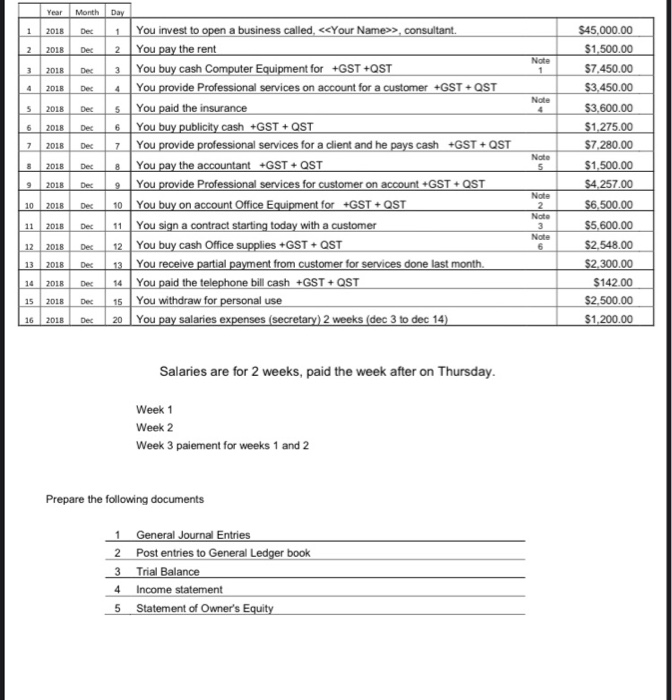

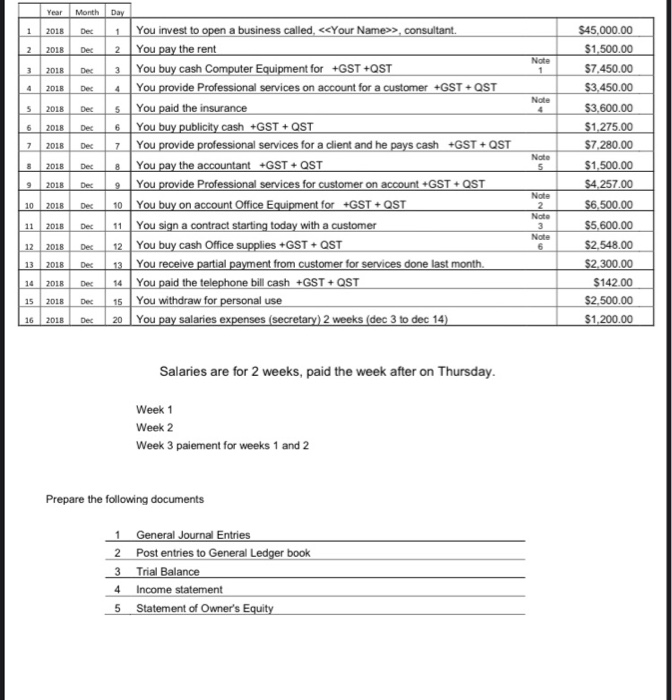

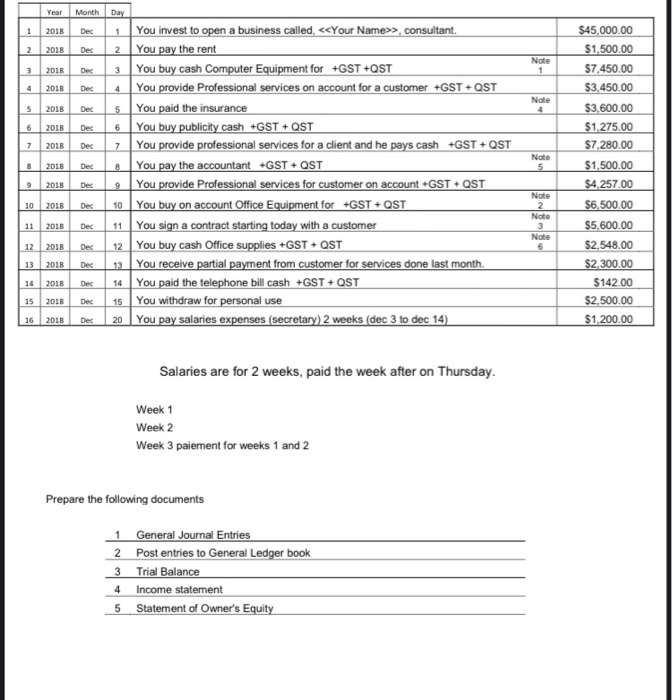

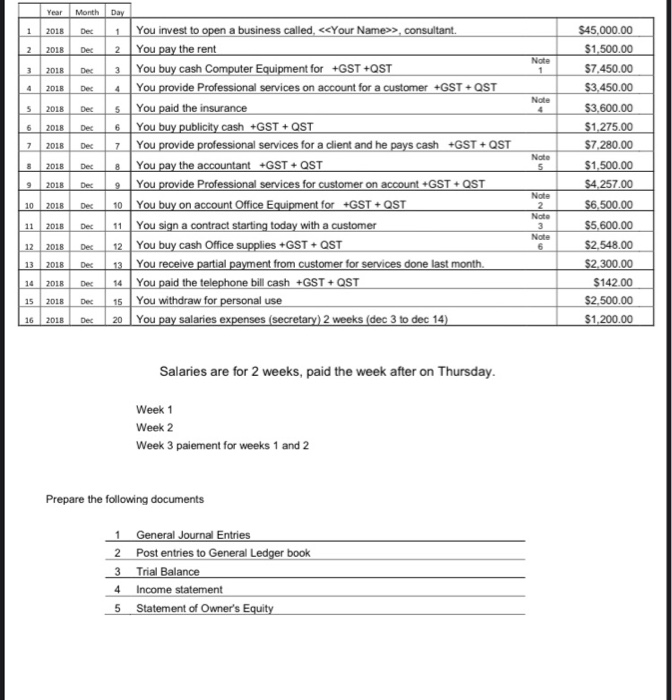

please solve all parts: 1. General journal, 2. Post entries to general ledger book, 3. Trail balance, 4. Income statement, 5. statement of owner's equity, 6. Balance sheet

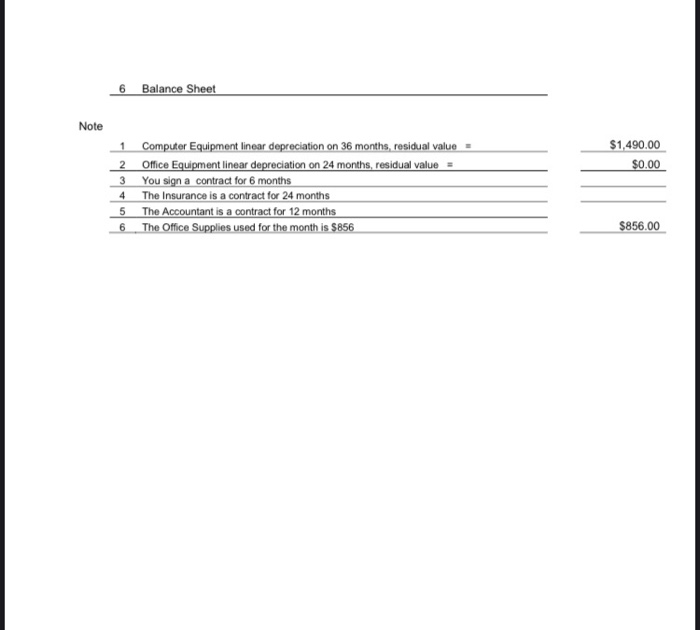

Day Year 2018 Month Dec 2018 Dec 12 3 2018 Dec 5 You invest to open a business called, >, consultant You pay the rent You buy cash Computer Equipment for +GST+QST You provide Professional services on account for a customer +GST + QST You paid the insurance You buy publicity cash +GST + QST You provide professional services for a client and he pays cash +GST + QST You pay the accountant GST + QST You provide Professional services for customer on account +GST + QST Note $45,000.00 $1,500.00 $7.450.00 $3,450.00 $3,600.00 $1.275.00 $7,280.00 $1,500.00 $4,257.00 $6,500.00 $5,600.00 $2.548.00 $2.300.00 $142.00 $2,500.00 $1,200.00 9 Dec 10 You buy on account Office Equipment for GST + QST You sign a contract starting today with a customer You buy cash Office supplies +GST + QST You receive partial payment from customer for services done last month. You paid the telephone bill cash +GST + OST You withdraw for personal use You pay salaries expenses (secretary) 2 weeks (dec 3 to dec 14) 14 15 16 2018 2018 2018 12 13 14 15 20 Dec Dec Dec Salaries are for 2 weeks, paid the week after on Thursday. Week 1 Week 2 Week 3 paiement for weeks 1 and 2 Prepare the following documents 1 2 3 4 5 General Journal Entries Post entries to General Ledger book Trial Balance Income statement Statement of