Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve and indicate which formula you used. Question 1 (30 points) Five years ago, Diane secured a bank loan of $300,000 to help finance

Please solve and indicate which formula you used.

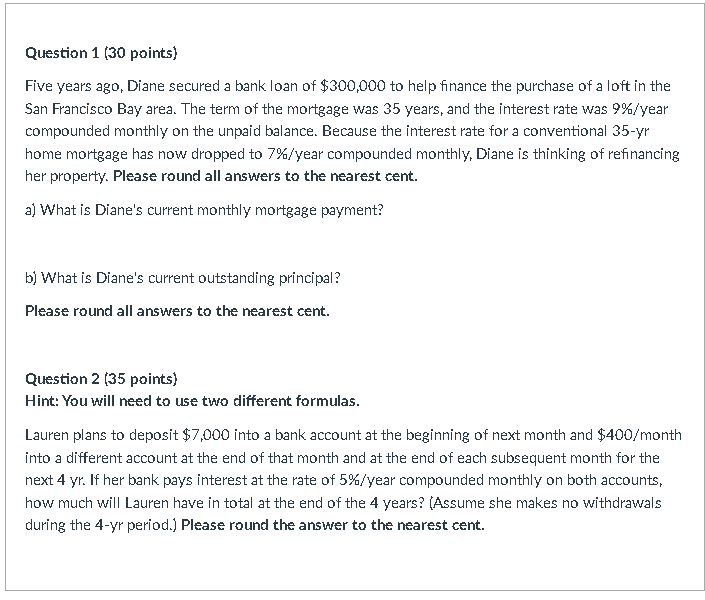

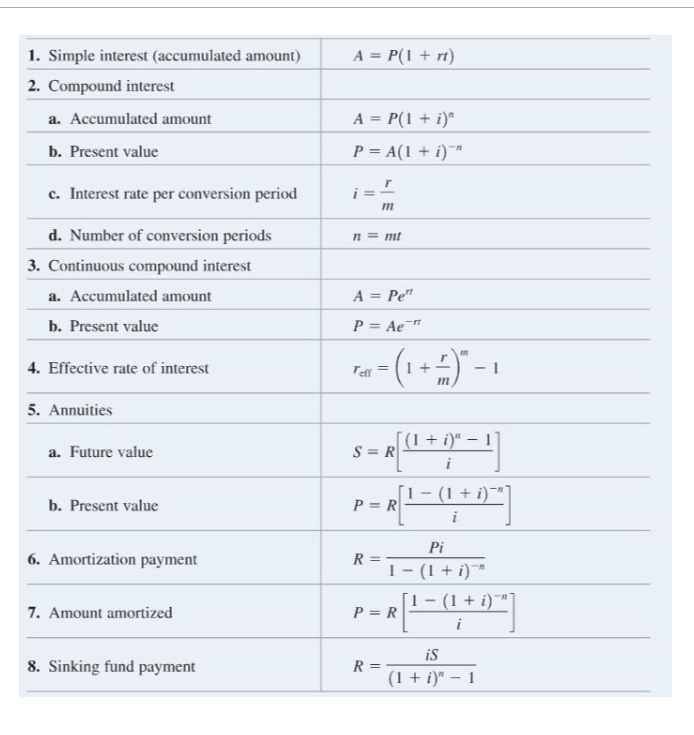

Question 1 (30 points) Five years ago, Diane secured a bank loan of $300,000 to help finance the purchase of a loft in the San Francisco Bay area. The term of the mortgage was 35 years, and the interest rate was 9%/year compounded monthly on the unpaid balance. Because the interest rate for a conventional 35-yr home mortgage has now dropped to 7%/year compounded monthly, Diane is thinking of refinancing her property. Please round all answers to the nearest cent. a) What is Diane's current monthly mortgage payment? b) What is Diane's current outstanding principal? Please round all answers to the nearest cent. Question 2 (35 points) Hint: You will need to use two different formulas. Lauren plans to deposit $7,000 into a bank account at the beginning of next month and $400/month into a different account at the end of that month and at the end of each subsequent month for the next 4 yr. If her bank pays interest at the rate of 5%/year compounded monthly on both accounts, how much will Lauren have in total at the end of the 4 years? (Assume she makes no withdrawals during the 4-yr period.) Please round the answer to the nearest cent. A = P(1 + rt) 1. Simple interest (accumulated amount) 2. Compound interest a. Accumulated amount b. Present value A = P(1 + i)" P = A(1 + i)" r c. Interest rate per conversion period m n = m d. Number of conversion periods 3. Continuous compound interest a. Accumulated amount b. Present value A = Pe" P = Ae-r 4. Effective rate of interest Por = = (1+)-1 + m 1 5. Annuities a. Future value ) [(1 + i)" S = R i [1 (1 + i)* P=R i b. Present value 6. Amortization payment - Pi R=- 1-(1 + i)** 1 - (1 + i) P=R i 7. Amount amortized - x[1+) 8. Sinking fund payment is R= (1 + i)" - 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started