*PLEASE SOLVE 3.9*

** Problem 3.7 is added just for reference**

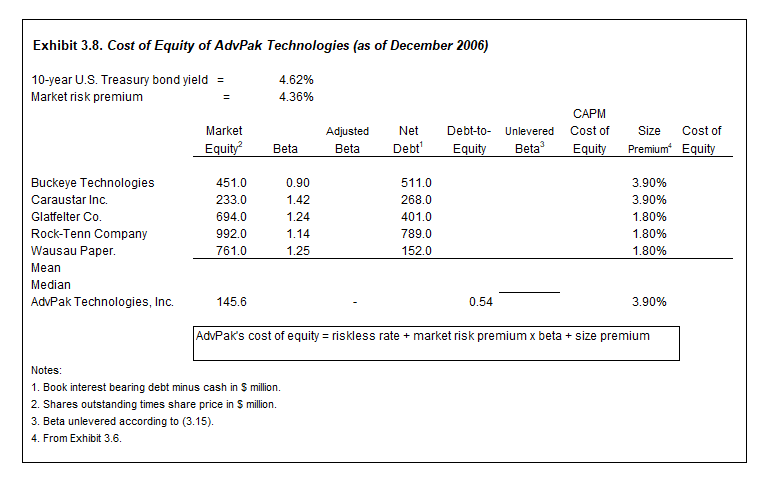

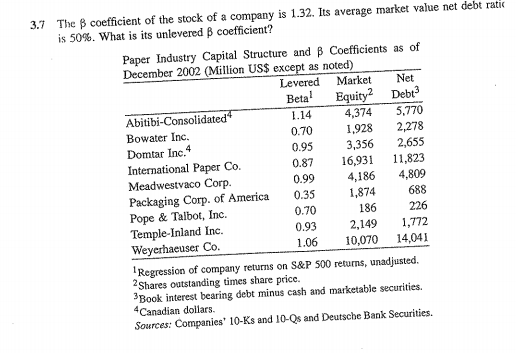

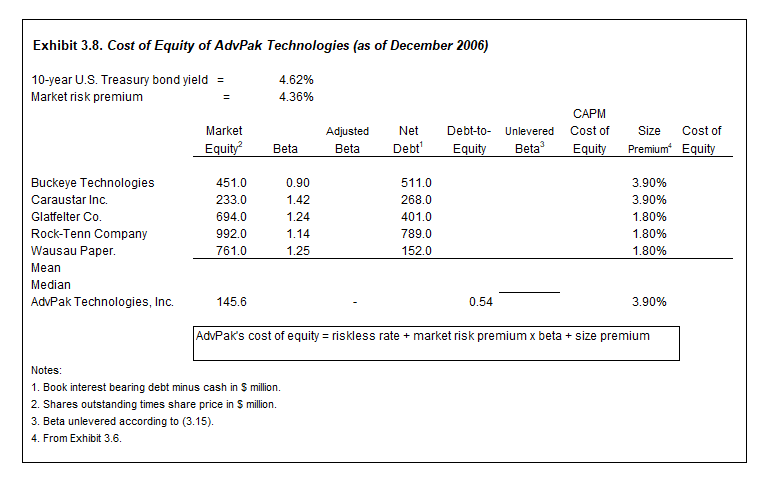

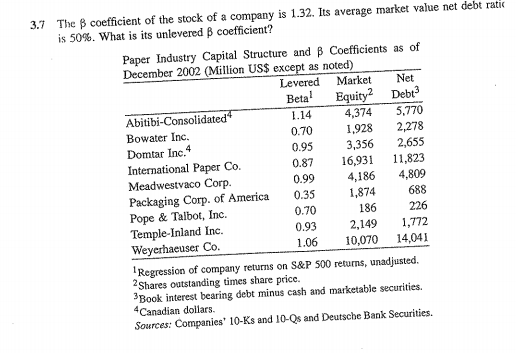

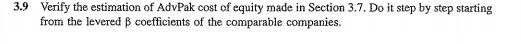

Exhibit 3.8. Cost of Equity of AdvPak Technologies (as of December 2006) 10-year U.S. Treasury bond yield = Market risk premium 4.62% 4.36% Market Equity Adjusted Beta Net Debt Debt-to- Equity CAPM Unlevered Cost of Size Cost of Beta Equity Premium Equity Beta Buckeye Technologies Caraustar Inc. Glatfelter Co. Rock-Tenn Company Wausau Paper. Mean Median AdvPak Technologies, Inc. 451.0 233.0 694.0 992.0 761.0 0.90 1.42 1.24 1.14 1.25 511.0 268.0 401.0 789.0 152.0 3.90% 3.90% 1.80% 1.80% 1.80% 145.6 0.54 3.90% AdvPak's cost of equity = riskless rate + market risk premium x beta + size premium Notes: 1. Book interest bearing debt minus cash in 5 million. 2. Shares outstanding times share price in 5 million. 3. Beta unlevered according to (3.15). 4. From Exhibit 3.6. 3.7 The B coefficient of the stock of a company is 1.32. Its average market value net debt ratic is 50%. What is its unlevered B coefficient? Paper Industry Capital Structure and B Coefficients as of December 2002 (Million US$ except as noted) Levered Market Net Betal Equity Debt? Abitibi-Consolidated" 1.14 4,374 5.770 Bowater Inc. 0.70 1.928 2,278 Domtar Inc. 0.95 3,356 2,655 International Paper Co. 0.87 16,931 11.823 Meadwestvaco Corp. 0.99 4,186 4,809 Packaging Corp. of America 0.35 1,874 688 Pope & Talbot, Inc. 0.70 186 226 Temple-Inland Inc. 0.93 2,149 1,772 Weyerhaeuser Co. 1.06 10,070 14,041 Regression of company returns on S&P 500 returns, unadjusted. 2 Shares outstanding times share price. Book interest bearing debt minus cash and marketable securities. Canadian dollars. Sources: Companies' 10-ks and 10-Qs and Deutsche Bank Securities. 