Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all the parts otherwise I will give 10 downvotes 1. National Company issued a 7.5%, 12-year bond, dated January 1,2023 , with a

Please solve all the parts otherwise I will give 10 downvotes

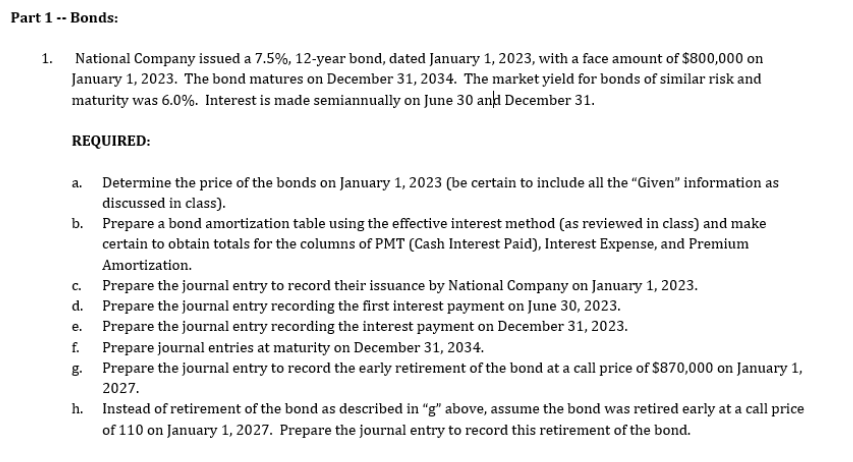

1. National Company issued a 7.5\%, 12-year bond, dated January 1,2023 , with a face amount of $800,000 on January 1, 2023. The bond matures on December 31, 2034. The market yield for bonds of similar risk and maturity was 6.0%. Interest is made semiannually on June 30 and December 31 . REQUIRED: a. Determine the price of the bonds on January 1,2023 (be certain to include all the "Given" information as discussed in class). b. Prepare a bond amortization table using the effective interest method (as reviewed in class) and make certain to obtain totals for the columns of PMT (Cash Interest Paid), Interest Expense, and Premium Amortization. c. Prepare the journal entry to record their issuance by National Company on January 1, 2023. d. Prepare the journal entry recording the first interest payment on June 30, 2023. e. Prepare the journal entry recording the interest payment on December 31, 2023. f. Prepare journal entries at maturity on December 31, 2034. g. Prepare the journal entry to record the early retirement of the bond at a call price of $870,000 on January 1 , 2027. h. Instead of retirement of the bond as described in "g" above, assume the bond was retired early at a call price of 110 on January 1,2027. Prepare the journal entry to record this retirement of the bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started