*PLEASE SOLVE 3.8*

** Problem 3.7 and Sec 3.3 is added just for reference**

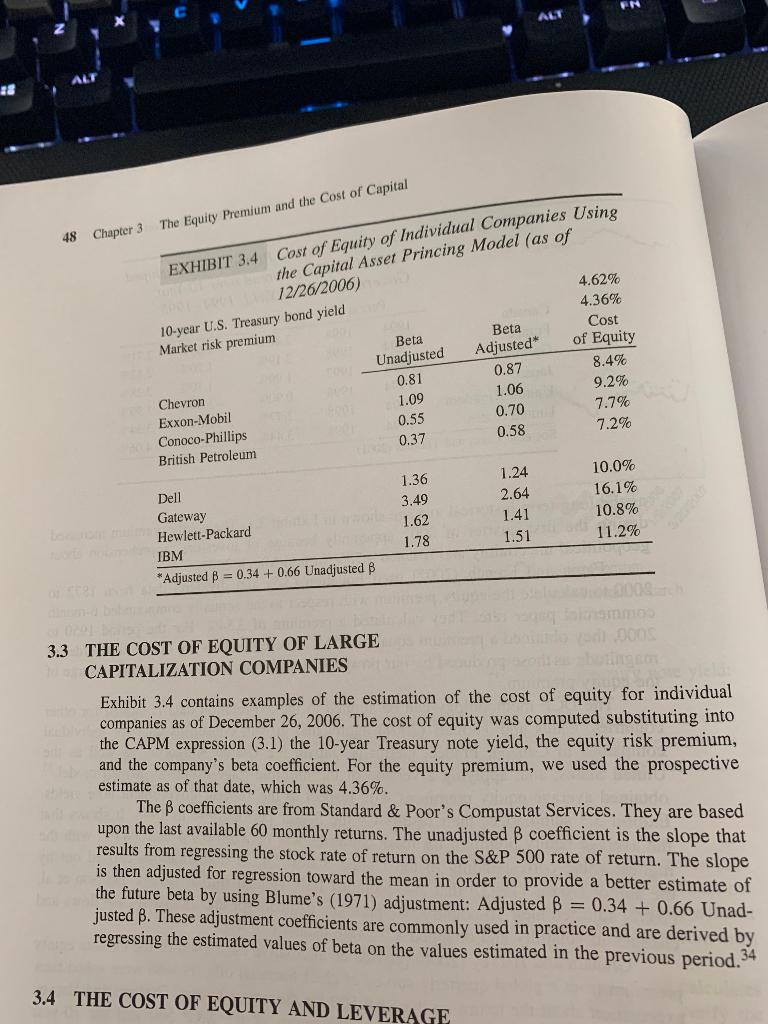

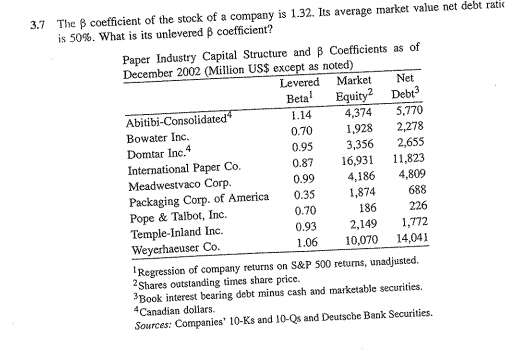

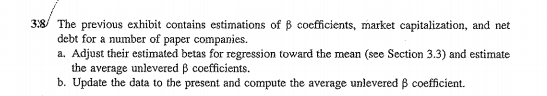

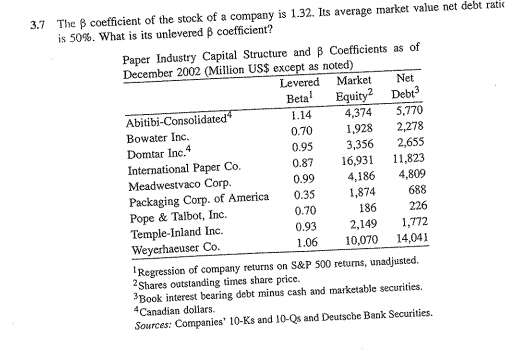

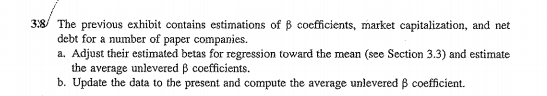

P ALT The Equity Premium and the Cost of Capital 48 Chapter 3 EXHIBIT 3.4 Cost of Equity of Individual Companies Using the Capital Asset Princing Model (as of 12/26/2006) 4.62% 10-year U.S. Treasury bond yield Market risk premium Beta Beta Unadjusted Adjusted Chevron 0.81 0.87 Exxon Mobil 1.09 1.06 Conoco-Phillips 0.55 0.70 British Petroleum 0.58 4.36% Cost of Equity 8.4% 9.2% 7.7% 7.2% 0.37 Dell Gateway Hewlett-Packard 1.36 3.49 1.62 1.78 1.24 2.64 1.41 1.51 10.0% 16.1% 10.8% 11.2% IBM *Adjusted B = 0.34 + 0.66 Unadjusted B 000 3.3 THE COST OF EQUITY OF LARGE CAPITALIZATION COMPANIES Exhibit 3.4 contains examples of the estimation of the cost of equity for individual companies as of December 26, 2006. The cost of equity was computed substituting into the CAPM expression (3.1) the 10-year Treasury note yield, the equity risk premium, and the company's beta coefficient. For the equity premium, we used the prospective estimate as of that date, which was 4.36%. The B coefficients are from Standard & Poor's Compustat Services. They are based upon the last available 60 monthly returns. The unadjusted coefficient is the slope that results from regressing the stock rate of return on the S&P 500 rate of return. The slope is then adjusted for regression toward the mean in order to provide a better estimate of the future beta by using Blume's (1971) adjustment: Adjusted = 0.34 + 0.66 Unad- justed B. These adjustment coefficients are commonly used in practice and are derived by regressing the estimated values of beta on the values estimated in the previous period. 34 3.4 THE COST OF EQUITY AND LEVERAGE 3.7 The B coefficient of the stock of a company is 1.32. Its average market value net debt ratic is 50%. What is its unlevered B coefficient? Paper Industry Capital Structure and B Coefficients as of December 2002 (Million US$ except as noted) Levered Market Net Betal Equity Debt? Abitibi-Consolidated" 1.14 4,374 5.770 Bowater Inc. 0.70 1.928 2,278 Domtar Inc. 0.95 3,356 2,655 International Paper Co. 0.87 16,931 11.823 Meadwestvaco Corp. 0.99 4,186 4,809 Packaging Corp. of America 0.35 1,874 688 Pope & Talbot, Inc. 0.70 186 226 Temple-Inland Inc. 0.93 2,149 1,772 Weyerhaeuser Co. 1.06 10,070 14,041 Regression of company returns on S&P 500 returns, unadjusted. 2 Shares outstanding times share price. Book interest bearing debt minus cash and marketable securities. Canadian dollars. Sources: Companies' 10-ks and 10-Qs and Deutsche Bank Securities. 