Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all questions. Read carefully the instructions. Show all work On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for

Please solve all questions. Read carefully the instructions. Show all work

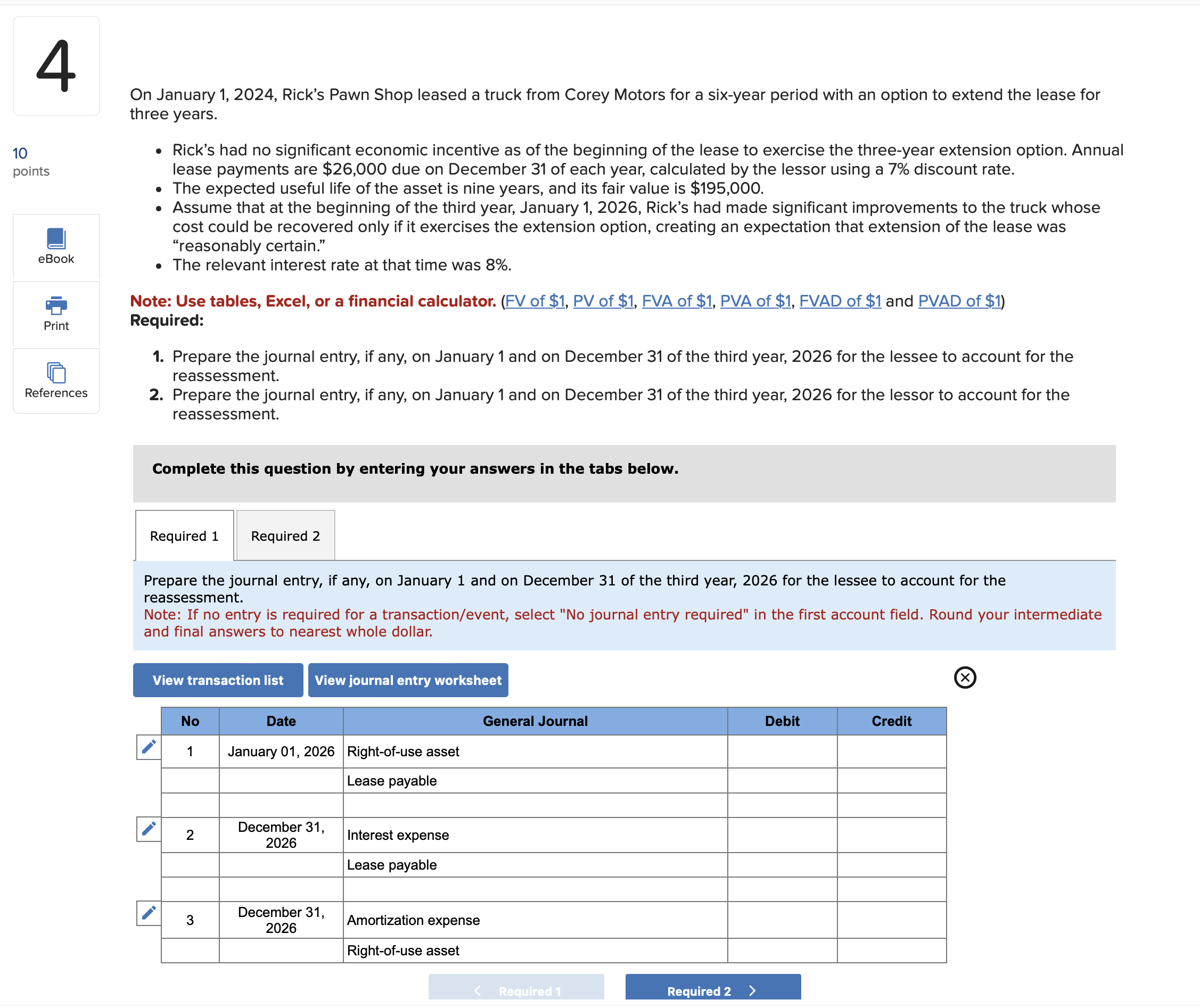

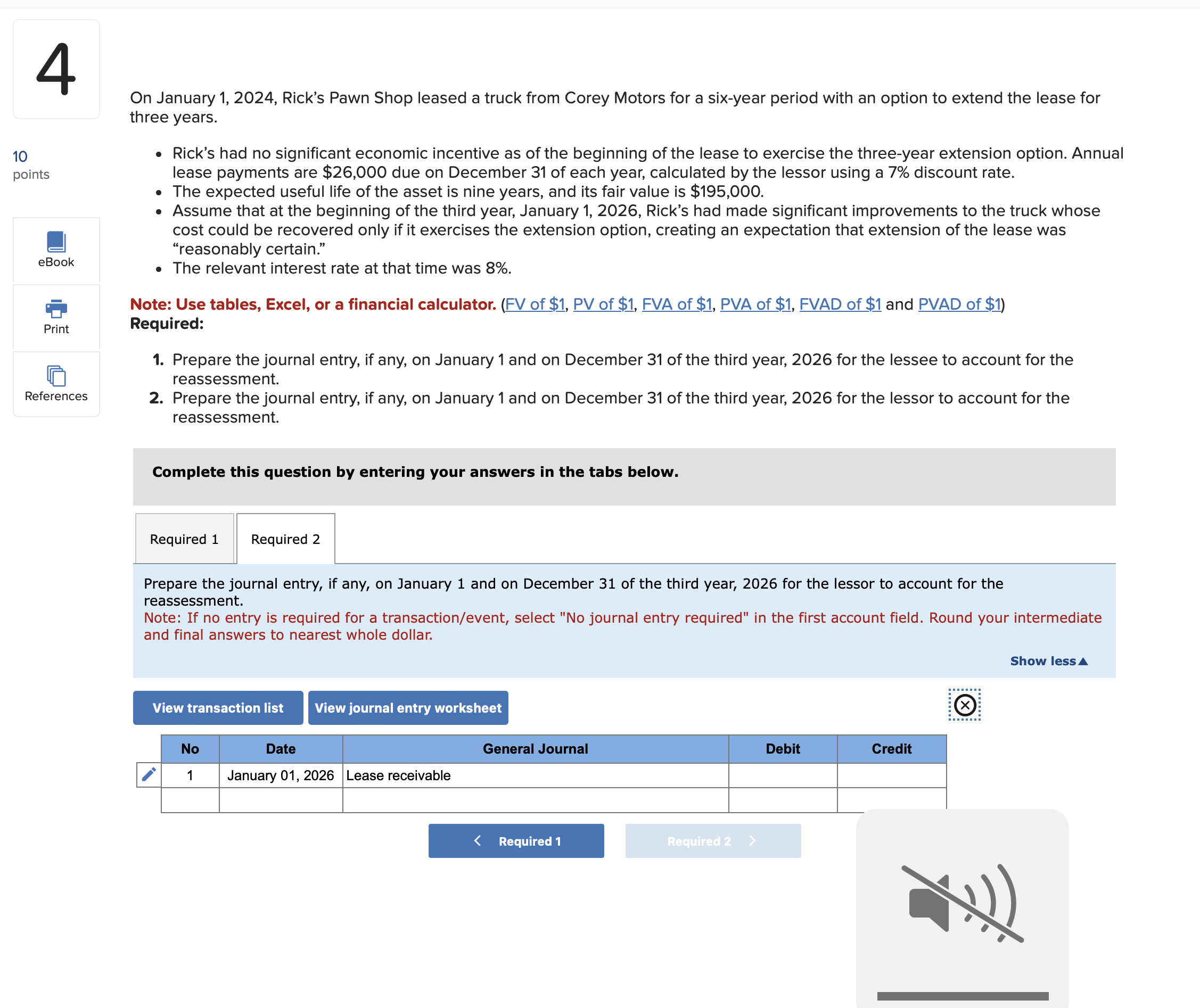

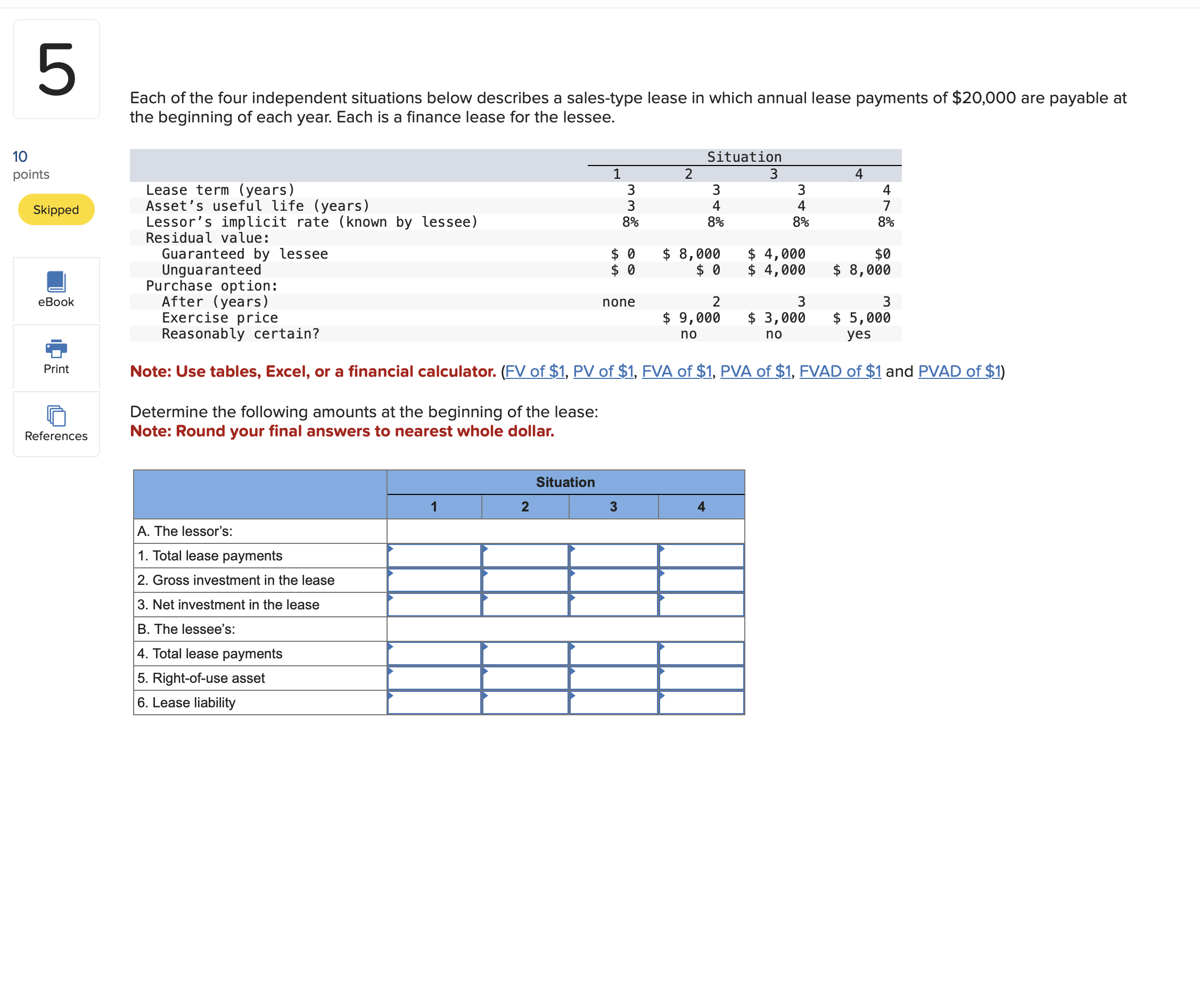

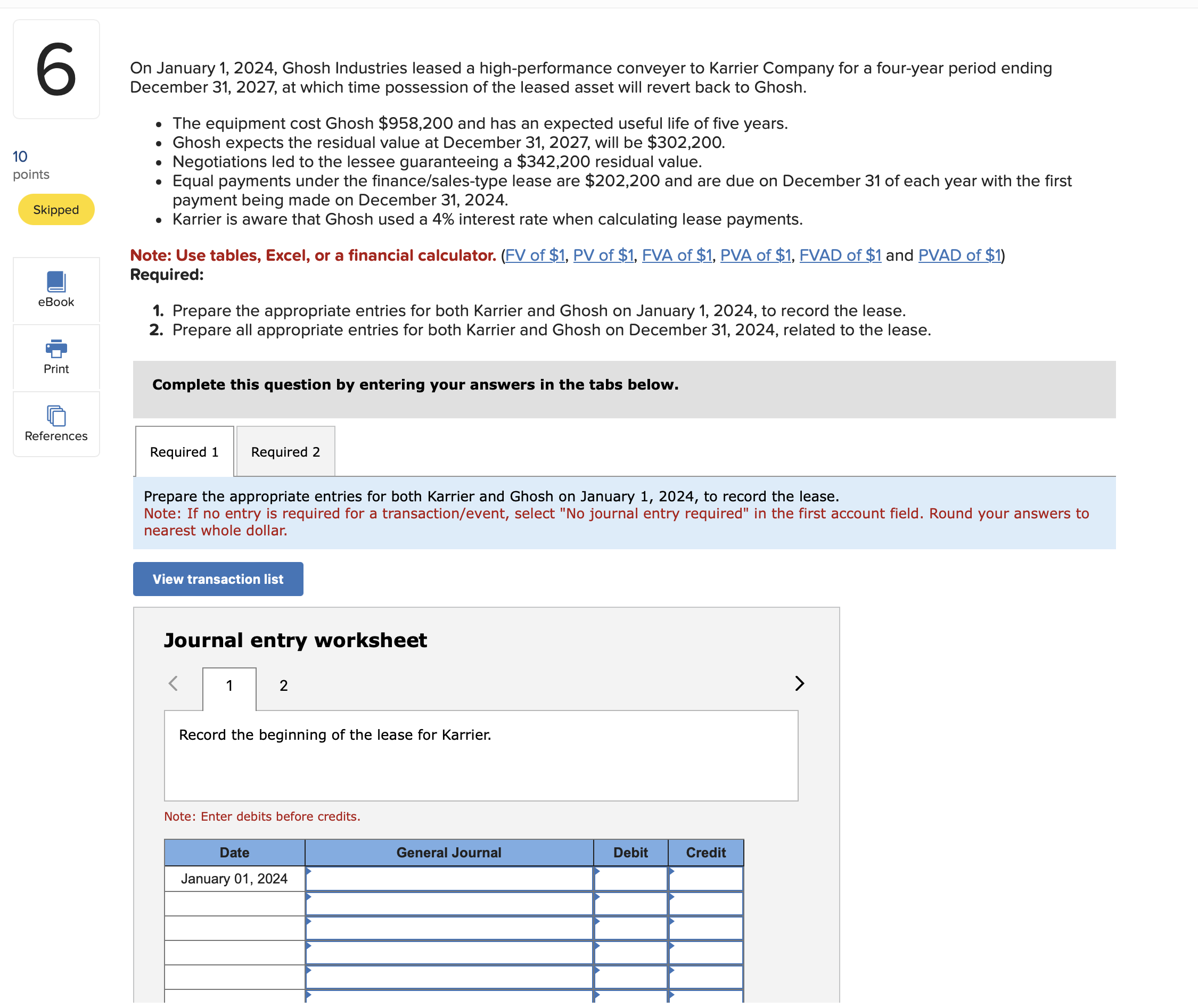

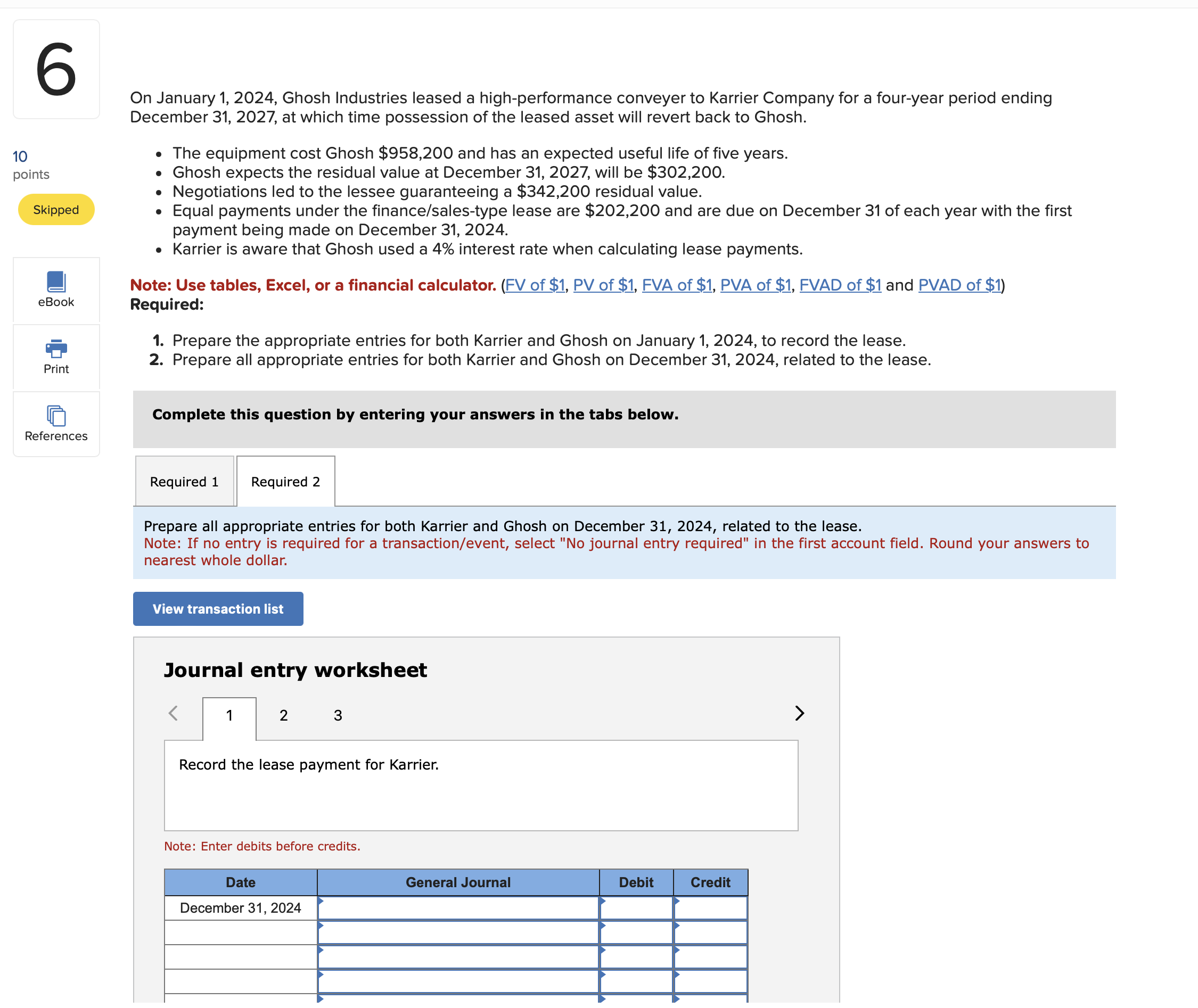

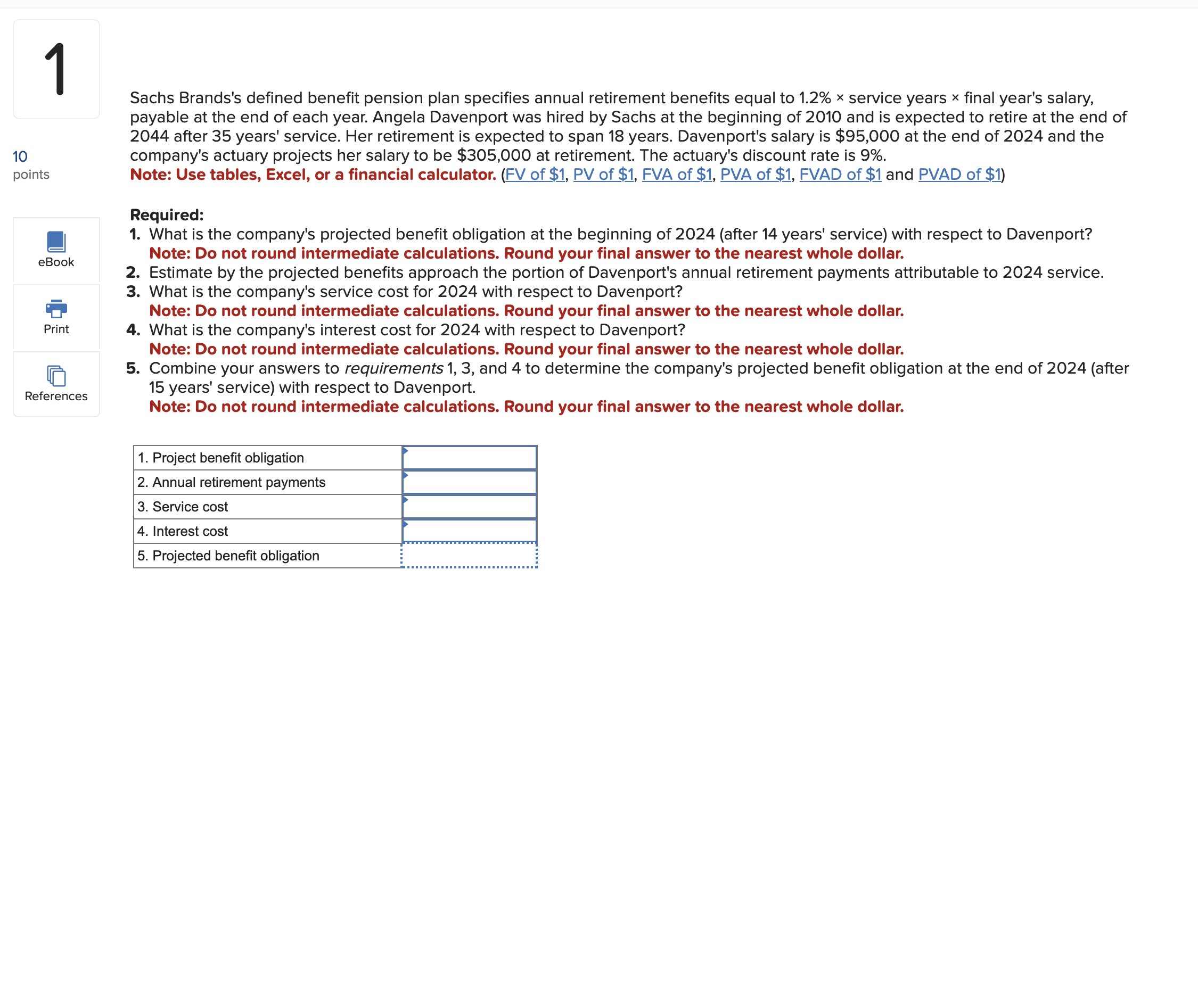

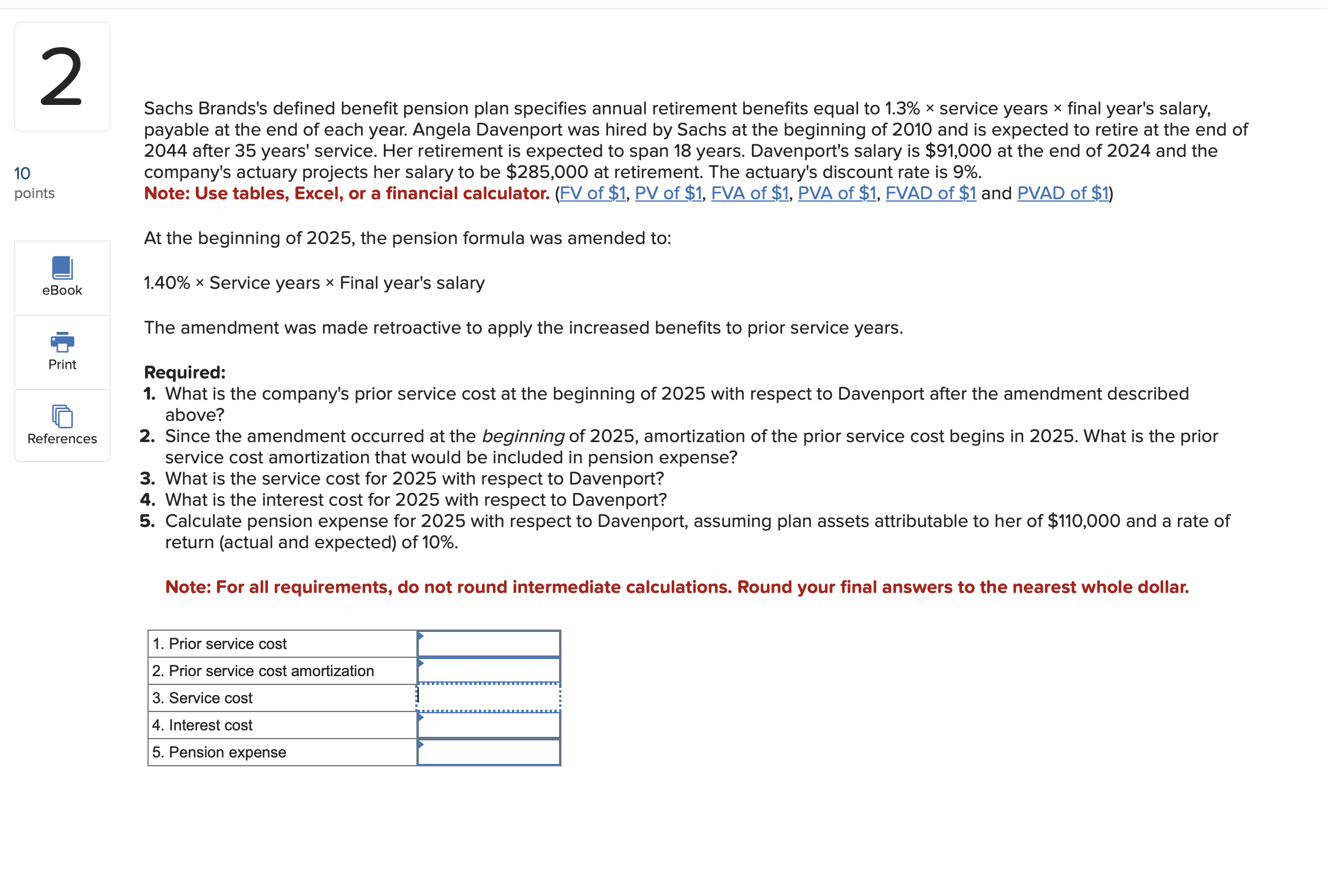

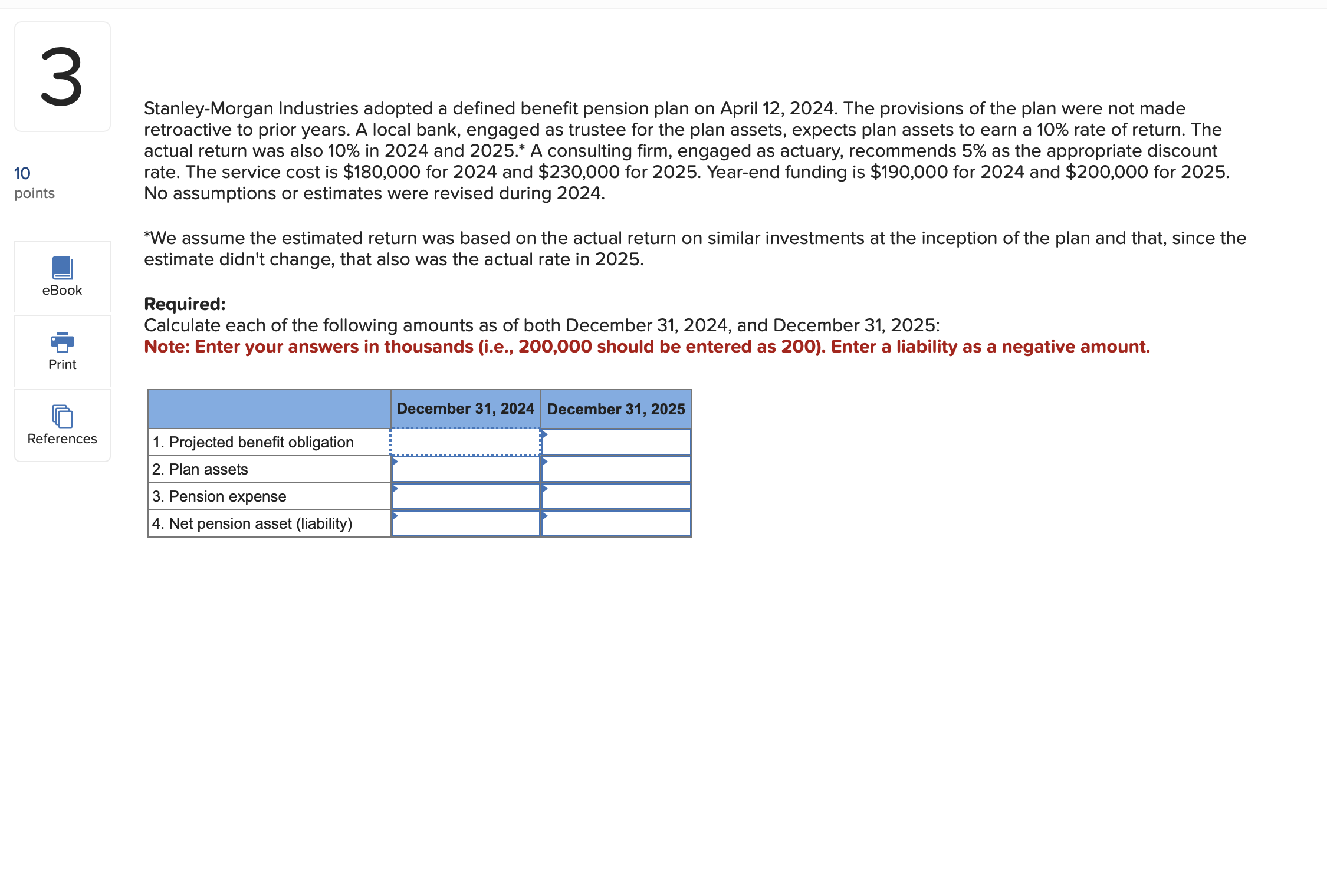

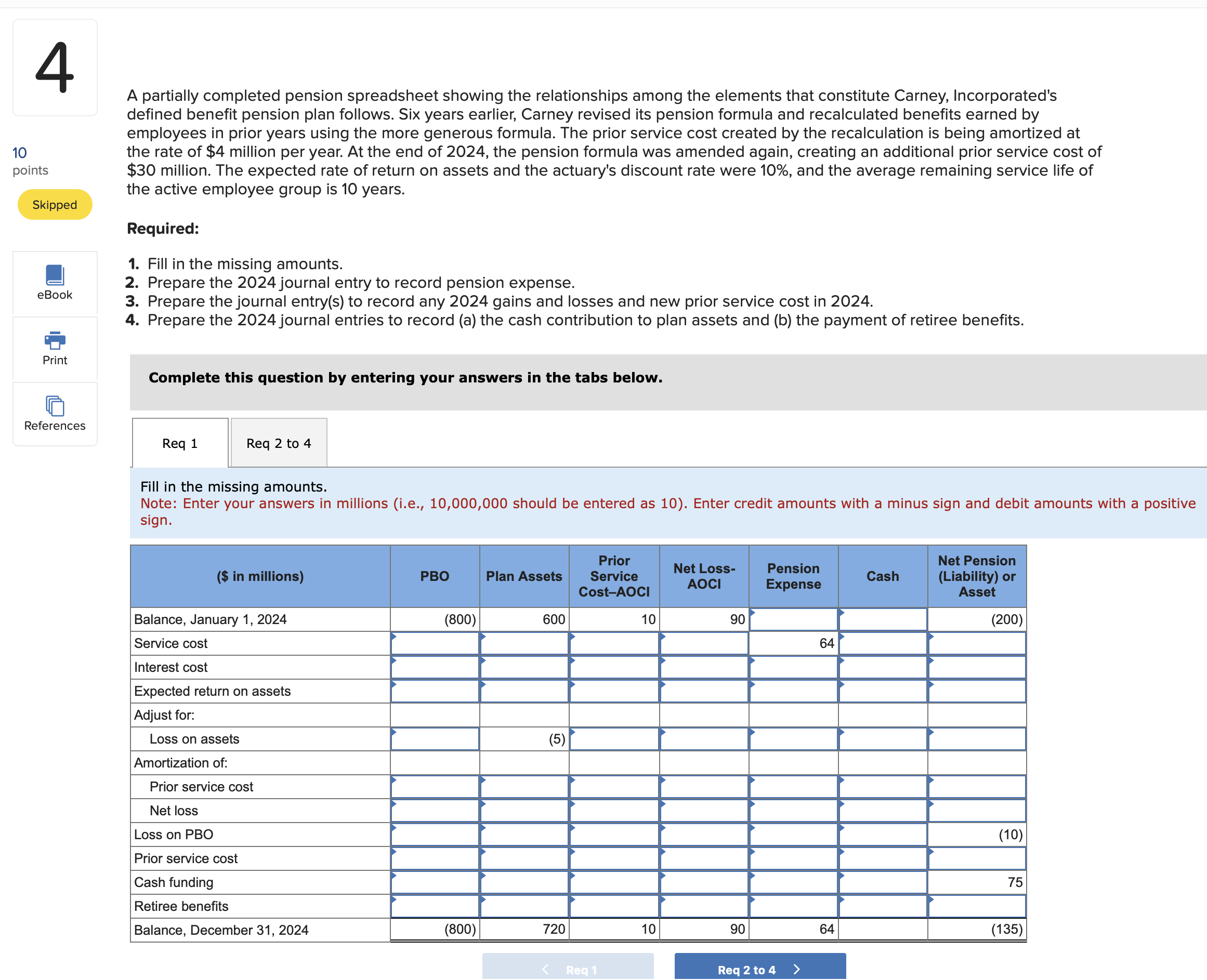

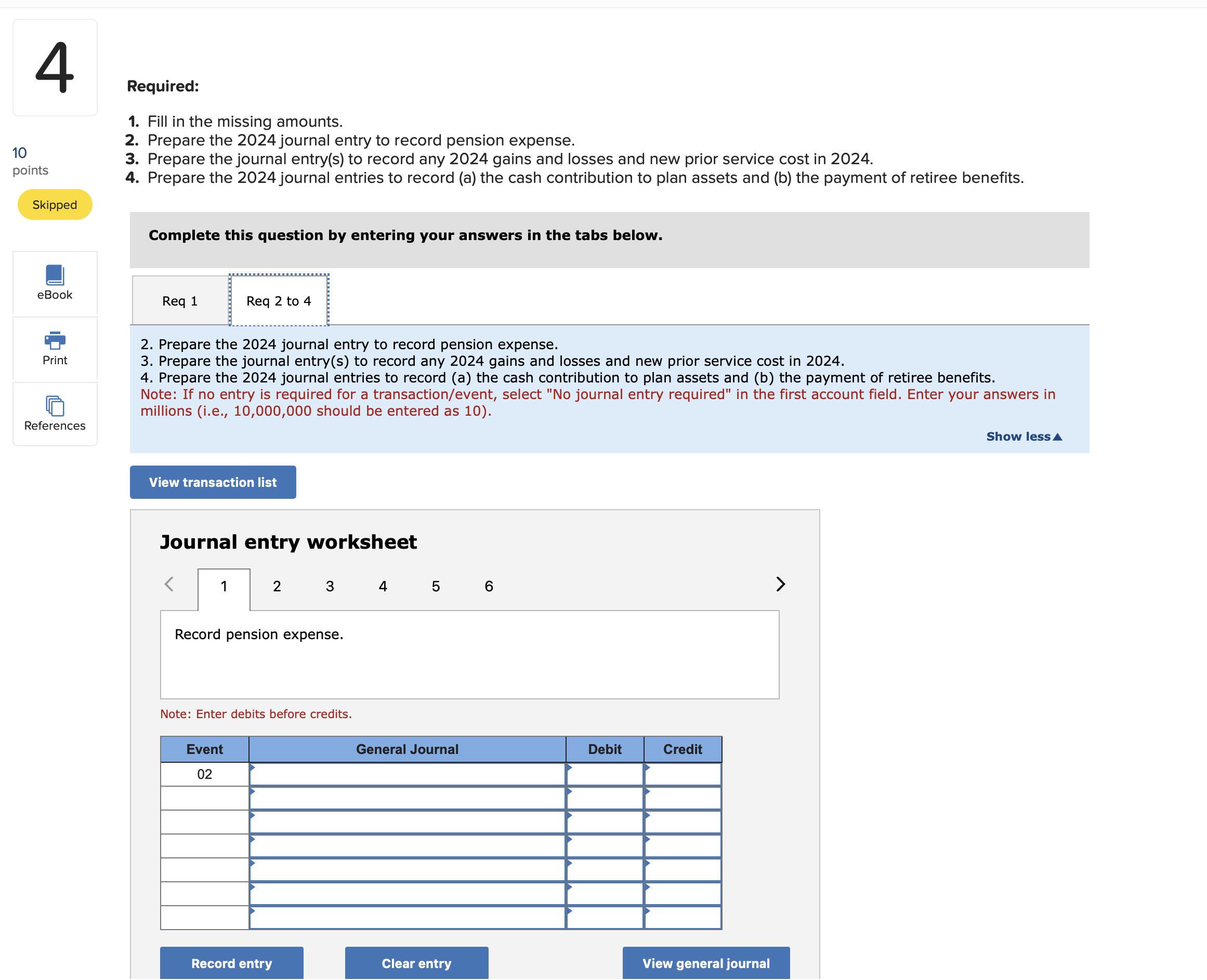

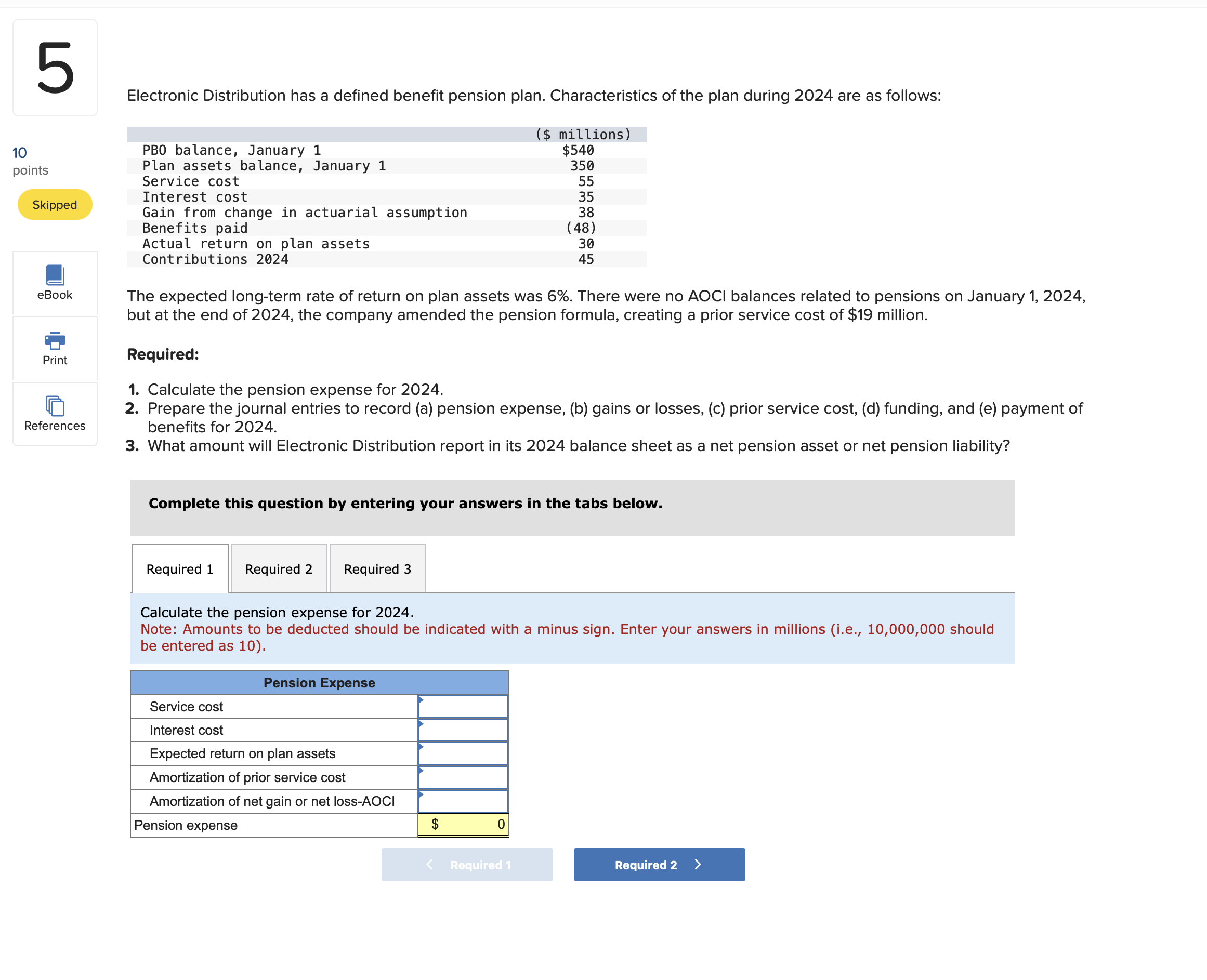

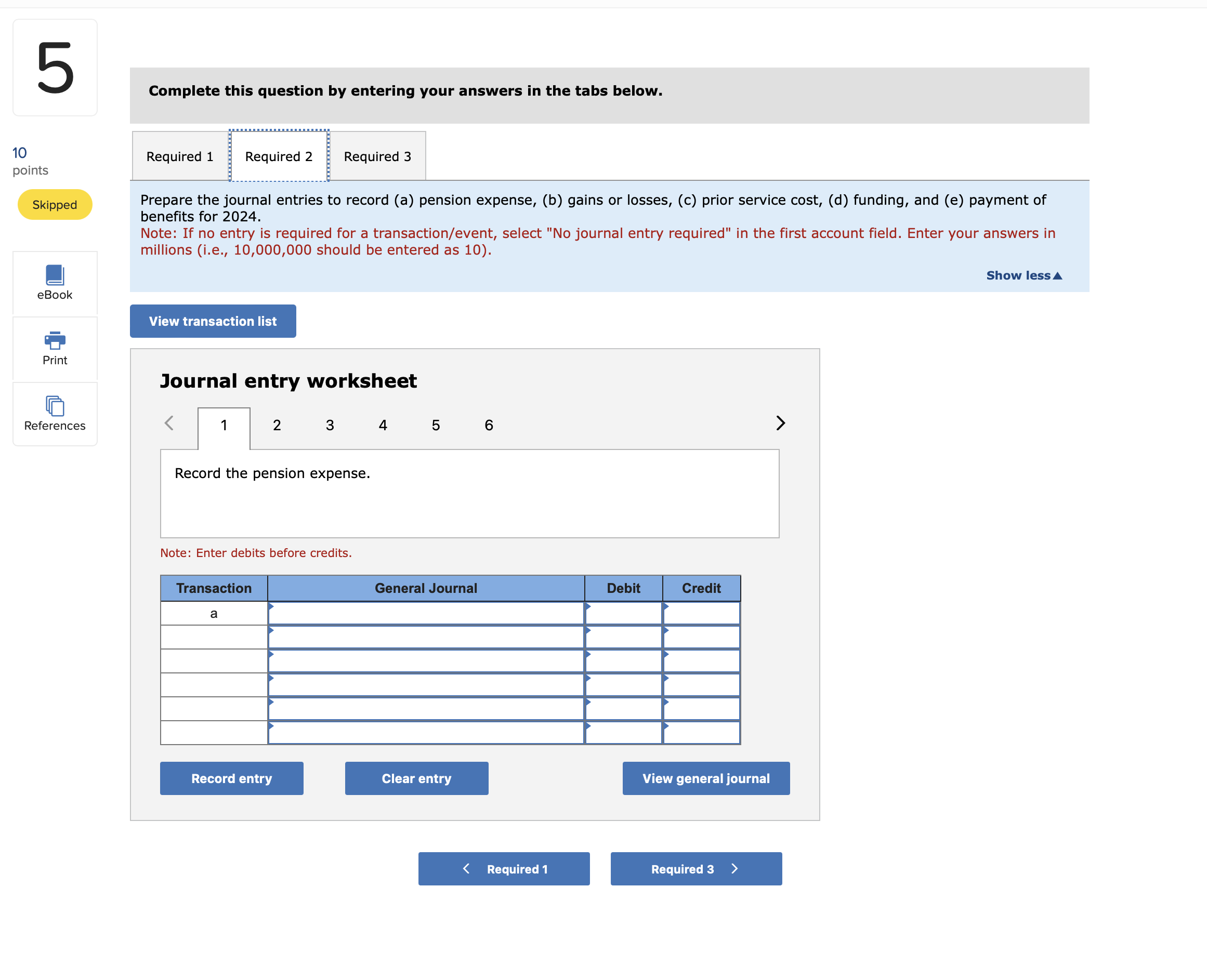

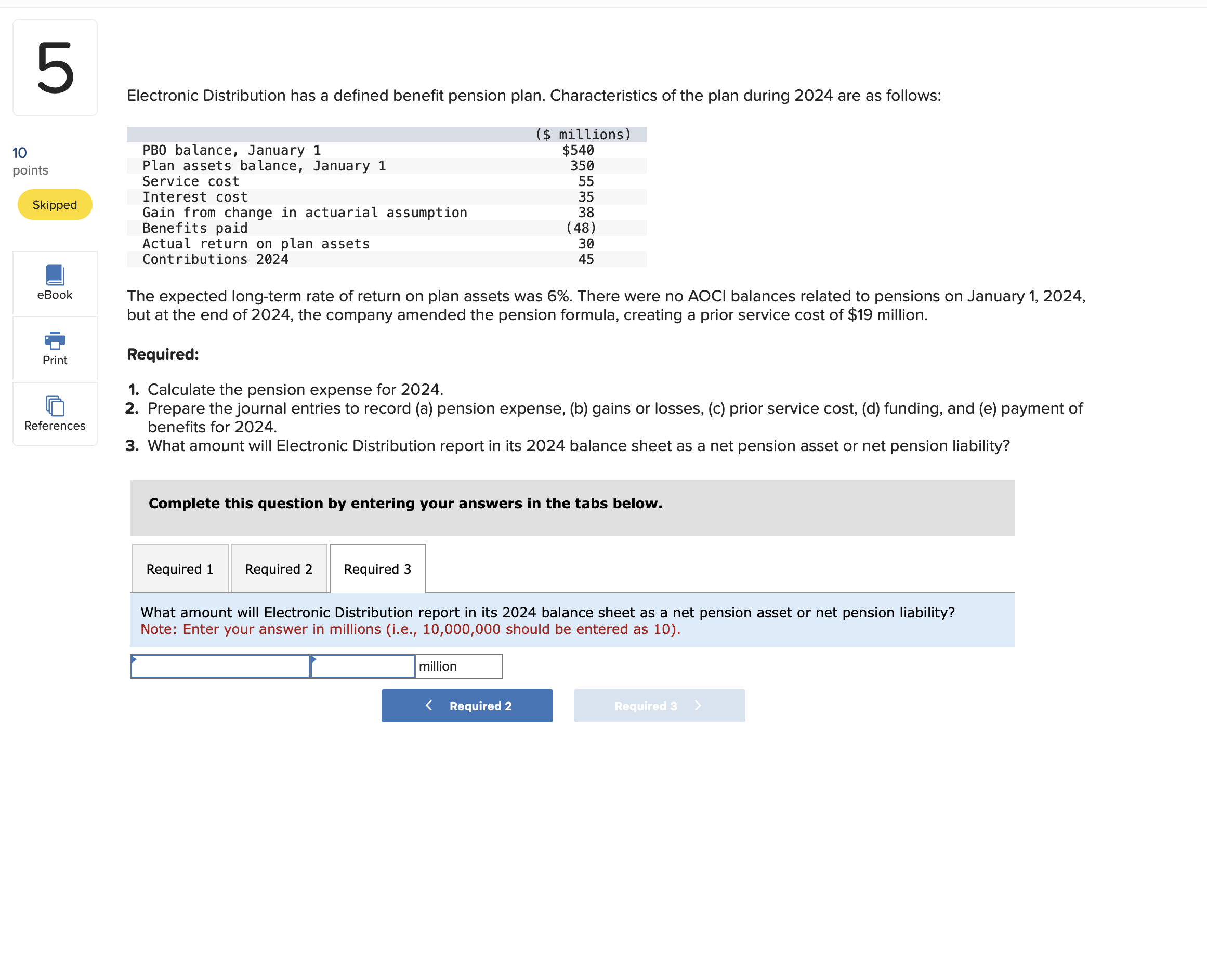

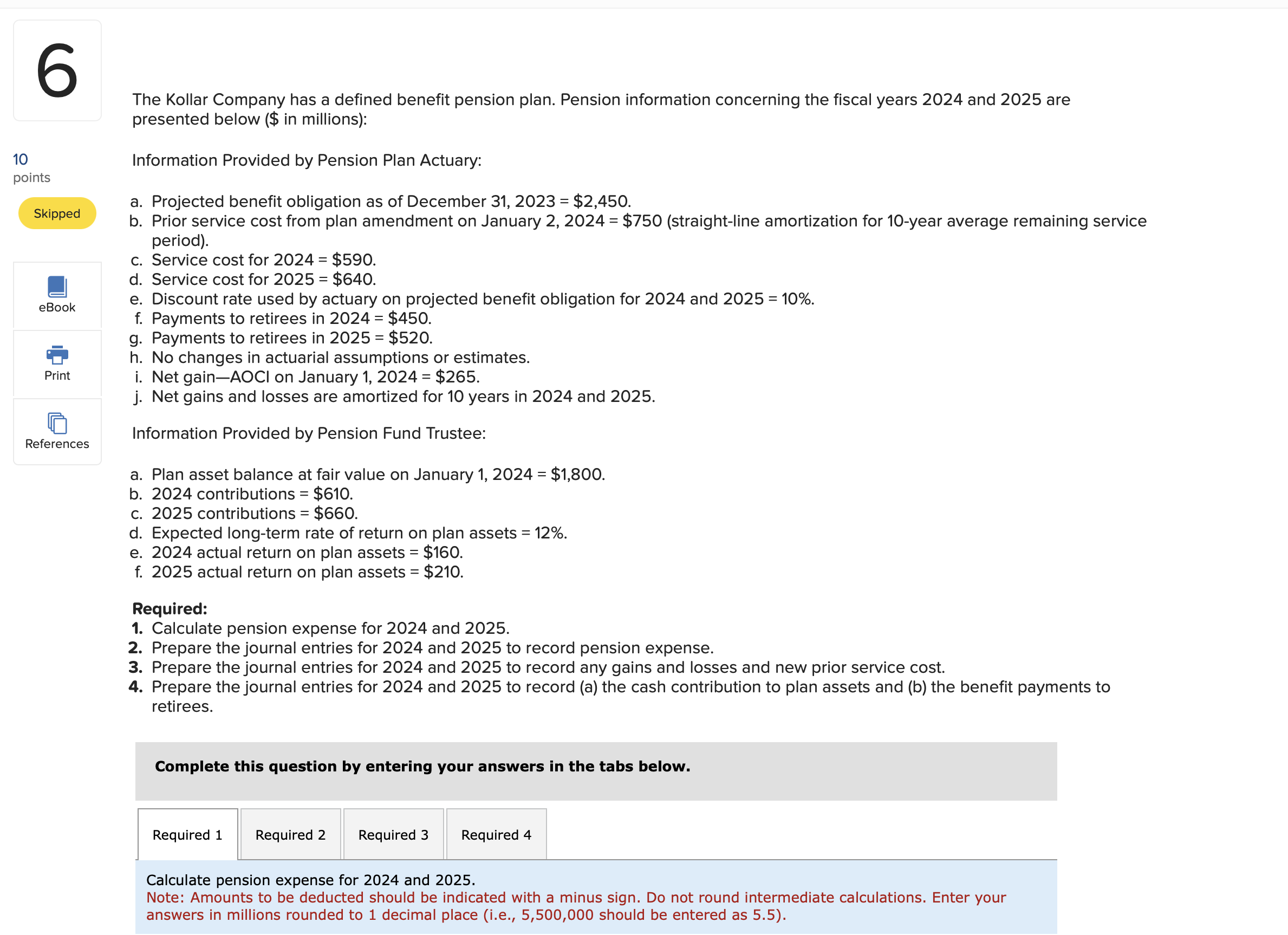

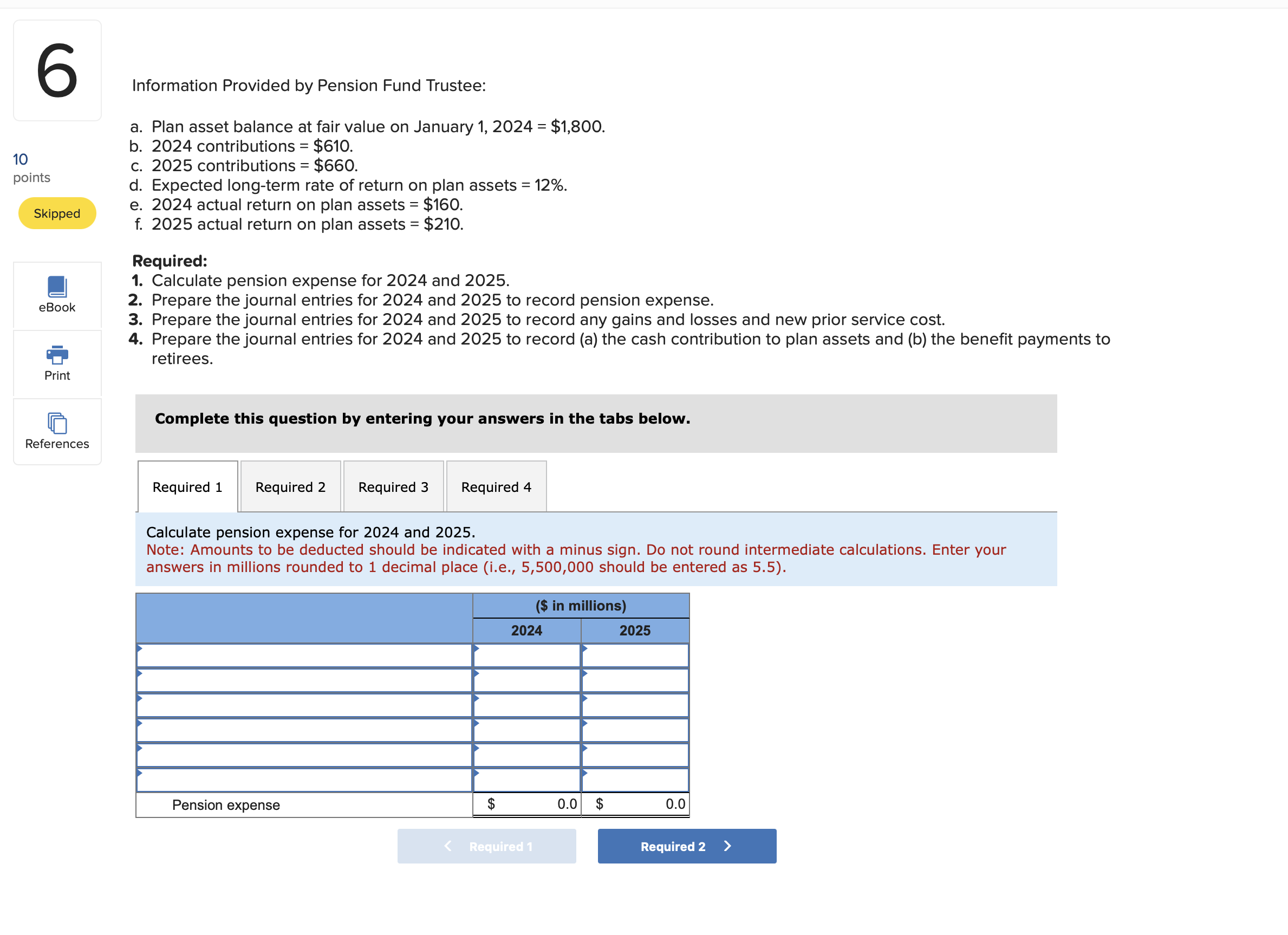

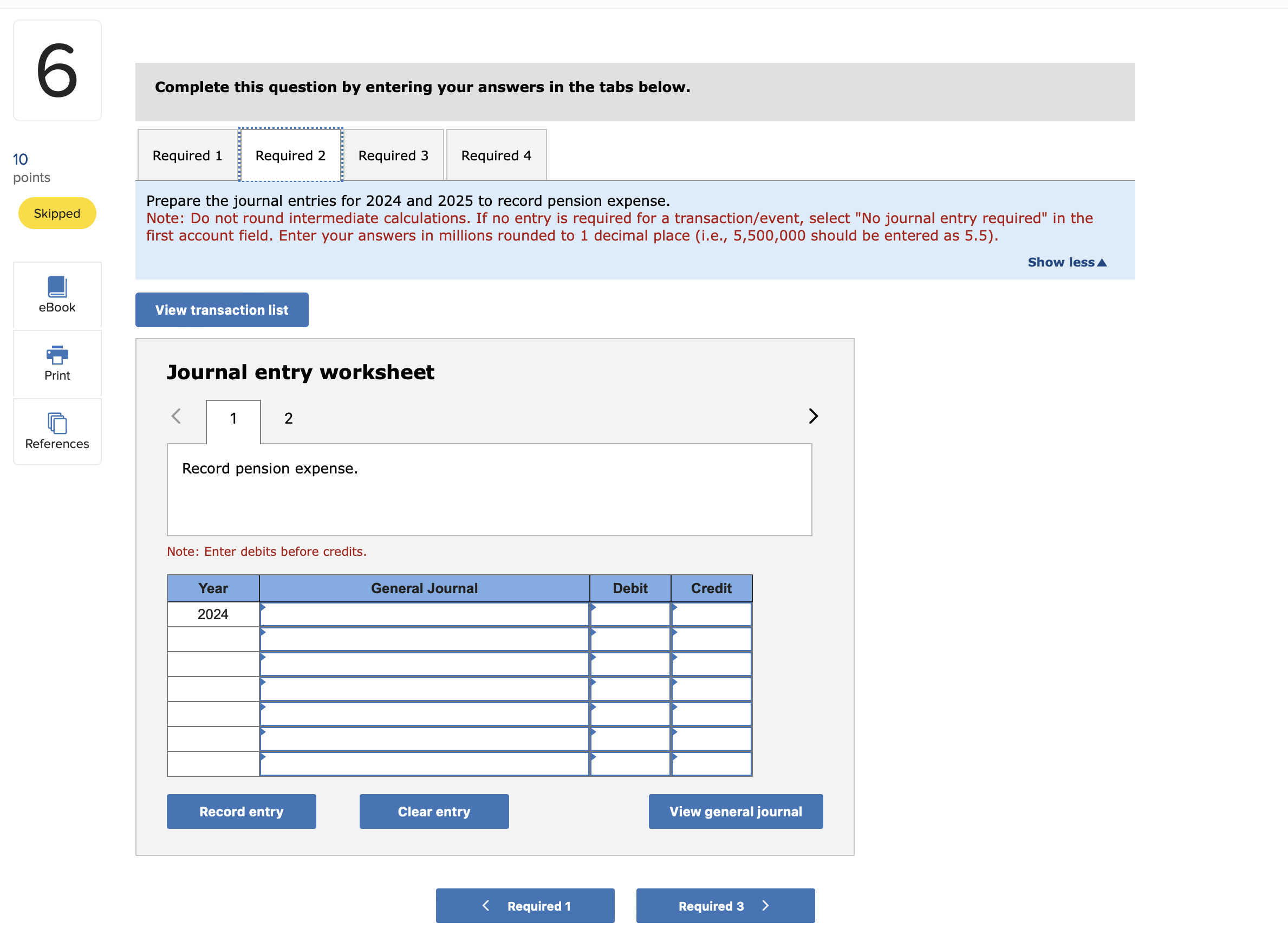

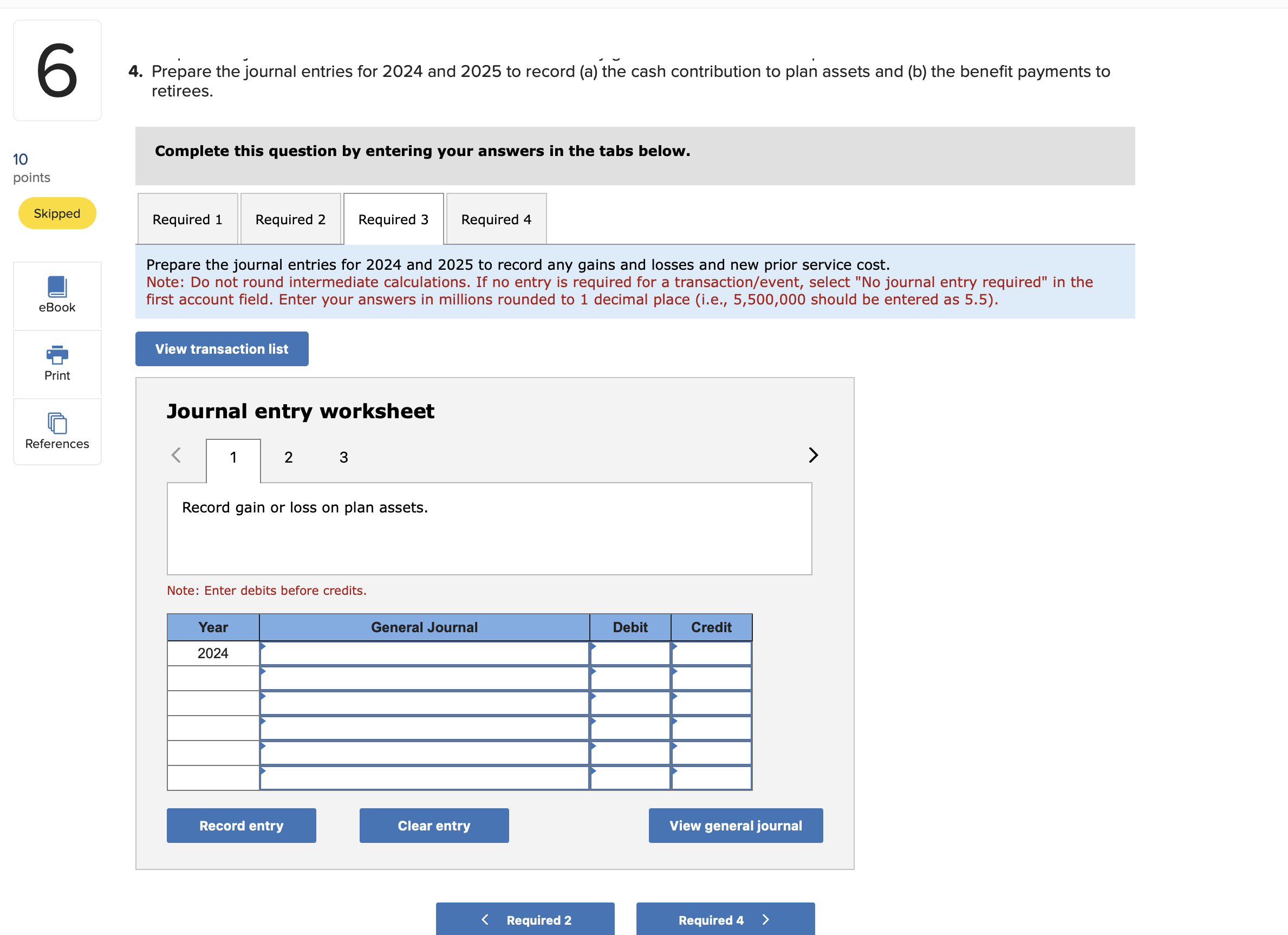

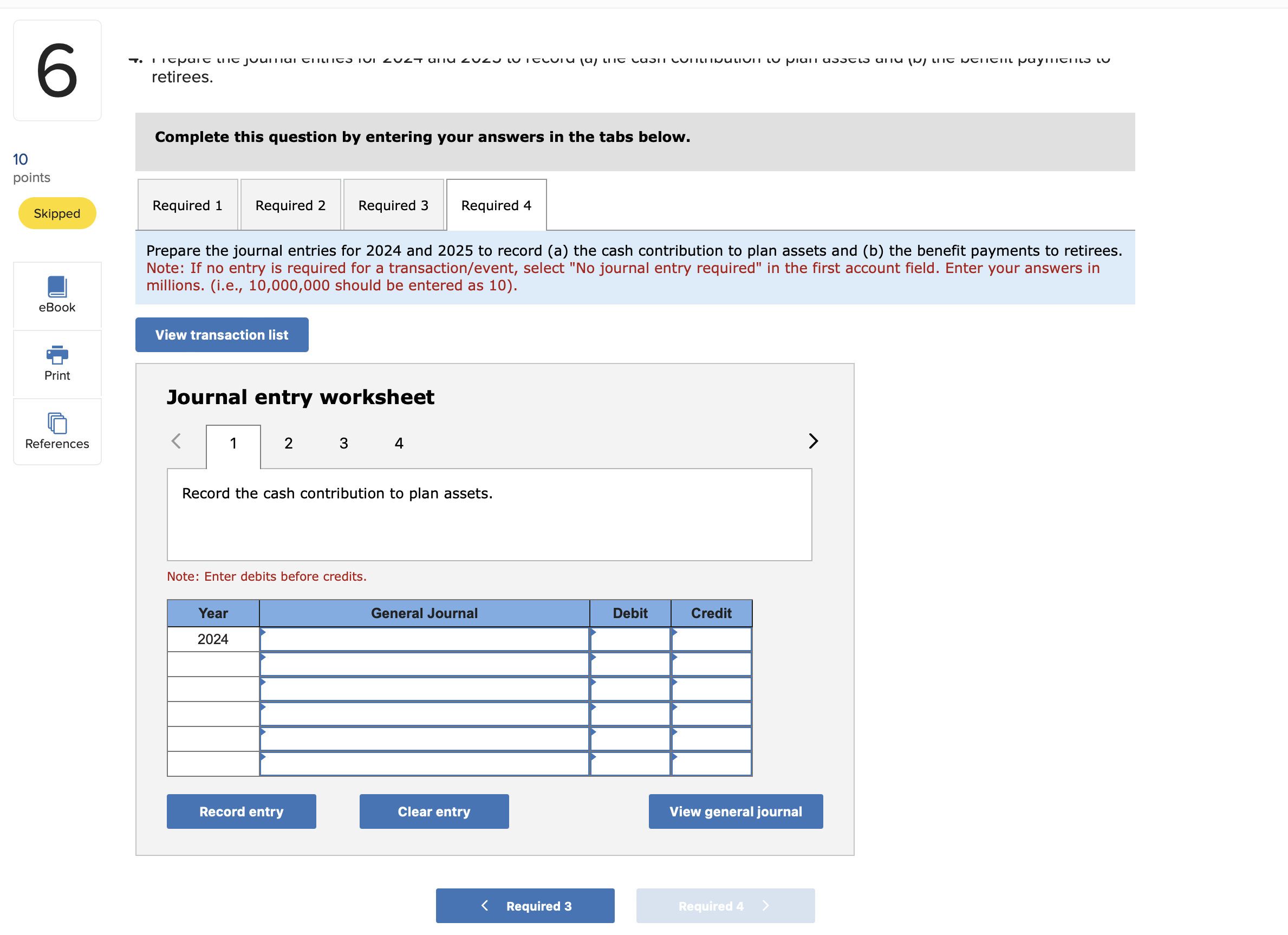

On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. - Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $26,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. - The expected useful life of the asset is nine years, and its fair value is $195,000. - Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." - The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar. On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. - Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $26,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. - The expected useful life of the asset is nine years, and its fair value is $195,000. - Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." - The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of $1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar. Each of the four independent situations below describes a sales-type lease in which annual lease payments of $20,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Determine the following amounts at the beginning of the lease: Note: Round your final answers to nearest whole dollar. On January 1, 2024, Ghosh Industries leased a high-performance conveyer to Karrier Company for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Ghosh. - The equipment cost Ghosh $958,200 and has an expected useful life of five years. - Ghosh expects the residual value at December 31, 2027, will be $302,200. - Negotiations led to the lessee guaranteeing a $342,200 residual value. - Equal payments under the finance/sales-type lease are $202,200 and are due on December 31 of each year with the first payment being made on December 31, 2024. - Karrier is aware that Ghosh used a 4% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. 2. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar. On January 1, 2024, Ghosh Industries leased a high-performance conveyer to Karrier Company for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Ghosh. - The equipment cost Ghosh $958,200 and has an expected useful life of five years. - Ghosh expects the residual value at December 31, 2027, will be $302,200. - Negotiations led to the lessee guaranteeing a $342,200 residual value. - Equal payments under the finance/sales-type lease are $202,200 and are due on December 31 of each year with the first payment being made on December 31, 2024. - Karrier is aware that Ghosh used a 4% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. 2. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Complete this question by entering your answers in the tabs below. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar. Journal entry worksheet INote: tnter aebits berore creaits. Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% service years final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $95,000 at the end of 2024 and the company's actuary projects her salary to be $305,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. What is the company's projected benefit obligation at the beginning of 2024 (after 14 years' service) with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 2. Estimate by the projected benefits approach the portion of Davenport's annual retirement payments attributable to 2024 service. 3. What is the company's service cost for 2024 with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 4. What is the company's interest cost for 2024 with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 5. Combine your answers to requirements 1,3 , and 4 to determine the company's projected benefit obligation at the end of 2024 (after 15 years' service) with respect to Davenport. Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% service years final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $91,000 at the end of 2024 and the company's actuary projects her salary to be $285,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) At the beginning of 2025 , the pension formula was amended to: 1.40% Service years Final year's salary The amendment was made retroactive to apply the increased benefits to prior service years. Required: 1. What is the company's prior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at the beginning of 2025 , amortization of the prior service cost begins in 2025 . What is the prior service cost amortization that would be included in pension expense? 3. What is the service cost for 2025 with respect to Davenport? 4. What is the interest cost for 2025 with respect to Davenport? 5. Calculate pension expense for 2025 with respect to Davenport, assuming plan assets attributable to her of $110,000 and a rate of return (actual and expected) of 10%. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar. Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10\% rate of return. The actual return was also 10\% in 2024 and 2025. A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $180,000 for 2024 and $230,000 for 2025 . Year-end funding is $190,000 for 2024 and $200,000 for 2025 . No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Incorporated's defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost created by the recalculation is being amortized at the rate of $4 million per year. At the end of 2024 , the pension formula was amended again, creating an additional prior service cost of $30 million. The expected rate of return on assets and the actuary's discount rate were 10%, and the average remaining service life of the active employee group is 10 years. Required: 1. Fill in the missing amounts. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. Fill in the missing amounts. Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amounts with a minus sign and debit amounts with a positi sign. Required: 1. Fill in the missing amounts. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Show less Journal entry worksheet Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: The expected long-term rate of return on plan assets was 6%. There were no AOCl balances related to pensions on January 1,2024 , but at the end of 2024, the company amended the pension formula, creating a prior service cost of $19 million. Required: 1. Calculate the pension expense for 2024 . 