluating what appears to be an attractive opportunity. She is currently the owner of a small manufacturing company and has the opportunity to acquire another small company's equipment that would provide production of a part currently purchased externally. She estimates that the savings from internal production will be $25,000 per year. She estimates that the equipment will last 10 years. The owner is asking $130,400 for the equipment. Her company's cost of capital is 10 percent. Required: 1. What is the payback period for each of Randy Willis's projects? If rapid payback is important, which project should be chosen? Which would you choose? Which of Randy's projects should be chosen based on the ARR? Assuming that Wilma Golding will live for another 20 years, should she take the lump sum or the annuity? Assuming a required rate of return of 8 percent for David Booth, calculate the NPV ofthe investment. Should David invest? Calculate the IRR for Patsy Folson's project. Should Patsy acquire the equipment