Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve as much as you can. I will up-vote you lifetime. : Refer to the attached financial statements then compute the following: 1. Comparative

Please solve as much as you can. I will up-vote you lifetime. :

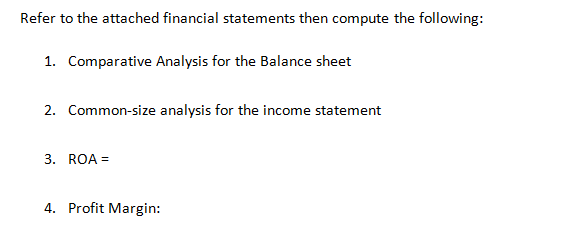

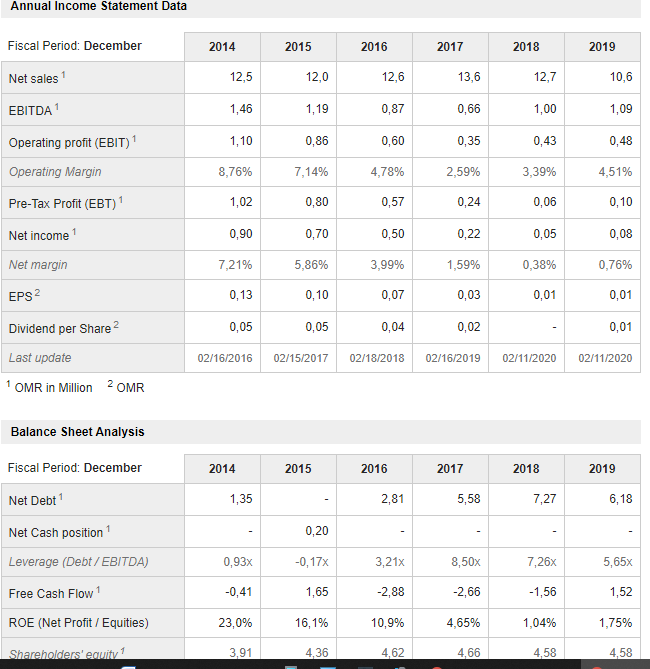

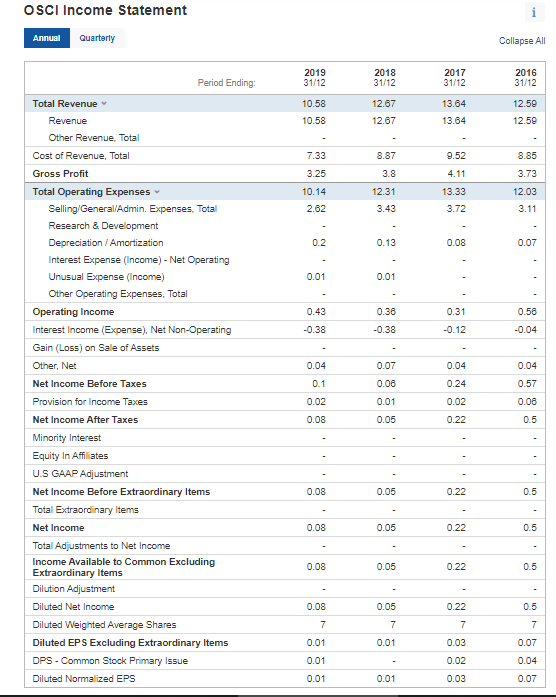

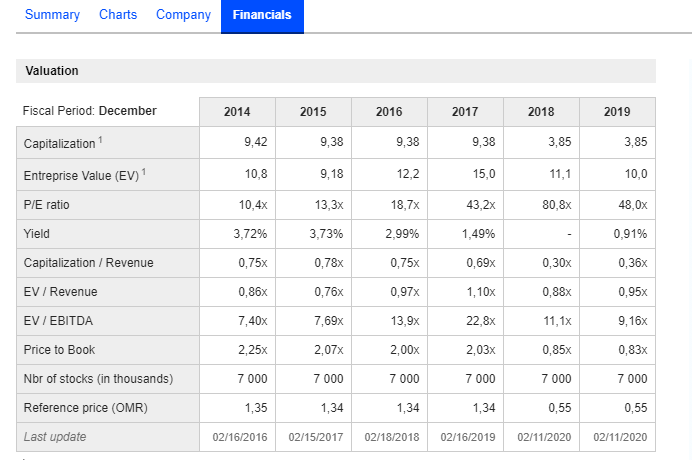

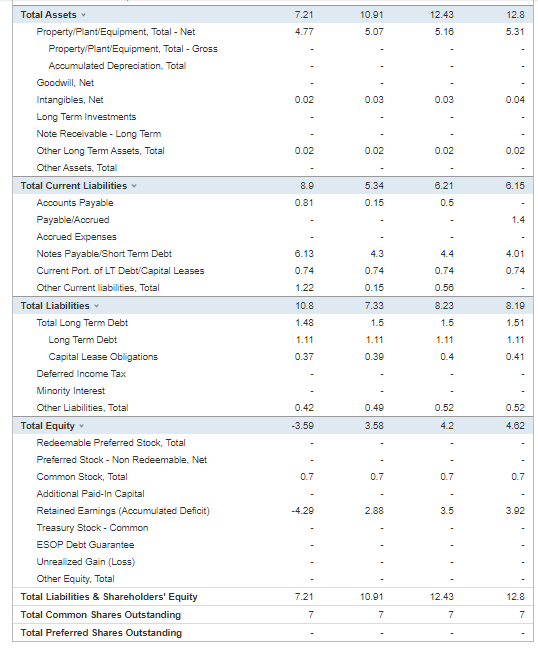

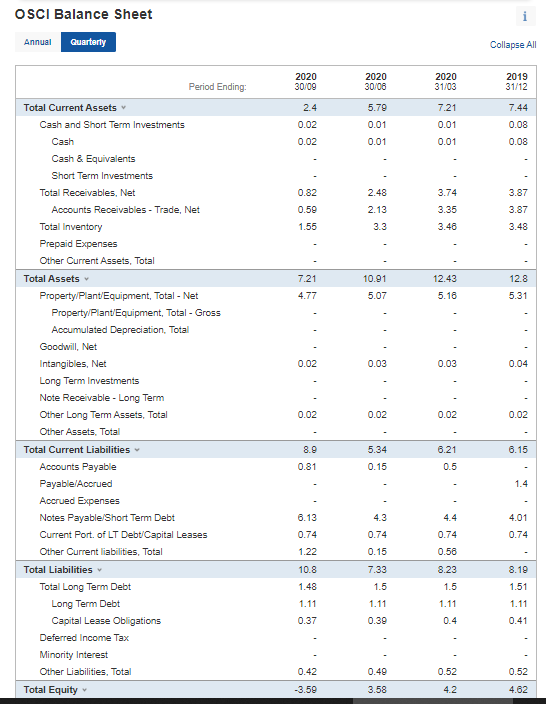

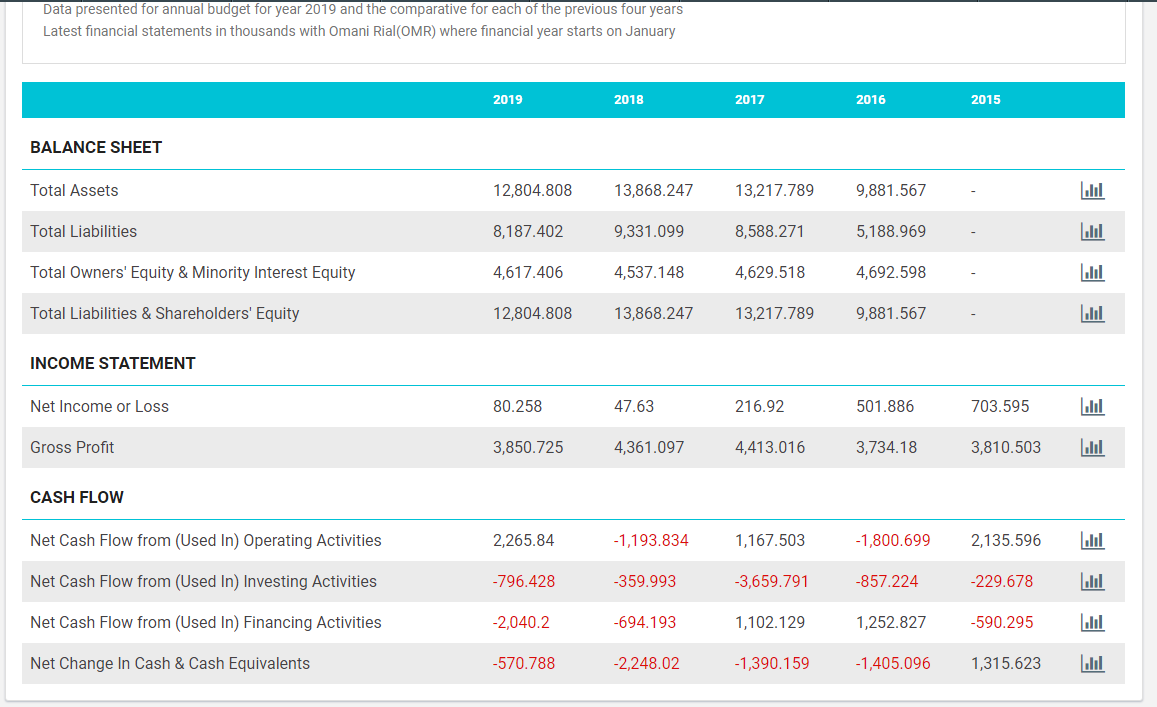

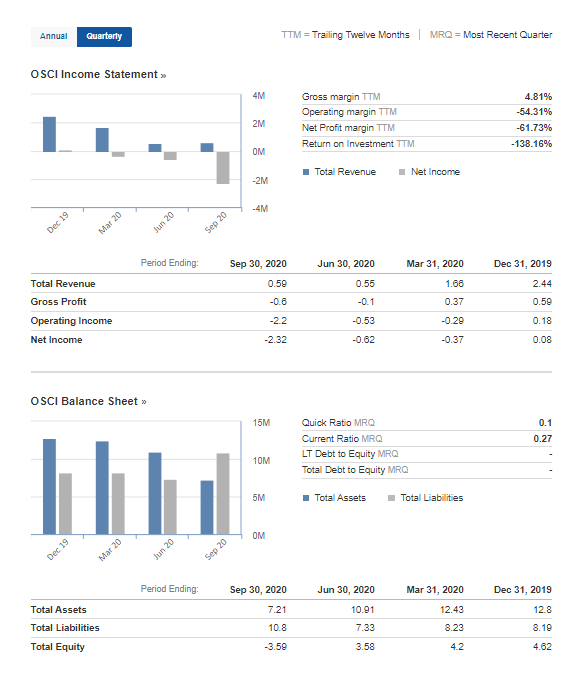

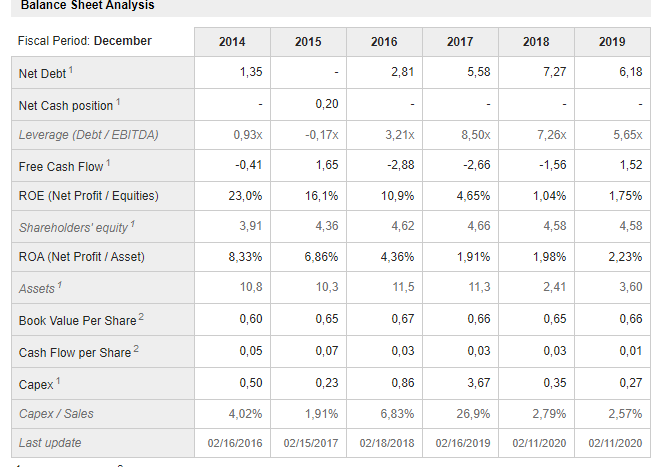

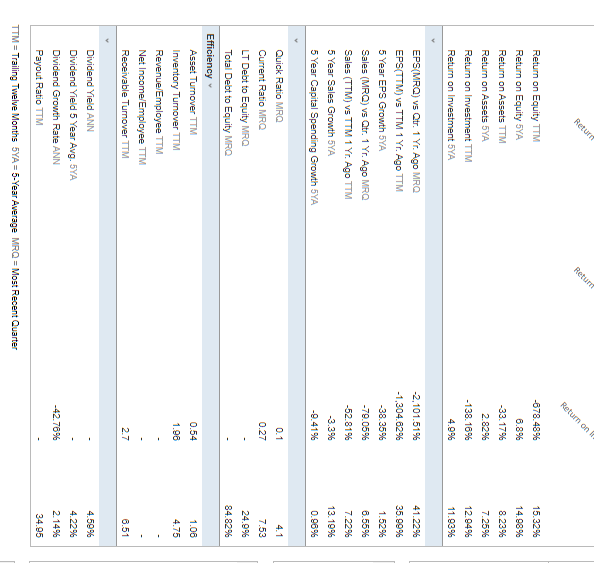

Refer to the attached financial statements then compute the following: 1. Comparative Analysis for the Balance sheet 2. Common-size analysis for the income statement 3. ROA = 4. Profit Margin: Annual Income Statement Data Fiscal Period: December 2014 2015 2016 2017 2018 2019 12,5 12,0 12,6 13,6 12,7 10.6 Net sales EBITDA1 1,46 1,19 0,87 0,66 1,00 1,09 Operating profit (EBIT) 1 1,10 0,86 0,60 0,35 0,43 0,48 8,76% 7,14% 4,78% 2,59% 3,39% 4,51% Operating Margin Pre-Tax Profit (EBT) 1 1,02 0,80 0,57 0,24 0,06 0,10 Net income 0,90 0,70 0,50 0,22 0,05 0,08 Net margin 7,21% 5,86% 3,99% 1,59% 0,38% 0,76% EPS 2 0,13 0,10 0,07 0,03 0,01 0,01 Dividend per Share 2 0,05 0,05 0,04 0,02 0,01 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 Last update 1 OMR in Million 2 OMR Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2,81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17x 