3.9 Verify the estimation of AdvPak cost of equity made in Section 3.7. Do it step by step starting from the levered B coefficients of the comparable companies. Exhibit 3.8. Cost of Equity of AdvPak Technologies (as of December 2006) 10-year U.S. Treasury bond yield = Market risk premium 4.62% 4.36% Market Equity Adjusted Beta Net Debt Debt-to- Equity CAPM Unlevered Cost of Size Cost of Beta Equity Premium Equity Beta Buckeye Technologies Caraustar Inc. Glatfelter Co. Rock-Tenn Company Wausau Paper. Mean Median AdvPak Technologies, Inc. 451.0 233.0 694.0 992.0 761.0 0.90 1.42 1.24 1.14 1.25 511.0 268.0 401.0 789.0 152.0 3.90% 3.90% 1.80% 1.80% 1.80% 145.6 0.54 3.90% AdvPak's cost of equity = riskless rate + market risk premium x beta + size premium Notes: 1. Book interest bearing debt minus cash in 5 million. 2. Shares outstanding times share price in 5 million. 3. Beta unlevered according to (3.15). 4. From Exhibit 3.6. 3.7 The B coefficient of the stock of a company is 1.32. Its average market value net debt ratic is 50%. What is its unlevered B coefficient? Paper Industry Capital Structure and B Coefficients as of December 2002 (Million US$ except as noted) Levered Market Net Betal Equity Debt? Abitibi-Consolidated" 1.14 4,374 5.770 Bowater Inc. 0.70 1.928 2,278 Domtar Inc. 0.95 3,356 2,655 International Paper Co. 0.87 16,931 11.823 Meadwestvaco Corp. 0.99 4,186 4,809 Packaging Corp. of America 0.35 1,874 688 Pope & Talbot, Inc. 0.70 186 226 Temple-Inland Inc. 0.93 2,149 1,772 Weyerhaeuser Co. 1.06 10,070 14,041 Regression of company returns on S&P 500 returns, unadjusted. 2 Shares outstanding times share price. Book interest bearing debt minus cash and marketable securities. Canadian dollars. Sources: Companies' 10-ks and 10-Qs and Deutsche Bank Securities. 3.9 Verify the estimation of AdvPak cost of equity made in Section 3.7. Do it step by step starting from the levered B coefficients of the comparable companies