Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all parts 1,2,4 and 5 nnect.mheducation.com%252F#/activity/question-group/KEZAS. REPt2JACSIS Saved Help Save & Exit Submit East Hill Home Healthcare Services was organized on January 1,

please solve all parts 1,2,4 and 5

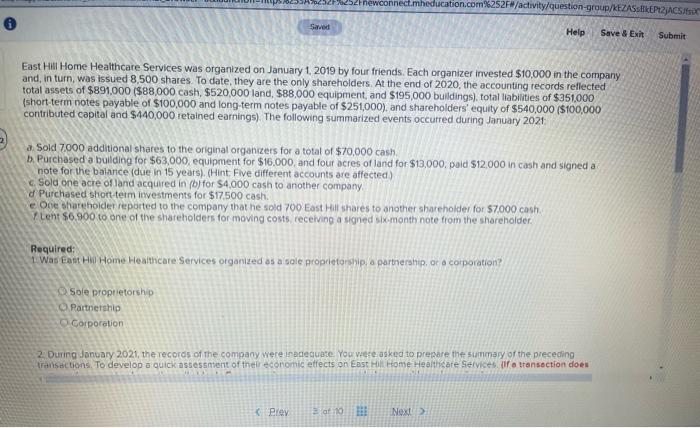

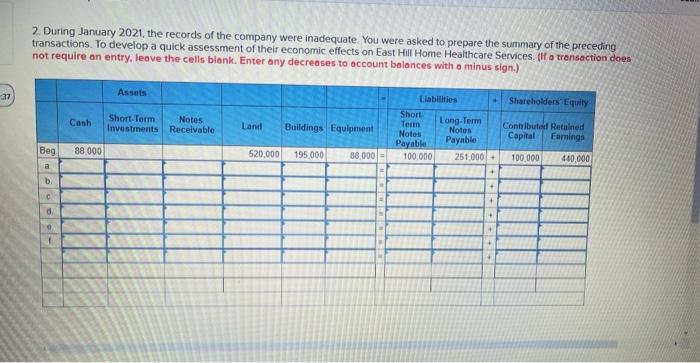

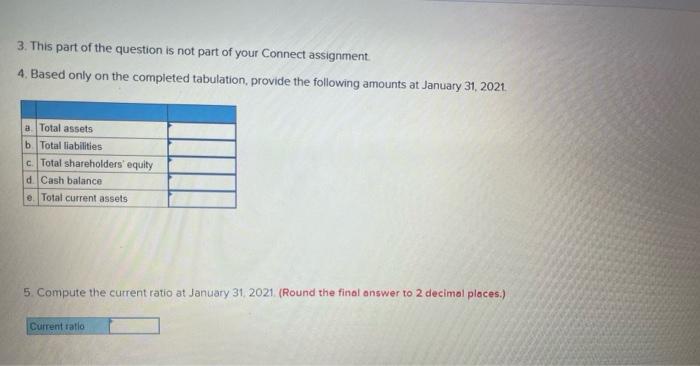

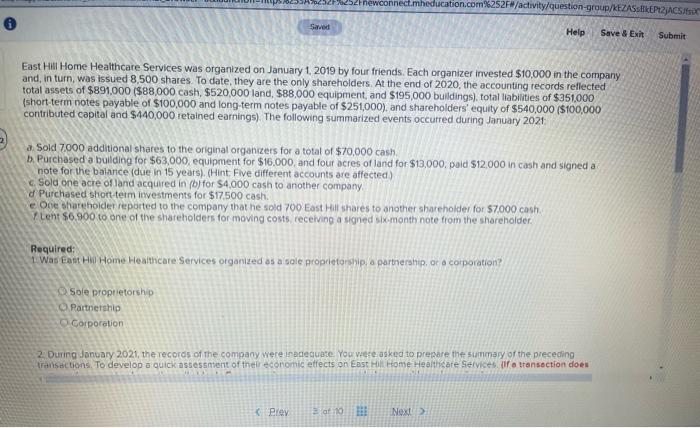

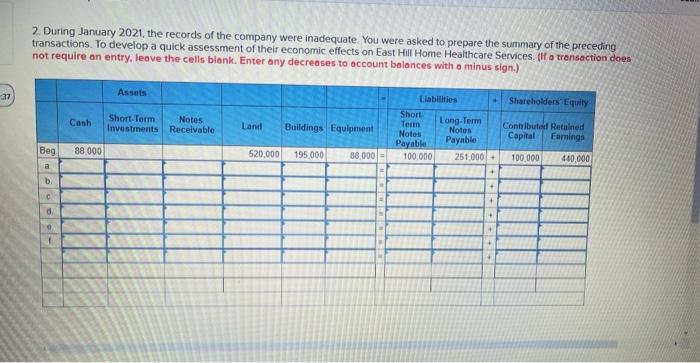

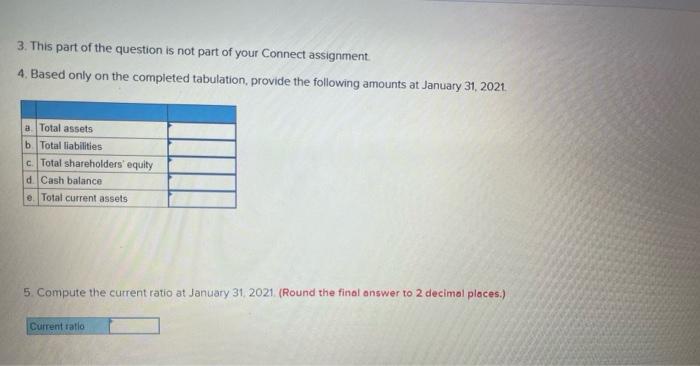

nnect.mheducation.com%252F#/activity/question-group/KEZAS. REPt2JACSIS Saved Help Save & Exit Submit East Hill Home Healthcare Services was organized on January 1, 2019 by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,500 shares. To date, they are the only shareholders. At the end of 2020, the accounting records reflected total assets of $891,000 ($88,000 cash, $520,000 land, $88,000 equipment, and $195,000 buildings), total liabilities of $351.000 (short-term notes payable of $100,000 and long-term notes payable of $251,000), and shareholders' equity of $540,000 ($100,000 contributed capital and $440,000 retained earnings). The following summarized events occurred during January 2021 a Sold 7000 additional shares to the original organizers for a total of $70,000 cash b. Purchased a building for $63,000, equipment for $16.000, and four acres of land for $13,000, paid $12,000 in cash and signed a note for the balance (due in 15 years). (Hint Five different accounts are affected) Sold one acre of land acquired in (b) for $4,000 cash to another company d Purchased short term investments for $17500 cash. e One shareholder reported to the company that he sold 700 East Hill shares to another shareholder for $7.000 cash Lent $6.900 to one of the shareholders for moving costs receiving a signed six-month note trom the shareholder Required: 1 Was Eau Hi Home Healthcare Services organized as a sole proprietorship, a partnership, or a corporation? Sole proprietorship Partnership Corporation 2. During January 2021, the records of the company were inadequate You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of the economic effects on East Hill Home Healthcare Services If a transaction does Brey of 10 BIL Next 2. During January 2021, the records of the company were inadequate. You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of their economic effects on East Hill Home Healthcare Services. If a transaction does not require an entry, leave the cells blank. Enter any decreases to account balances with a minus sign.) 37 Assets Shareholders' Equity Canh Short Term Notes Investments Receivable Land Buildings Equipment Llabilities Short Term Long-Term Notes Notes Payable Payable 100.000 251 000 Conbibuted Retained Capital Earnings Beg 88.000 520.000 195.000 38.000 100,000 440,000 a b. d + . 