3,21x 8,50x 7,26x 5,65x Free Cash Flow 1 -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 1 3.91 4,36 4,62 4,66 4,58 4,58 OSCI Income Statement Annual Quarterly Collapse All 2019 31/12 2018 31/12 2017 31/12 2016 31/12 12.59 10.58 10.58 12.67 12.67 13.64 13.64 12.59 7.33 8.87 9.52 8.85 3.25 3.8 4.11 3.73 10.14 12.31 3.43 13.33 3.72 12.03 3.11 2.62 0.2 0.13 0.08 0.07 0.01 0.01 0.43 0.38 0.31 0.58 -0.38 -0.38 -0.12 -0.04 0.04 0.07 0.04 0.04 Period Ending Total Revenue Revenue Other Revenue, Total Cost of Revenue, Total Gross Profit Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary Items Net Income Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment Diluted Net Income Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue Diluted Normalized EPS 0.1 0.08 0.24 0.57 0.02 0.01 0.02 0.08 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 7 7 7 7 0.07 0.01 0.01 0.03 0.01 0.02 0.04 0.01 0.01 0.03 0.07 Summary Charts Company Financials Valuation Fiscal Period: December 2014 2015 2016 2017 2018 2019 9,42 9,38 9,38 9,38 3,85 3,85 Capitalization Entreprise Value (EV) P/E ratio 10,8 9,18 122 15,0 11,1 10,0 10,4x 13,3x 18,7% 43,2x 80,8x 48,0x Yield 3,72% 3,73% 2,99% 1,49% 0,91% Capitalization / Revenue 0,75x 0,78x 0,75x 0,69% 0,30x 0,36x EV / Revenue 0,86x 0,76x 0,97% 1,10x 0,88 0,95x EV / EBITDA 7,40x 7,69% 13,9% 22,8x 11,1x 9,16x 2,25x 2,07x 2,00x 2,03x 0,85x Price to Book Nbr of stocks (in thousands) Reference price (OMR) 0,83% 7 000 7 000 7000 7 000 7 000 7000 1,35 1,34 1,34 1,34 0,55 0,55 Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 7.21 10.91 12.8 12.43 5.18 4.77 5.07 5.31 0.02 0.03 0.03 0.04 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 1.48 Total Assets Property/Plant Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets. Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities. Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities. Total Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding Total Preferred Shares Outstanding 7.33 1.5 8.23 1.5 8.19 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.49 0.52 0.52 0.42 -3.59 3.58 4.2 4.62 0.7 0.7 0.7 0.7 -4 29 2.88 3.5 3.92 7.21 10.91 12.43 12.8 7 7 7 7 OSCI Balance Sheet Annual Quarterly Collapse All 2020 30/09 2020 30/06 2020 31/03 2019 31/12 2.4 5.79 7.21 7.44 0.08 0.01 0.02 0.02 0.01 0.01 0.01 0.08 0.82 2.48 2.13 3.74 3.35 3.87 3.87 0.59 1.55 3.3 3.48 3.48 12.8 7.21 4.77 10.91 5.07 12.43 5.18 5.31 0.02 0.03 0.03 0.04 Period Ending: Total Current Assets Cash and Short Term Investments Cash Cash & Equivalents Short Term Investments Total Receivables, Net Accounts Receivables - Trade, Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Assets Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities, Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities, Total Total Equity 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 8.23 8.19 7.33 1.5 1.48 1.5 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.42 0.49 0.52 0.52 -3.50 3.58 4.2 4.62 Data presented for annual budget for year 2019 and the comparative for each of the previous four years Latest