Please solve

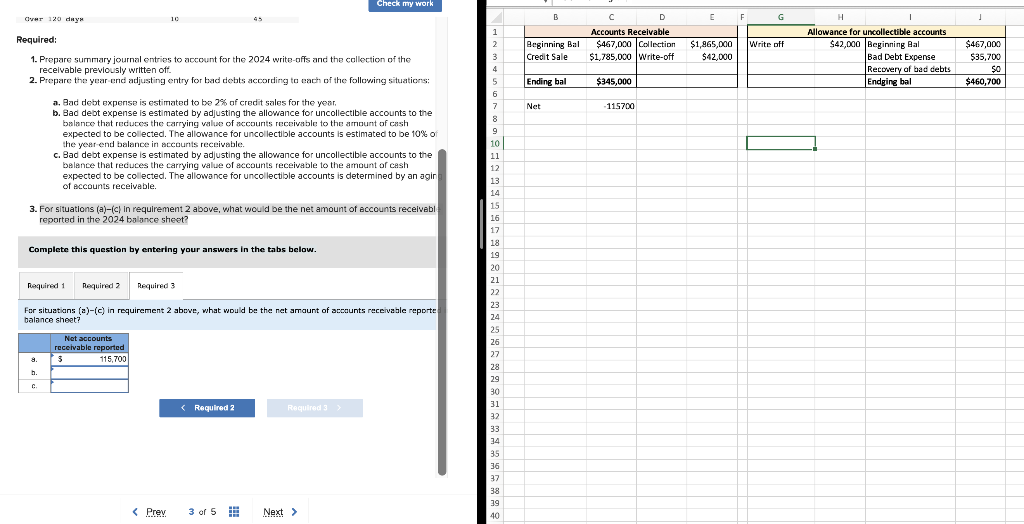

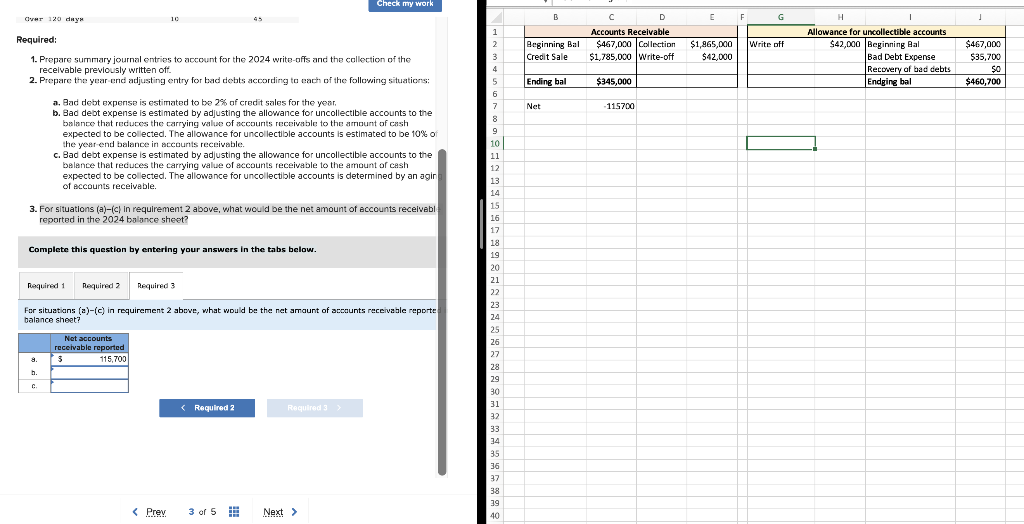

1. Prepare summary journal entries to acccunt for the 2024 write-affs and the collection of the recelvable previously written oft. 2. Prepare the year-end adjusting entry for bad debts according to cach of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year, b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balanee that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectlole accounts is estimated to be 10% of the year-end balance in accounts receivable. c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an agin of accounts receivable. 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts recelvabl reported in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. For situatians (a)-(c) in roquirement 2 above, what would be the net amaunt of accaunts receivable reporte balance sheet? 1. Prepare summary journal entries to acccunt for the 2024 write-affs and the collection of the recelvable previously written oft. 2. Prepare the year-end adjusting entry for bad debts according to cach of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year, b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balanee that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectlole accounts is estimated to be 10% of the year-end balance in accounts receivable. c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an agin of accounts receivable. 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts recelvabl reported in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. For situatians (a)-(c) in roquirement 2 above, what would be the net amaunt of accaunts receivable reporte balance sheet