3. This part of the question is not part of your Connect assignment 4. Based only on the completed tabulation, provide the following amounts at January 31, 2021 a Total assets b Total liabilities Total shareholders' equity d. Cash balance e. Total current assets 5. Compute the current ratio at January 31 2021 (Round the final answer to 2 decimal places.) Current ratio nnect.mheducation.com%252F#/activity/question-group/KEZAS. REPt2JACSIS Saved Help Save & Exit Submit East Hill Home Healthcare Services was organized on January 1, 2019 by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,500 shares. To date, they are the only shareholders. At the end of 2020, the accounting records reflected total assets of $891,000 ($88,000 cash, $520,000 land, $88,000 equipment, and $195,000 buildings), total liabilities of $351.000 (short-term notes payable of $100,000 and long-term notes payable of $251,000), and shareholders' equity of $540,000 ($100,000 contributed capital and $440,000 retained earnings). The following summarized events occurred during January 2021 a Sold 7000 additional shares to the original organizers for a total of $70,000 cash b. Purchased a building for $63,000, equipment for $16.000, and four acres of land for $13,000, paid $12,000 in cash and signed a note for the balance (due in 15 years). (Hint Five different accounts are affected) Sold one acre of land acquired in (b) for $4,000 cash to another company d Purchased short term investments for $17500 cash. e One shareholder reported to the company that he sold 700 East Hill shares to another shareholder for $7.000 cash Lent $6.900 to one of the shareholders for moving costs receiving a signed six-month note trom the shareholder Required: 1 Was Eau Hi Home Healthcare Services organized as a sole proprietorship, a partnership, or a corporation? Sole proprietorship Partnership Corporation 2. During January 2021, the records of the company were inadequate You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of the economic effects on East Hill Home Healthcare Services If a transaction does Brey of 10 BIL Next 2. During January 2021, the records of the company were inadequate. You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of their economic effects on East Hill Home Healthcare Services. If a transaction does not require an entry, leave the cells blank. Enter any decreases to account balances with a minus sign.) 37 Assets Shareholders' Equity Canh Short Term Notes Investments Receivable Land Buildings Equipment Llabilities Short Term Long-Term Notes Notes Payable Payable 100.000 251 000 Conbibuted Retained Capital Earnings Beg 88.000 520.000 195.000 38.000 100,000 440,000 a b. d + . 3. This part of the question is not part of your Connect assignment 4. Based only on the completed tabulation, provide the following amounts at January 31, 2021 a Total assets b Total liabilities Total shareholders' equity d. Cash balance e. Total current assets 5. Compute the current ratio at January 31 2021 (Round the final answer to 2 decimal places.) Current ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started