financial statements in thousands with Omani Rial (OMR) where financial year starts on January 2019 2018 2017 2016 2015 BALANCE SHEET Total Assets 12,804.808 13,868.247 13,217.789 9,881.567 Jul Total Liabilities 8,187.402 9,331.099 8,588.271 5,188.969 Total Owners' Equity & Minority Interest Equity 4,617.406 4,537.148 4,629.518 4,692.598 Total Liabilities & Shareholders' Equity 12,804.808 13,868.247 13,217.789 9,881.567 lil INCOME STATEMENT Net Income or Loss 80.258 47.63 216.92 501.886 703.595 Gross Profit 3,850.725 4,361.097 4,413.016 3,734.18 3,810.503 Jul CASH FLOW Net Cash Flow from (Used In) Operating Activities 2,265.84 -1,193.834 1,167.503 -1,800.699 2,135.596 Net Cash Flow from (Used In) Investing Activities -796.428 -359.993 -3,659.791 -857.224 -229.678 E LEE Net Cash Flow from (Used In) Financing Activities -2,040.2 -694.193 1,102.129 1,252.827 -590.295 Net Change In Cash & Cash Equivalents -570.788 -2,248.02 -1,390.159 -1,405.096 1,315.623 Annual Quarterly TTM = Trailing Twelve Months | MRQ = Most Recent Quarter OSCI Income Statement >> 4M 2M Gross margin TTM Operating margin TTM Net Profit margin TTM Return on Investment TTM 4.81% -54.31% -61.73% -138.16% OM Total Revenue Net Income -2M -4M Mar 20 Jun 20 Sep 20 Dec 19 Period Ending: Sep 30, 2020 Mar 31, 2020 Jun 30, 2020 0.55 0.59 1.66 Dec 31, 2019 2.44 0.59 -0.8 -0.1 0.37 Total Revenue Gross Profit Operating Income Net Income -22 -0.53 -0.29 0.18 -2.32 -0.62 -0.37 0.08 OSCI Balance Sheet 15M 0.1 0.27 Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO 10M 5M Total Assets