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. Calculate the pension expense for 2024 . Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Complete this question by entering your answers in the tabs below. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Journal entry worksheet ivUle. LilleI uevils VeIUIE hieuIls. Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: The expected long-term rate of return on plan assets was 6%. There were no AOCI balances related to pensions on January 1,2024 , but at the end of 2024 , the company amended the pension formula, creating a prior service cost of $19 million. Required: 1. Calculate the pension expense for 2024 . 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below (\$ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31,2023=$2,450. b. Prior service cost from plan amendment on January 2, 2024=$750 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024=$590. d. Service cost for 2025=$640. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025=10%. f. Payments to retirees in 2024=$450. g. Payments to retirees in 2025=$520. h. No changes in actuarial assumptions or estimates. i. Net gain-AOCl on January 1, 2024=$265. j. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1,2024=$1,800. b. 2024 contributions =$610. c. 2025 contributions =$660. d. Expected long-term rate of return on plan assets =12%. e. 2024 actual return on plan assets =$160. f. 2025 actual return on plan assets =$210. Required: 1. Calculate pension expense for 2024 and 2025. 2. Prepare the journal entries for 2024 and 2025 to record pension expense. 3. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Calculate pension expense for 2024 and 2025. Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1,2024=$1,800. b. 2024 contributions =$610. c. 2025 contributions =$660. d. Expected long-term rate of return on plan assets =12%. e. 2024 actual return on plan assets =$160. f. 2025 actual return on plan assets =$210. Required: 1. Calculate pension expense for 2024 and 2025. 2. Prepare the journal entries for 2024 and 2025 to record pension expense. 3. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Calculate pension expense for 2024 and 2025. Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record pension expense. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Show less Journal entry worksheet 2 Note: Enter debits before credits. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Record gain or loss on plan assets. Note: Enter debits before credits. retirees. Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Record the cash contribution to plan assets. Note: Enter debits before credits

