Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve 25, 28 showing work/explanation. will upvote, thank you in advance. 25. Suppose the yield on short-term government securities (perceived to be risk-free about

please solve 25, 28 showing work/explanation. will upvote, thank you in advance.

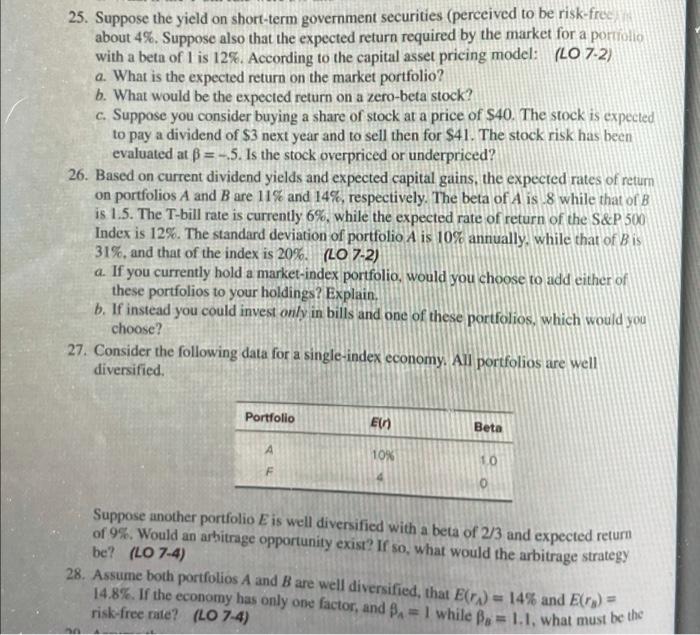

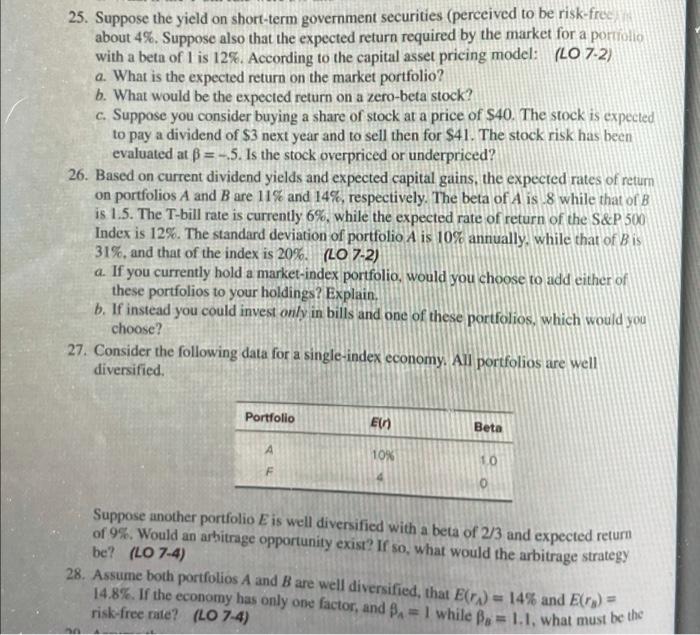

25. Suppose the yield on short-term government securities (perceived to be risk-free about 4%. Suppose also that the expected return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing model: (LO 7-2) a. What is the expected return on the market portfolio? b. What would be the expected return on a zero-beta stock? c. Suppose you consider buying a share of stock at a price of $40. The stock is expected to pay a dividend of $3 next year and to sell then for $41. The stock risk has been evaluated at =-.5. Is the stock overpriced or underpriced? 26. Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 11% and 14%, respectively. The beta of A is 8 while that of B is 1.5. The T-bill rate is currently 6%, while the expected rate of return of the S&P 500 Index is 12%. The standard deviation of portfolio A is 10% annually, while that of Bis 31%, and that of the index is 20%. (LO 7-2) a. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain. b. If instead you could invest only in bills and one of these portfolios, which would you choose? 27. Consider the following data for a single-index economy. All portfolios are well diversified. Portfolio E(r) Beta 10% 1.0 F Suppose another portfolio E is well diversified with a beta of 2/3 and expected return of 9%. Would an arbitrage opportunity exist? If so, what would the arbitrage strategy be? (LO 7-4) 28. Assume both portfolios A and B are well diversified, that E(r) = 14% and E(ra) = 14.8%. If the economy has only one factor, and =1 while Ba= 1.1, what must be the risk-free rate? (LO 7-4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started