Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all the requirements asap Roger Mills, the Vice President of Finance of Global Resources, was concerned about the fact that Global Resources used

please solve all the requirements asap

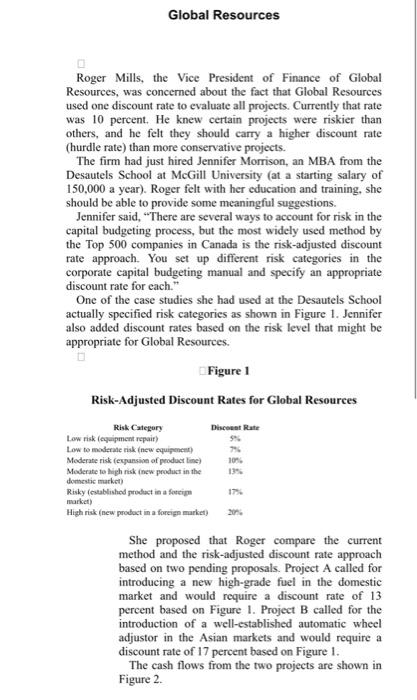

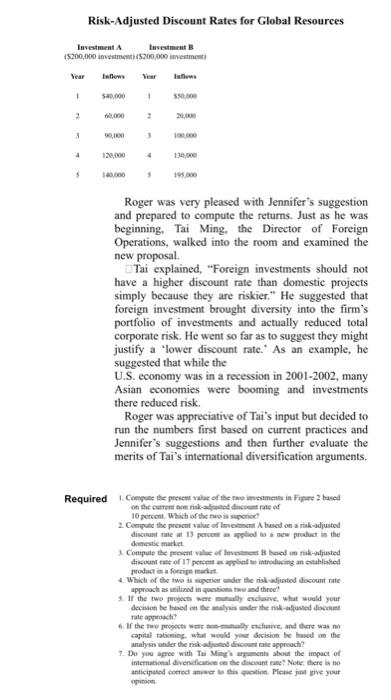

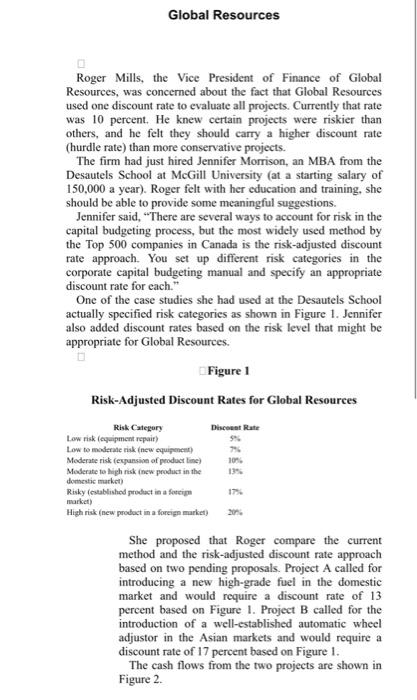

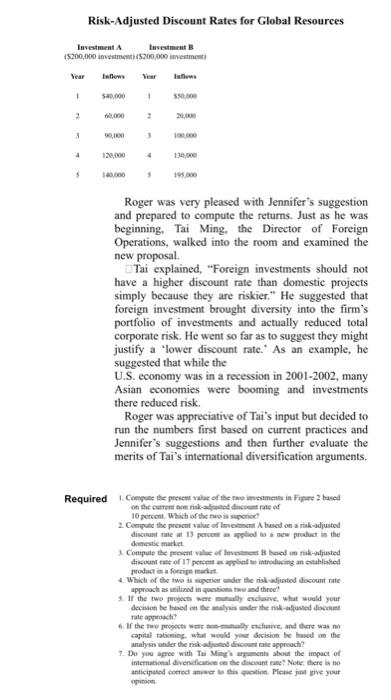

Roger Mills, the Vice President of Finance of Global Resources, was concerned about the fact that Global Resources used one discount rate to evaluate all projects. Currently that rate was 10 percent. He knew certain projects were riskier than others, and he felt they should carry a higher discount rate (hurdle rate) than more conservative projects. The firm had just hired Jennifer Morrison, an MBA from the Desautels School at McGill University (at a starting salary of 150,000 a year). Roger felt with her education and training, she should be able to provide some meaningful suggestions. Jennifer said, "There are several ways to account for risk in the capital budgeting process, but the most widely used method by the Top 500 companies in Canada is the risk-adjusted discount rate approach. You set up different risk categories in the corporate capital budgeting manual and specify an appropriate discount rate for each." One of the case studies she had used at the Desautels School actually specified risk categories as shown in Figure 1. Jennifer also added discount rates based on the risk level that might be appropriate for Global Resources. Figure 1 Risk-Adjusted Discount Rates for Global Resources She proposed that Roger compare the current method and the risk-adjusted discount rate approach based on two pending proposals. Project A called for introducing a new high-grade fuel in the domestic market and would require a discount rate of 13 percent based on Figure 1. Project B called for the introduction of a well-established automatic wheel adjustor in the Asian markets and would require a discount rate of 17 percent based on Figure 1. The cash flows from the two projects are shown in Figure 2. Risk-Adjusted Discount Rates for Global Resources Investment A Insestment B (\$200,000 imestment) (\$200,000 investment) Roger was very pleased with Jennifer's suggestion and prepared to compute the returns. Just as he was beginning. Tai Ming, the Director of Foreign Operations, walked into the room and examined the new proposal. Tai explained, "Foreign investments should not have a higher discount rate than domestic projects simply because they are riskier." He suggested that foreign investment brought diversity into the firm's portfolio of investments and actually reduced total corporate risk. He went so far as to suggest they might justify a 'lower discount rate.' As an example, he suggested that while the U.S. economy was in a recession in 2001-2002, many Asian economies were booming and investments there reduced risk. Roger was appreciative of Tai's input but decided to run the numbers first based on current practices and Jennifer's suggestions and then further evaluate the merits of Tai's international diversification arguments. Required 1. Ceempute the present valie of Ale no invimens in Fipere 2 haved 10 percent. Which of the two is sepencet discount rate at 13 pencest as ippliod to a new procluct in the domestic maket. product is a fortign matat. approach as initized in quations tow ind three? 5. If the two propects were mataly exclasive, what sould your rate approadi? 6. If the fap projects war noe-mally ectuave, and there was no analysis under the nik alfeated dincount rate approach? 7. Do you apree with Thi Ming's arenents about the impact of rinice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started