Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all the steps from the first to the last, meaning from 19 to 31 More Info 2017 Dec 19 Received a $3,000, 60-day,

Please solve all the steps from the first to the last, meaning from 19 to 31

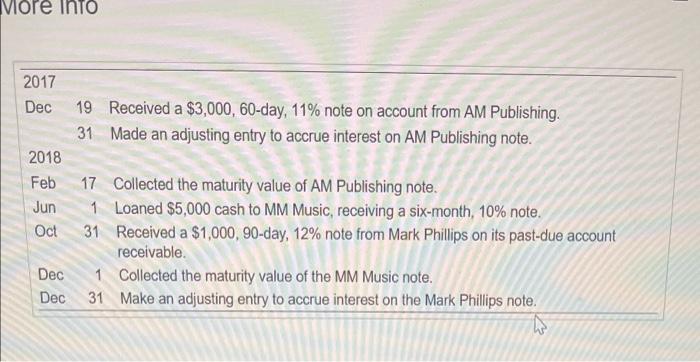

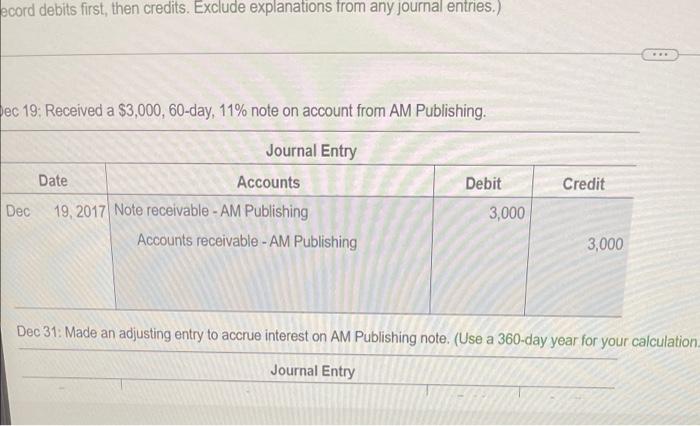

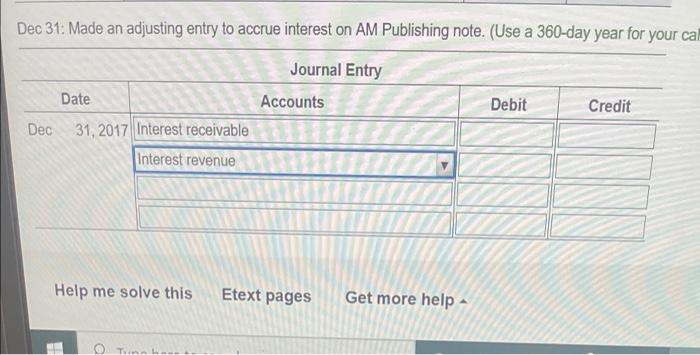

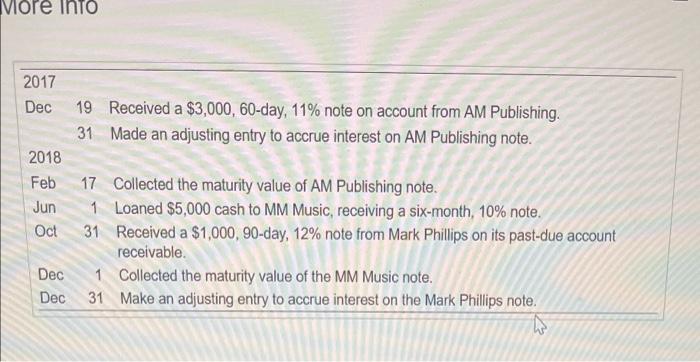

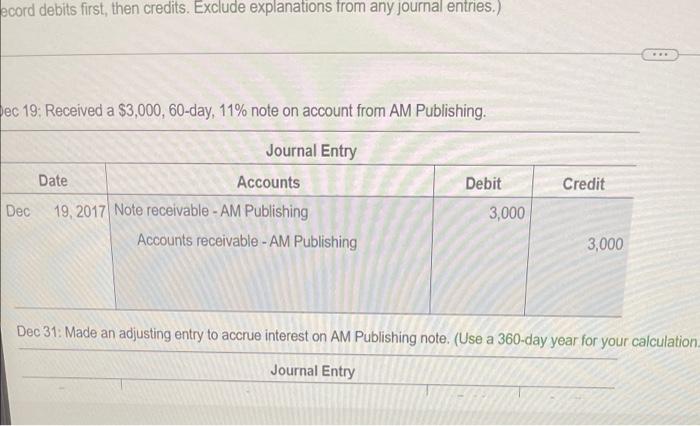

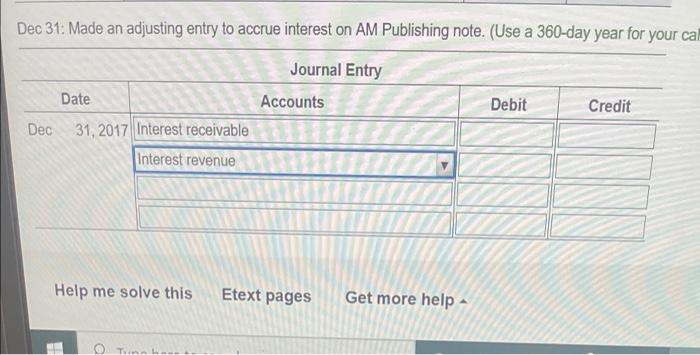

More Info 2017 Dec 19 Received a $3,000, 60-day, 11% note on account from AM Publishing. 31 Made an adjusting entry to accrue interest on AM Publishing note. 2018 Feb Jun Oct 17 Collected the maturity value of AM Publishing note. 1 Loaned $5,000 cash to MM Music, receiving a six-month, 10% note. 31 Received a $1,000, 90-day, 12% note from Mark Phillips on its past-due account receivable. 1 Collected the maturity value of the MM Music note. 31 Make an adjusting entry to accrue interest on the Mark Phillips note. Dec Dec ecord debits first, then credits. Exclude explanations from any journal entries.) Dec 19: Received a $3,000, 60-day, 11% note on account from AM Publishing. Debit Journal Entry Date Accounts 19, 2017 Note receivable - AM Publishing Accounts receivable - AM Publishing Credit Dec 3,000 3,000 Dec 31: Made an adjusting entry to accrue interest on AM Publishing note. (Use a 360-day year for your calculation Journal Entry Dec 31: Made an adjusting entry to accrue interest on AM Publishing note. (Use a 360-day year for your cal Journal Entry Accounts Date Debit Credit Dec 31, 2017 Interest receivable Interest revenue Help me solve this Etext pages Get more help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started