Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all 3 ! Vernon-Nelson Chemicals is planning to release a new brand of insecticide, Bee-Safe, that will kill many insect pests but not

Please solve all 3 !

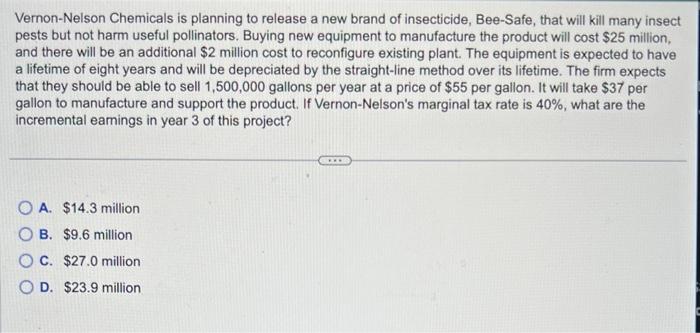

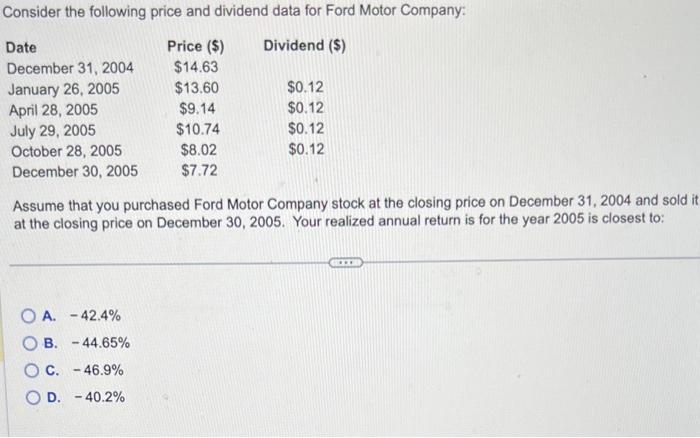

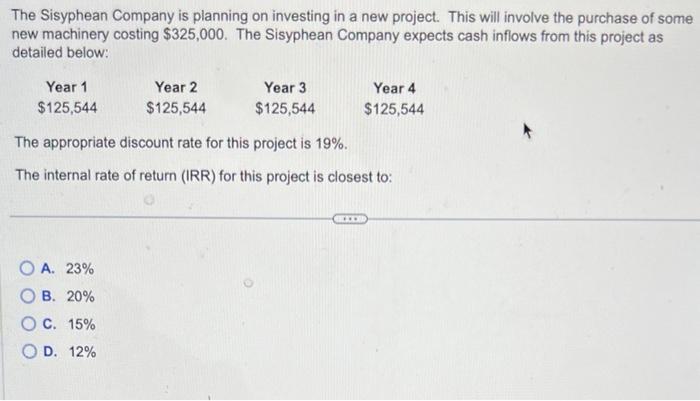

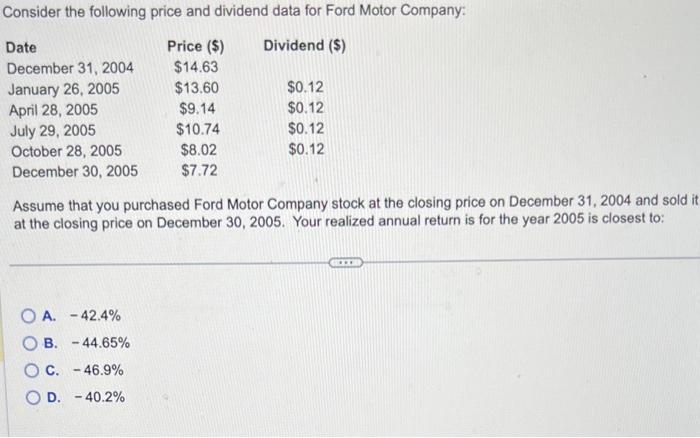

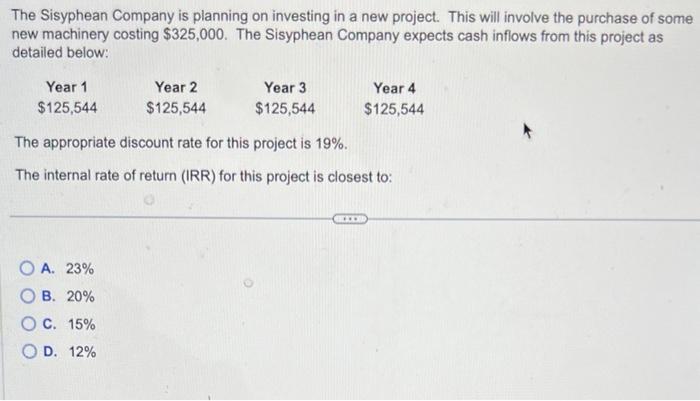

Vernon-Nelson Chemicals is planning to release a new brand of insecticide, Bee-Safe, that will kill many insect pests but not harm useful pollinators. Buying new equipment to manufacture the product will cost $25 million, and there will be an additional $2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of eight years and will be depreciated by the straight-line method over its lifetime. The firm expects that they should be able to sell 1,500,000 gallons per year at a price of $55 per gallon. It will take $37 per gallon to manufacture and support the product. If Vernon-Nelson's marginal tax rate is 40%, what are the incremental eamings in year 3 of this project? A. $14.3 million B. $9.6 million C. $27.0 million D. $23.9 million Consider the following price and dividend data for Ford Motor Company: Assume that you purchased Ford Motor Company stock at the closing price on December 31, 2004 and sold i at the closing price on December 30,2005 . Your realized annual return is for the year 2005 is closest to: A. 42.4% B. 44.65% C. 46.9% D. 40.2% The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $325,000. The Sisyphean Company expects cash inflows from this project as detailed below: The appropriate discount rate for this project is 19%. The internal rate of return (IRR) for this project is closest to: A. 23% B. 20% C. 15% D. 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started