3:8/ The previous exhibit contains estimations of B coefficients, market capitalization, and net debt for a number of paper companies. a. Adjust their estimated betas for regression toward the mean (sce Section 3.3) and estimate the average unlevered coefficients. b. Update the data to the present and compute the average unlevered coefficient. P ALT The Equity Premium and the Cost of Capital 48 Chapter 3 EXHIBIT 3.4 Cost of Equity of Individual Companies Using the Capital Asset Princing Model (as of 12/26/2006) 4.62% 10-year U.S. Treasury bond yield Market risk premium Beta Beta Unadjusted Adjusted Chevron 0.81 0.87 Exxon Mobil 1.09 1.06 Conoco-Phillips 0.55 0.70 British Petroleum 0.58 4.36% Cost of Equity 8.4% 9.2% 7.7% 7.2% 0.37 Dell Gateway Hewlett-Packard 1.36 3.49 1.62 1.78 1.24 2.64 1.41 1.51 10.0% 16.1% 10.8% 11.2% IBM *Adjusted B = 0.34 + 0.66 Unadjusted B 000 3.3 THE COST OF EQUITY OF LARGE CAPITALIZATION COMPANIES Exhibit 3.4 contains examples of the estimation of the cost of equity for individual companies as of December 26, 2006. The cost of equity was computed substituting into the CAPM expression (3.1) the 10-year Treasury note yield, the equity risk premium, and the company's beta coefficient. For the equity premium, we used the prospective estimate as of that date, which was 4.36%. The B coefficients are from Standard & Poor's Compustat Services. They are based upon the last available 60 monthly returns. The unadjusted coefficient is the slope that results from regressing the stock rate of return on the S&P 500 rate of return. The slope is then adjusted for regression toward the mean in order to provide a better estimate of the future beta by using Blume's (1971) adjustment: Adjusted = 0.34 + 0.66 Unad- justed B. These adjustment coefficients are commonly used in practice and are derived by regressing the estimated values of beta on the values estimated in the previous period. 34 3.4 THE COST OF EQUITY AND LEVERAGE 3.7 The B coefficient of the stock of a company is 1.32. Its average market value net debt ratic is 50%. What is its unlevered B coefficient? Paper Industry Capital Structure and B Coefficients as of December 2002 (Million US$ except as noted) Levered Market Net Betal Equity Debt? Abitibi-Consolidated" 1.14 4,374 5.770 Bowater Inc. 0.70 1.928 2,278 Domtar Inc. 0.95 3,356 2,655 International Paper Co. 0.87 16,931 11.823 Meadwestvaco Corp. 0.99 4,186 4,809 Packaging Corp. of America 0.35 1,874 688 Pope & Talbot, Inc. 0.70 186 226 Temple-Inland Inc. 0.93 2,149 1,772 Weyerhaeuser Co. 1.06 10,070 14,041 Regression of company returns on S&P 500 returns, unadjusted. 2 Shares outstanding times share price. Book interest bearing debt minus cash and marketable securities. Canadian dollars. Sources: Companies' 10-ks and 10-Qs and Deutsche Bank Securities. 3:8/ The previous exhibit contains estimations of B coefficients, market capitalization, and net debt for a number of paper companies. a. Adjust their estimated betas for regression toward the mean (sce Section 3.3) and estimate the average unlevered coefficients. b. Update the data to the present and compute the average unlevered coefficient