please solve all the questions and solve them correctly if you want a like.

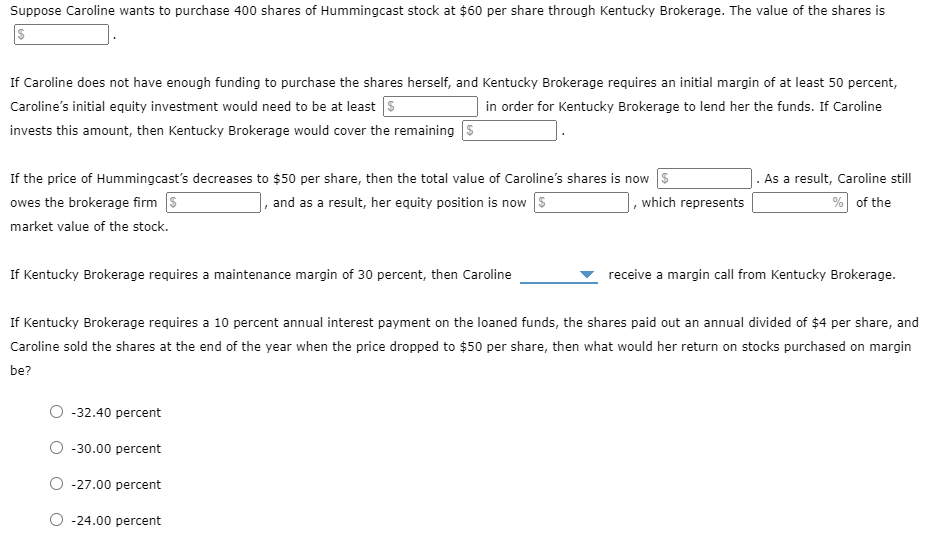

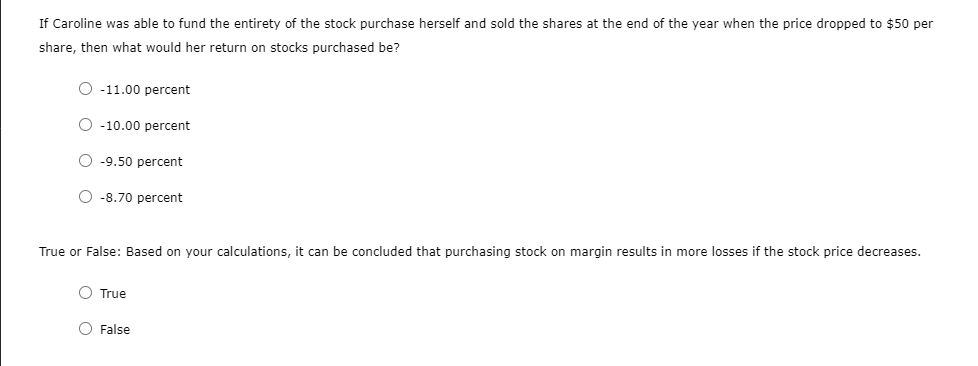

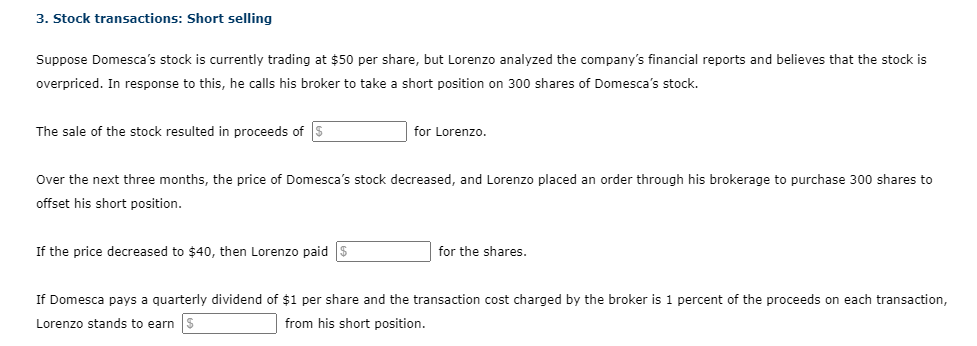

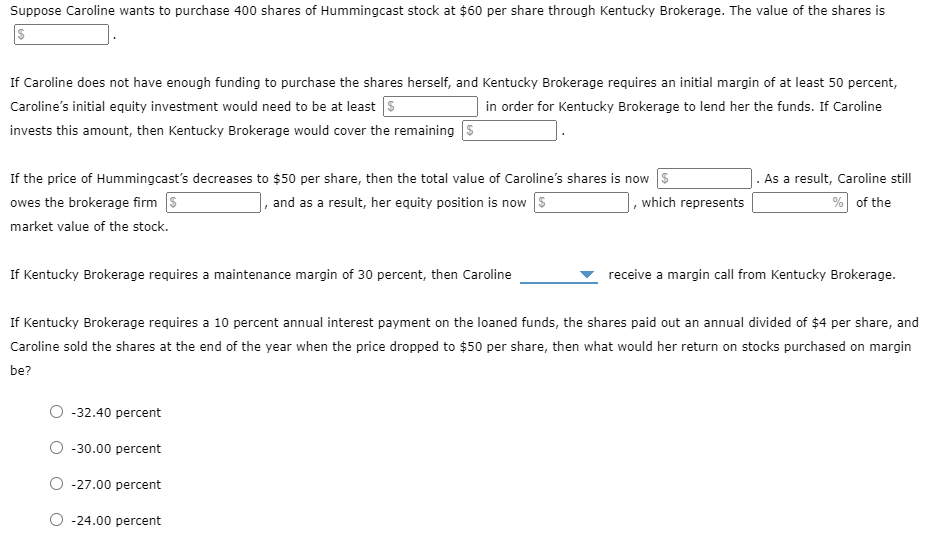

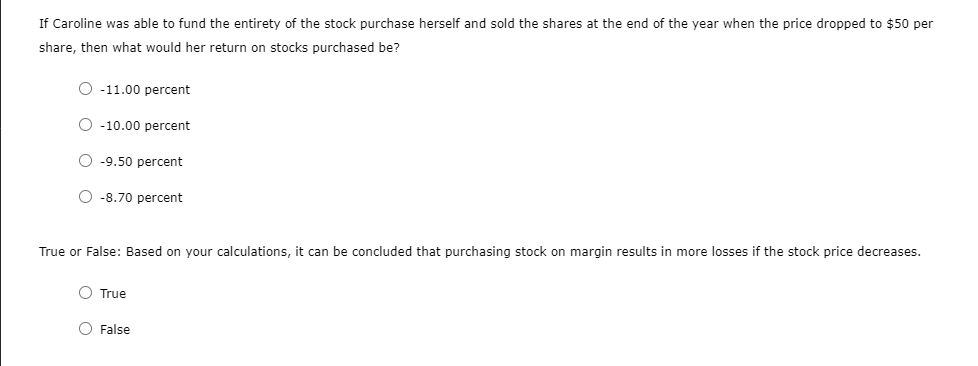

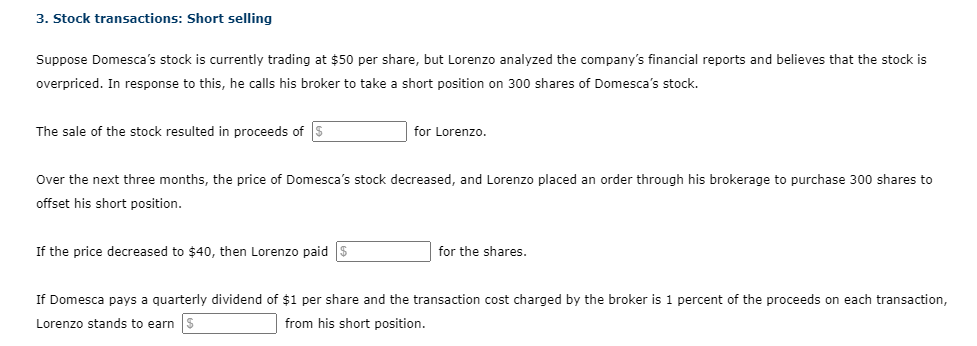

Suppose Caroline wants to purchase 400 shares of Hummingcast stock at $60 per share through Kentucky Brokerage. The value of the shares is $ If Caroline does not have enough funding to purchase the shares herself, and Kentucky Brokerage requires an initial margin of at least 50 percent, Caroline's initial equity investment would need to be at least $ in order for Kentucky Brokerage to lend her the funds. If Caroline invests this amount, then Kentucky Brokerage would cover the remaining S If the price of Hummingcast's decreases to $50 per share, then the total value of Caroline's shares is now $ owes the brokerage firms J, and as a result, her equity position is now s which represents market value of the stock. As a result, Caroline still % of the If Kentucky Brokerage requires a maintenance margin of 30 percent, then Caroline receive a margin call from Kentucky Brokerage. If Kentucky Brokerage requires a 10 percent annual interest payment on the loaned funds, the shares paid out an annual divided of $4 per share, and Caroline sold the shares at the end of the year when the price dropped to $50 per share, then what would her return on stocks purchased on margin be? -32.40 percent -30.00 percent -27.00 percent -24.00 percent If Caroline was able to fund the entirety of the stock purchase herself and sold the shares at the end of the year when the price dropped to $50 per share, then what would her return on