Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all parts completely: 1. You are planning to start up a new asset management firm and are considering two possible investment strategies: Global

Please solve all parts completely:

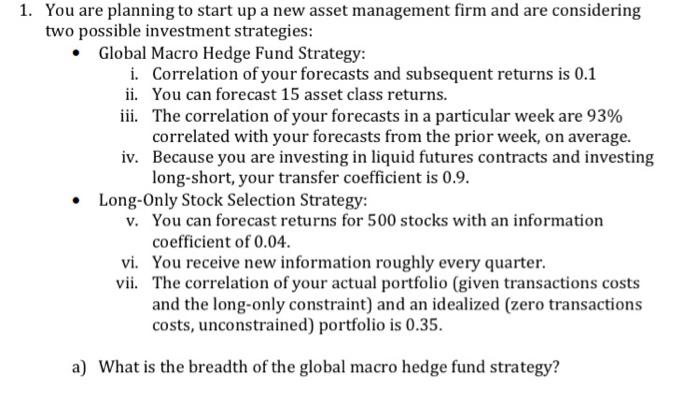

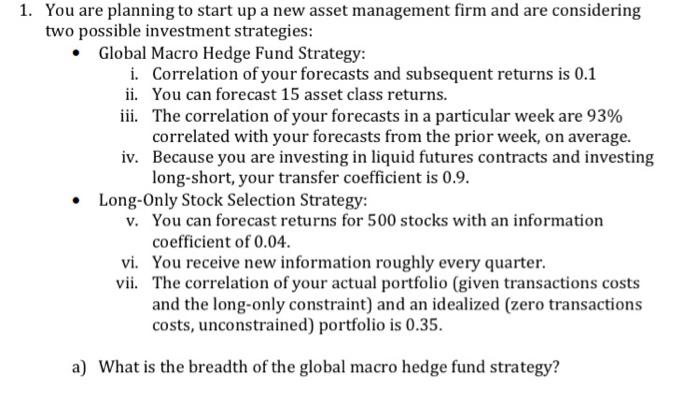

1. You are planning to start up a new asset management firm and are considering two possible investment strategies: Global Macro Hedge Fund Strategy: i. Correlation of your forecasts and subsequent returns is 0.1 ii. You can forecast 15 asset class returns. iii. The correlation of your forecasts in a particular week are 93% correlated with your forecasts from the prior week, on average. iv. Because you are investing in liquid futures contracts and investing long-short, your transfer coefficient is 0.9. Long-Only Stock Selection Strategy: V. You can forecast returns for 500 stocks with an information coefficient of 0.04. vi. You receive new information roughly every quarter. vii. The correlation of your actual portfolio (given transactions costs and the long-only constraint) and an idealized (zero transactions costs, unconstrained) portfolio is 0.35. a) What is the breadth of the global macro hedge fund strategy? b) What is the transfer coefficient of the long-only stock selection strategy? c) Which strategy has the higher expected information ratio? d) What information coefficient for the stock selection strategy would lead to equal expected information ratios for the two strategies? 1. You are planning to start up a new asset management firm and are considering two possible investment strategies: Global Macro Hedge Fund Strategy: i. Correlation of your forecasts and subsequent returns is 0.1 ii. You can forecast 15 asset class returns. iii. The correlation of your forecasts in a particular week are 93% correlated with your forecasts from the prior week, on average. iv. Because you are investing in liquid futures contracts and investing long-short, your transfer coefficient is 0.9. Long-Only Stock Selection Strategy: V. You can forecast returns for 500 stocks with an information coefficient of 0.04. vi. You receive new information roughly every quarter. vii. The correlation of your actual portfolio (given transactions costs and the long-only constraint) and an idealized (zero transactions costs, unconstrained) portfolio is 0.35. a) What is the breadth of the global macro hedge fund strategy? b) What is the transfer coefficient of the long-only stock selection strategy? c) Which strategy has the higher expected information ratio? d) What information coefficient for the stock selection strategy would lead to equal expected information ratios for the two strategies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started