Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please SOLVE ALL THE QUESTIONS Q1-Q10 Using the timeline method and show all the work , without using excel THANKS Business Finance Assignment (Show all

Please SOLVE ALL THE QUESTIONS Q1-Q10 Using the timeline method and show all the work , without using excel

Please SOLVE ALL THE QUESTIONS Q1-Q10 Using the timeline method and show all the work , without using excel

THANKS

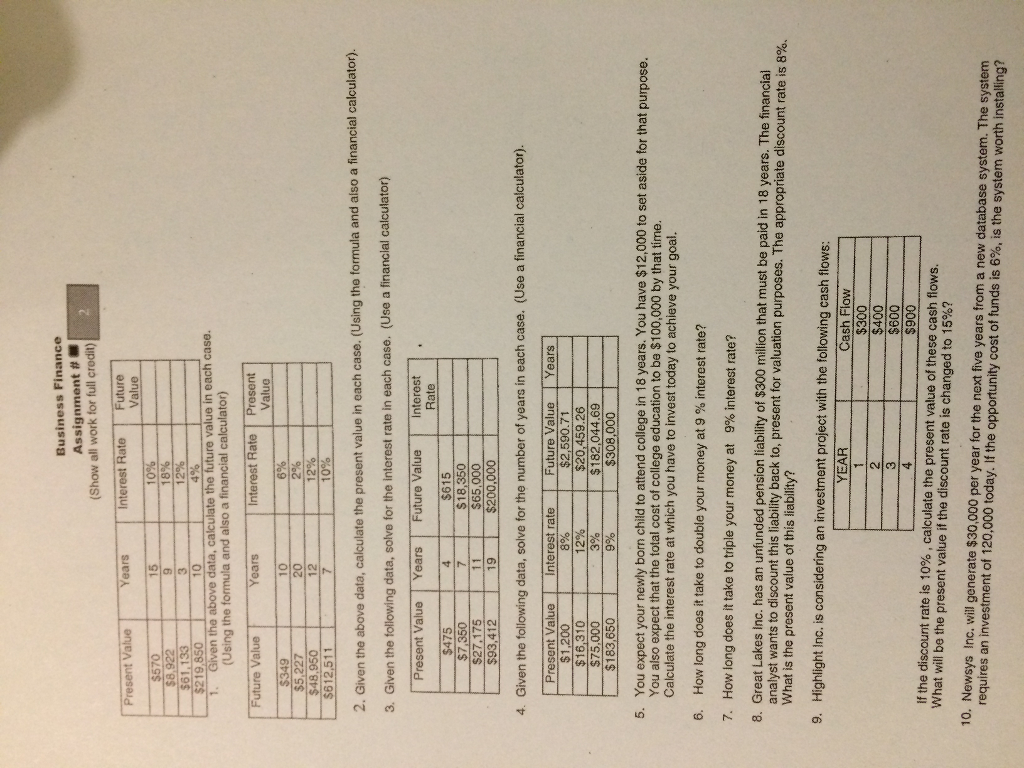

Business Finance Assignment (Show all work for full credit) S 570 15 10 calculate the future value in each case Given the above dat Using the formula and also a financial calculator) interest Rate Presen Years Future Value Value $5,227 12 $48,950 $612,511 2. Given data, calculate the present value in each case. (Using the formula and also a financial calculator). the above 3. Given the following data, solve for the interest rate in each case. (Use a financial calculator) ars Future Value T Interest Rate $18,350 27.175 11 S65,000 $93,412 19 200,000 4. Given the following data, solve for the number of years in each case. (Use a financial calculator). Present Value Interest rate Future Value Years 1200 8% $2,590.71 310 12% $20,459.26 $182,044.69 3% $75,000 99% $308,000 $183,650 5. You expect your newly born child to attend college in 18 years. You have $12,000 to set aside for that purpose. You also expect that the total cost of college education to be $100,000 by that time. Calculate the interest rate at which you have to invest today to achieve your goal. 6. How long does it take to double your money at 9 interest rate? 7. How long does it take to triple your money at 9% interest rate? 8. Great Lakes Inc. has an unfunded pension liability of $300 million that must be paid years. financial analyst wants to discount this liability back to, present for valuation purposes. The appropriate discount rate is 8% What is the present value of this liability? 9. Highlight Inc. is considering an investment project with the following cash flows: YEAR Cash Flow $300 $400 $600 $900 if the discount rate is 10%, calculate the present value of these cash flows. What will be the present value if the discount rate is changed to 15%? 10. Newsys Inc. will generate $30,000 per year for the next five years from a new database system. The system requires an investment of 120,000 today. If the opportunity cost of funds is 6%, is the system worth installing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started