Answered step by step

Verified Expert Solution

Question

1 Approved Answer

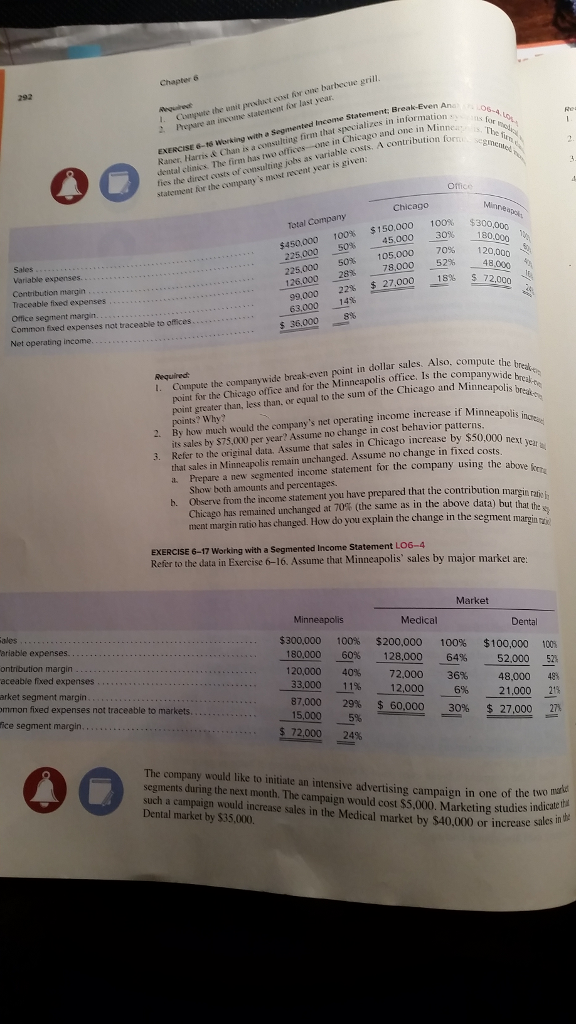

Please solve 6-16 Chapter 6 L. Cnpute the unit prowhuct cost for one barbecue grill Prepare an income statestent for last year. 292 Raner, Hams

Please solve 6-16

Chapter 6 L. Cnpute the unit prowhuct cost for one barbecue grill Prepare an income statestent for last year. 292 Raner, Hams & Chan is a consulting firm that specializes in informat dental clinics The firm bas two offices-one in Chicago and one in M fies the direct costs of consulting jobs as variable coss, A contribution statement for the company's most revent year is given: forne The Chicago Total Company 100% $300,000 $450,000 100% $150,000 1 45.000 30% -500001 225,000 50% 225,000 126,000 99,000 22% $ 27,000-8% -72,000 63.000 14 50% 105,000 70% 120 28% 78,000 52% 48 Sales Variable expenses. Contribution margin Traceable fixed expenses Office segment margin. Common fixed expenses not traceable to officeS 8% $ 36,000 Net operating income. t. Compute the companywide break-even point in dollar sales. Also, compute the mpanywide Required point for the Chicago office and for the Minneapolis office, Is the company wide point greater than, less than, or equal to the sum of the Chicago and Minneapolis bre points? Why By how much would th its sales by $75,000 per year? Assume no change in cost behavior patterns 2. e company's net operating income increase if Minneapolis 3. Refer to the original data. Assume that sales in Chicago in crease by $50,000 n next year that sales in Minneapolis remain unchanged. Assume no change in fixed costs a. Prepare a new segmented income statement for the company using the ab0 s lis o Show both amounts and percentages on margin Chicago has remained unchanged at 70% (the same as in the above data) but that ment margin ratio has changed. How do you explain the change in the segment margin i in the segment margin ra EXERCISE 6-17 Working with a Segmented Income Statement LO6-4 Refer to the data in Exercise 6-16. Assume that Minneapolis" sales by major market are: Market Medical ales ariable expenses ontribution margin aceable foxed expenses arket segment margin mmon fixed expenses not traceable to markets... ice segment margin Dental $300,000 100% $200,000 100% $100,000 100% 52% 12,000 6% 21,000 29 180,000 60% 128,000 64% 52,000 sa 120,000 40% 72,000 36% 48,000 33,000 11% 87,000 29% $60,000 30% $27,000 15,000 5% $72,000 24% The company would like to initiate an intensive advertising campaign segments during the next month. The campaign would cost $5,000. Marketing studies indica such a campaign would increase sales in the Medical market by $40,000 or increase Dental market by $35,000. in one of the two ma'ki ncrease sales inthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started