On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. - Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $26,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. - The expected useful life of the asset is nine years, and its fair value is $195,000. - Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." - The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar. On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. - Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $26,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. - The expected useful life of the asset is nine years, and its fair value is $195,000. - Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." - The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of $1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Prepare the journal entry, if any, on January 1 and on December 31 of the third year, 2026 for the lessor to account for the reassessment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar. Each of the four independent situations below describes a sales-type lease in which annual lease payments of $20,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Determine the following amounts at the beginning of the lease: Note: Round your final answers to nearest whole dollar. On January 1, 2024, Ghosh Industries leased a high-performance conveyer to Karrier Company for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Ghosh. - The equipment cost Ghosh $958,200 and has an expected useful life of five years. - Ghosh expects the residual value at December 31, 2027, will be $302,200. - Negotiations led to the lessee guaranteeing a $342,200 residual value. - Equal payments under the finance/sales-type lease are $202,200 and are due on December 31 of each year with the first payment being made on December 31, 2024. - Karrier is aware that Ghosh used a 4% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. 2. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar. On January 1, 2024, Ghosh Industries leased a high-performance conveyer to Karrier Company for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Ghosh. - The equipment cost Ghosh $958,200 and has an expected useful life of five years. - Ghosh expects the residual value at December 31, 2027, will be $302,200. - Negotiations led to the lessee guaranteeing a $342,200 residual value. - Equal payments under the finance/sales-type lease are $202,200 and are due on December 31 of each year with the first payment being made on December 31, 2024. - Karrier is aware that Ghosh used a 4% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) Required: 1. Prepare the appropriate entries for both Karrier and Ghosh on January 1, 2024, to record the lease. 2. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Complete this question by entering your answers in the tabs below. Prepare all appropriate entries for both Karrier and Ghosh on December 31, 2024, related to the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar. Journal entry worksheet INote: tnter aebits berore creaits. Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% service years final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $95,000 at the end of 2024 and the company's actuary projects her salary to be $305,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. What is the company's projected benefit obligation at the beginning of 2024 (after 14 years' service) with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 2. Estimate by the projected benefits approach the portion of Davenport's annual retirement payments attributable to 2024 service. 3. What is the company's service cost for 2024 with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 4. What is the company's interest cost for 2024 with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 5. Combine your answers to requirements 1,3 , and 4 to determine the company's projected benefit obligation at the end of 2024 (after 15 years' service) with respect to Davenport. Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% service years final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $91,000 at the end of 2024 and the company's actuary projects her salary to be $285,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) At the beginning of 2025 , the pension formula was amended to: 1.40% Service years Final year's salary The amendment was made retroactive to apply the increased benefits to prior service years. Required: 1. What is the company's prior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at the beginning of 2025 , amortization of the prior service cost begins in 2025 . What is the prior service cost amortization that would be included in pension expense? 