Owner's Equity 6 Balance Sheet Note 1 2 3 $1,490.00 $0.00 Computer Equipment linear depreciation on 36 months, residual value = Office Equipment linear depreciation on 24 months, residual value = You sign a contract for 6 months The Insurance is a contract for 24 months The Accountant is a contract for 12 months The Office Supplies used for the month is $856 6 $856.00 Day Year 2018 Month Dec 2018 Dec 12 3 2018 Dec 5 You invest to open a business called, >, consultant You pay the rent You buy cash Computer Equipment for +GST+QST You provide Professional services on account for a customer +GST + QST You paid the insurance You buy publicity cash +GST + QST You provide professional services for a client and he pays cash +GST + QST You pay the accountant GST + QST You provide Professional services for customer on account +GST + QST Note $45,000.00 $1,500.00 $7.450.00 $3,450.00 $3,600.00 $1.275.00 $7,280.00 $1,500.00 $4,257.00 $6,500.00 $5,600.00 $2.548.00 $2.300.00 $142.00 $2,500.00 $1,200.00 9 Dec 10 You buy on account Office Equipment for GST + QST You sign a contract starting today with a customer You buy cash Office supplies +GST + QST You receive partial payment from customer for services done last month. You paid the telephone bill cash +GST + OST You withdraw for personal use You pay salaries expenses (secretary) 2 weeks (dec 3 to dec 14) 14 15 16 2018 2018 2018 12 13 14 15 20 Dec Dec Dec Salaries are for 2 weeks, paid the week after on Thursday. Week 1 Week 2 Week 3 paiement for weeks 1 and 2 Prepare the following documents 1 2 3 4 5 General Journal Entries Post entries to General Ledger book Trial Balance Income statement Statement of Owner's Equity