Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all will upvote! You bought 3M at the beginning of the year for $145/share. At the end of the year it was trading

please solve all will upvote!

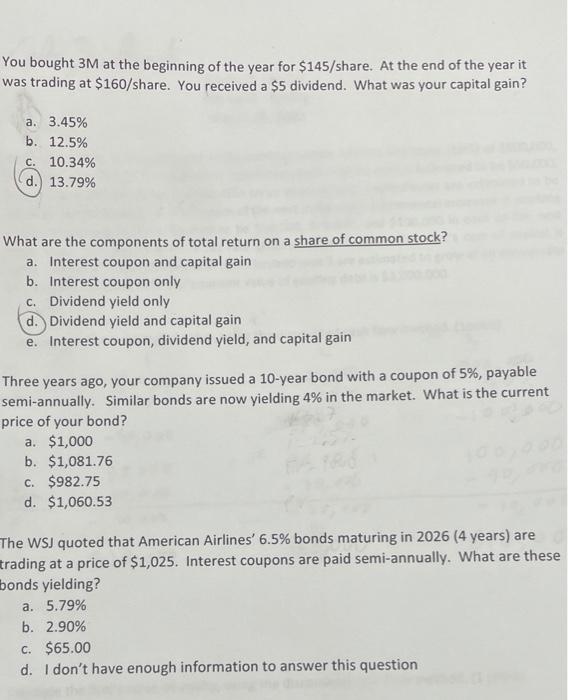

You bought 3M at the beginning of the year for $145/share. At the end of the year it was trading at $160/share. You received a $5 dividend. What was your capital gain? a. 3.45% b. 12.5% C. 10.34% d.) 13.79% What are the components of total return on a share of common stock? a. Interest coupon and capital gain b. Interest coupon only C. Dividend yield only d. Dividend yield and capital gain e. Interest coupon, dividend yield, and capital gain Three years ago, your company issued a 10-year bond with a coupon of 5%, payable semi-annually. Similar bonds are now yielding 4% in the market. What is the current price of your bond? a. $1,000 b. $1,081.76 C. $982.75 d. $1,060.53 The WSJ quoted that American Airlines' 6.5% bonds maturing in 2026 (4 years) are trading at a price of $1,025. Interest coupons are paid semi-annually. What are these bonds yielding? a. 5.79% b. 2.90% C. $65.00 d. I don't have enough information to answer this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started