Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all the question, it's only one question with multible part. 4. The following information on two mutually exclusive projects is given below: Which

Please solve all the question, it's only one question with multible part.

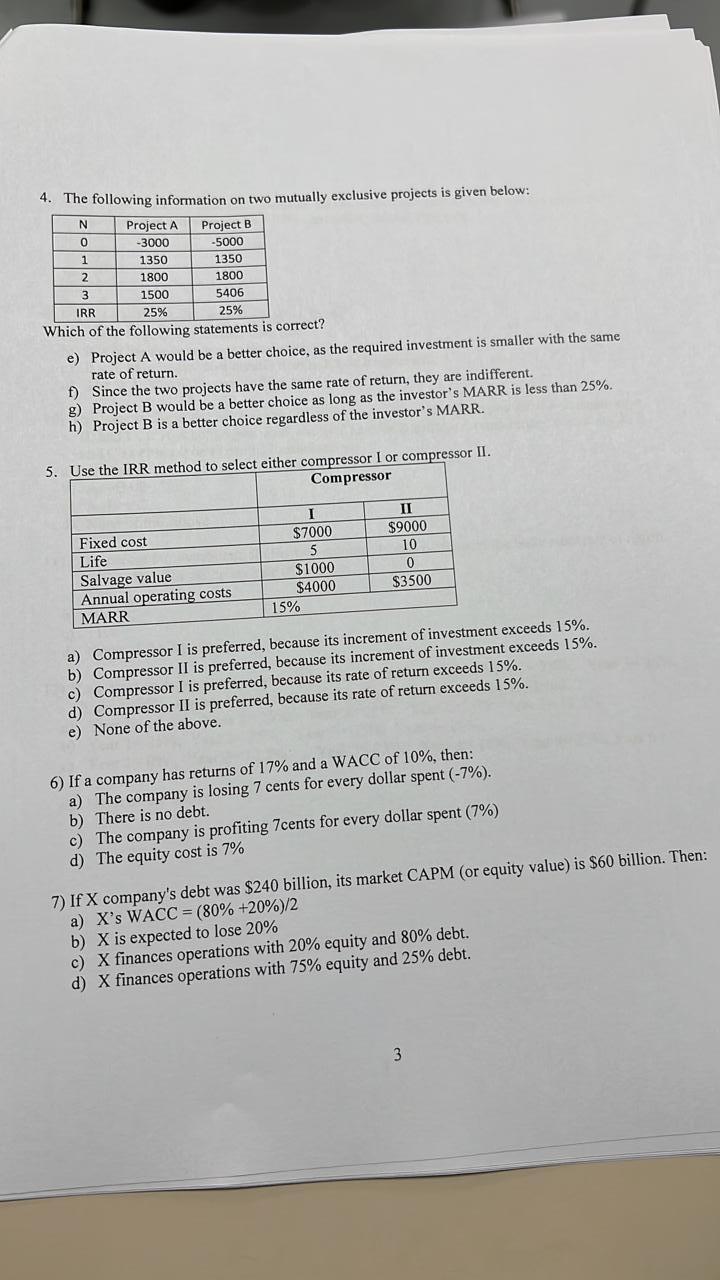

4. The following information on two mutually exclusive projects is given below: Which of the following statements is correct? e) Project A would be a better choice, as the required investment is smaller with the same rate of return. f) Since the two projects have the same rate of return, they are indifferent. g) Project B would be a better choice as long as the investor's MARR is less than 25%. h) Project B is a better choice regardless of the investor's MARR. a) Compressor I is preferred, because its increment of investment exceeds 15%. b) Compressor II is preferred, because its increment of investment exceeds 15%. c) Compressor I is preferred, because its rate of return exceeds 15%. d) Compressor II is preferred, because its rate of return exceeds 15%. e) None of the above. 6) If a company has returns of 17% and a WACC of 10%, then: a) The company is losing 7 cents for every dollar spent (7%). b) There is no debt. c) The company is profiting 7 cents for every dollar spent (7%) d) The equity cost is 7% 7) If X company's debt was $240 billion, its market CAPM (or equity value) is $60 billion. Then: a) XsWACC=(80%+20%)/2 b) X is expected to lose 20% c) X finances operations with 20% equity and 80% debt. d) X finances operations with 75% equity and 25% debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started