Answered step by step

Verified Expert Solution

Question

1 Approved Answer

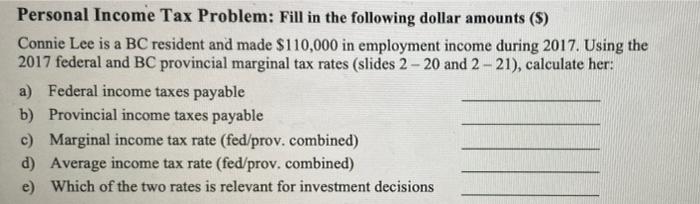

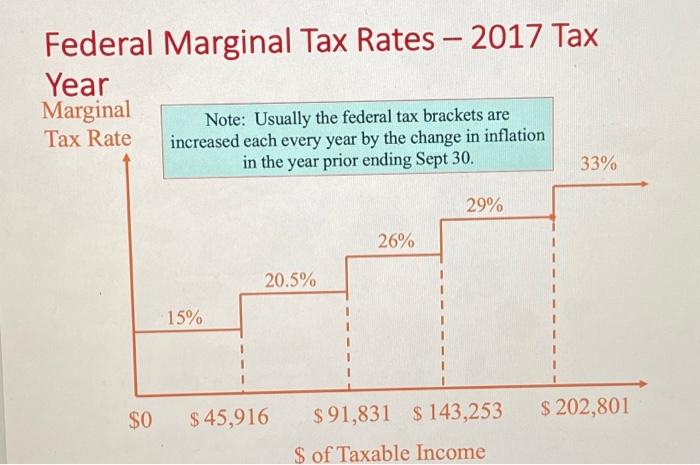

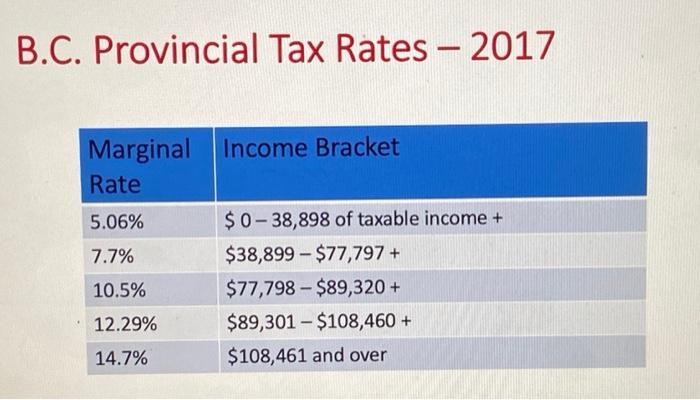

please solve all the parts of one question. show calculations too. Personal Income Tax Problem: Fill in the following dollar amounts (5) Connie Lee is

please solve all the parts of one question.

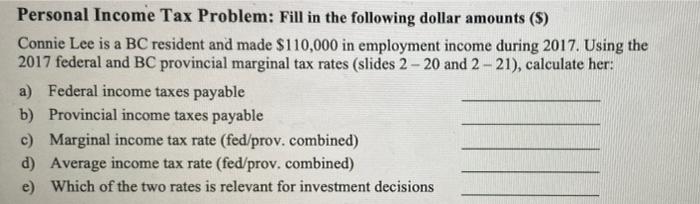

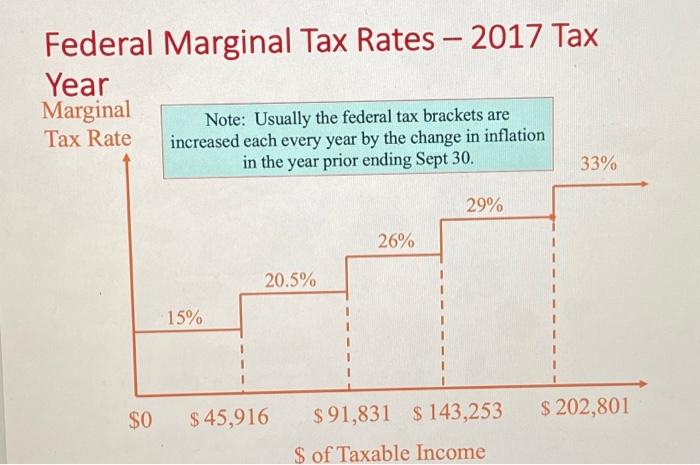

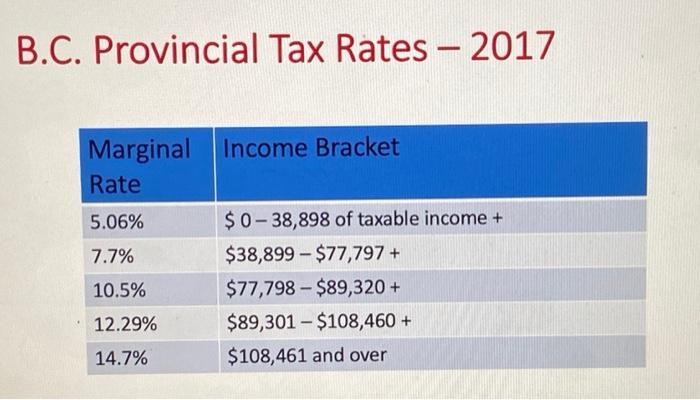

Personal Income Tax Problem: Fill in the following dollar amounts (5) Connie Lee is a BC resident and made $110,000 in employment income during 2017. Using the 2017 federal and BC provincial marginal tax rates (slides 2 - 20 and 2 - 21), calculate her: a) Federal income taxes payable b) Provincial income taxes payable c) Marginal income tax rate (fed/prov. combined) d) Average income tax rate (fed/prov. combined) e) Which of the two rates is relevant for investment decisions Federal Marginal Tax Rates - 2017 Tax Year Marginal Note: Usually the federal tax brackets are Tax Rate increased each every year by the change in inflation in the year prior ending Sept 30. 33% 29% 26% 20.5% 15% $0 $ 45,916 $ 202,801 $ 91,831 $ 143,253 $ of Taxable Income B.C. Provincial Tax Rates - 2017 Marginal Income Bracket Rate 5.06% $ 0-38,898 of taxable income + 7.7% $38,899 - $77,797 + 10.5% $77,798 - $89,320 + 12.29% $89,301 - $108,460 + 14.7% $108,461 and over show calculations too.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started