stocks purchased be? 0 -11.00 percent 0 -10.00 percent 0 -9.50 percent -8.70 percent True or False: Based on your calculations, it can be concluded that purchasing stock on margin results in more losses if the stock price decreases. O True O False 3. Stock transactions: Short selling Suppose Domesca's stock is currently trading at $50 per share, but Lorenzo analyzed the company's financial reports and believes that the stock is overpriced. In response to this, he calls his broker to take a short position on 300 shares of Domesca's stock. The sale of the stock resulted in proceeds of $ for Lorenzo. Over the next three months, the price of Domesca's stock decreased, and Lorenzo placed an order through his brokerage to purchase 300 shares to offset his short position. If the price decreased to $40, then Lorenzo paid $ for the shares. If Domesca pays a quarterly dividend of $1 per share and the transaction cost charged by the broker is 1 percent of the proceeds on each transaction, Lorenzo stands to earn $ from his short position. Suppose Caroline wants to purchase 400 shares of Hummingcast stock at $60 per share through Kentucky Brokerage. The value of the shares is $ If Caroline does not have enough funding to purchase the shares herself, and Kentucky Brokerage requires an initial margin of at least 50 percent, Caroline's initial equity investment would need to be at least $ in order for Kentucky Brokerage to lend her the funds. If Caroline invests this amount, then Kentucky Brokerage would cover the remaining S If the price of Hummingcast's decreases to $50 per share, then the total value of Caroline's shares is now $ owes the brokerage firms J, and as a result, her equity position is now s which represents market value of the