3. What is the service cost for 2025 with respect to Davenport? 4. What is the interest cost for 2025 with respect to Davenport? 5. Calculate pension expense for 2025 with respect to Davenport, assuming plan assets attributable to her of $110,000 and a rate of return (actual and expected) of 10%. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar. Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10\% rate of return. The actual return was also 10\% in 2024 and 2025. A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $180,000 for 2024 and $230,000 for 2025 . Year-end funding is $190,000 for 2024 and $200,000 for 2025 . No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Incorporated's defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost created by the recalculation is being amortized at the rate of $4 million per year. At the end of 2024 , the pension formula was amended again, creating an additional prior service cost of $30 million. The expected rate of return on assets and the actuary's discount rate were 10%, and the average remaining service life of the active employee group is 10 years. Required: 1. Fill in the missing amounts. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. Fill in the missing amounts. Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amounts with a minus sign and debit amounts with a positi sign. Required: 1. Fill in the missing amounts. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Show less Journal entry worksheet Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: The expected long-term rate of return on plan assets was 6%. There were no AOCl balances related to pensions on January 1,2024 , but at the end of 2024, the company amended the pension formula, creating a prior service cost of $19 million. Required: 1. Calculate the pension expense for 2024 . 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. Calculate the pension expense for 2024 . Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Complete this question by entering your answers in the tabs below. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Journal entry worksheet ivUle. LilleI uevils VeIUIE hieuIls. Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: The expected long-term rate of return on plan assets was 6%. There were no AOCI balances related to pensions on January 1,2024 , but at the end of 2024 , the company amended the pension formula, creating a prior service cost of $19 million. Required: 1. Calculate the pension expense for 2024 . 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below (\$ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31,2023=$2,450. b. Prior service cost from plan amendment on January 2, 2024=$750 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024=$590. d. Service cost for 2025=$640. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025=10%. f. Payments to retirees in 2024=$450. g. Payments to retirees in 2025=$520. h. No changes in actuarial assumptions or estimates. i. Net gain-AOCl on January 1, 2024=$265. j. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1,2024=$1,800. b. 2024 contributions =$610. c. 2025 contributions =$660. d. Expected long-term rate of return on plan assets =12%. e. 2024 actual return on plan assets =$160. f. 2025 actual return on plan assets =$210. Required: 1. Calculate pension expense for 2024 and 2025. 2. Prepare the journal entries for 2024 and 2025 to record pension expense. 3. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Calculate pension expense for 2024 and 2025. Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1,2024=$1,800. b. 2024 contributions =$610. c. 2025 contributions =$660. d. Expected long-term rate of return on plan assets =12%. e. 2024 actual return on plan assets =$160. f. 2025 actual return on plan assets =$210. Required: 1. Calculate pension expense for 2024 and 2025. 2. Prepare the journal entries for 2024 and 2025 to record pension expense. 3. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Calculate pension expense for 2024 and 2025. Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record pension expense. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Show less Journal entry worksheet 2 Note: Enter debits before credits. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Record gain or loss on plan assets. Note: Enter debits before credits. retirees. Complete this question by entering your answers in the tabs below. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to retirees. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Record the cash contribution to plan assets. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started