stock. As a result, Caroline still % of the If Kentucky Brokerage requires a maintenance margin of 30 percent, then Caroline receive a margin call from Kentucky Brokerage. If Kentucky Brokerage requires a 10 percent annual interest payment on the loaned funds, the shares paid out an annual divided of $4 per share, and Caroline sold the shares at the end of the year when the price dropped to $50 per share, then what would her return on stocks purchased on margin be? -32.40 percent -30.00 percent -27.00 percent -24.00 percent If Caroline was able to fund the entirety of the stock purchase herself and sold the shares at the end of the year when the price dropped to $50 per share, then what would her return on stocks purchased be? 0 -11.00 percent 0 -10.00 percent 0 -9.50 percent -8.70 percent True or False: Based on your calculations, it can be concluded that purchasing stock on margin results in more losses if the stock price decreases. O True O False 3. Stock transactions: Short selling Suppose Domesca's stock is currently trading at $50 per share, but Lorenzo analyzed the company's financial reports and believes that the stock is overpriced. In response to this, he calls his broker to take a short position on 300 shares of Domesca's stock. The sale of the stock resulted in proceeds of $ for Lorenzo. Over the next three months, the price of Domesca's stock decreased, and Lorenzo placed an order through his brokerage to purchase 300 shares to offset his short position. If the price decreased to $40, then Lorenzo paid $ for the shares. If Domesca pays a quarterly dividend of $1 per share and the transaction cost charged by the broker is 1 percent of the proceeds on each transaction, Lorenzo stands to earn $ from his short position