Total Liabilities OM Dec 19 Mar 20 Jun 20 Sep 20 Period Ending Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 7.21 10.91 12.8 Total Assets Total Liabilities Total Equity 12.43 8.23 10.8 7.33 8.19 -3.59 3.58 4.2 4.62 Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2.81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17% 3,21x 8,50x 7,26% 5,65x Free Cash Flow -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 3,91 4,36 4,62 4,66 4,58 4,58 ROA (Net Profit / Asset) 8,33% 6,86% 4,36% 1,91% 1,98% 2.23% Assets 10,8 10,3 11,5 11,3 2,41 3,60 Book Value Per Share 2 0,60 0,65 0,67 0,66 0,65 0,66 Cash Flow per Share 2 0,05 0,07 0,03 0,03 0,03 0,01 Capex 1 0,50 0,23 0,86 3,67 0,35 0,27 Capex / Sales 4,02% 1,91% 6,83% 26,9% 2,79% 2,57% Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 Retur Retund Return on -678.48% 15.32% 14.98% 8.23% Return on Equity TTM Return on Equity 5YA Return on Assets TTM Return on Assets 5YA Return on Investment TTM Return on Investment 5YA 6.8% -33.17% 2.82% -138.16% 4.9% 7.2596 12.94% 11.63% 41.22% 35.99% 1.529% EPS(MRO) vs Otr. 1 Yr. Ago MRQ EPS(TTM) vs TTM 1 Yr. Ago TTM 5 Year EPS Growth 5YA Sales (MRQ) vs Qtr. 1 Yr Ago MRQ Sales (TTM) vs TTM 1 Yr. Ago TTM 5 Year Sales Growth 5YA 5 Year Capital Spending Growth SYA -2,101.51% -1,304.629 -38.35% -79.05% -52.81% -3.3% 6.55% 7.2296 13. 19% -9.41 0.96% 4.1 0.1 0.27 7.53 24.9% 84.82% Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO Efficiency Asset Turnover TTM Inventory Tumover TTM Revenue/Employee TTM Net Income/Employee TTM Receivable Turnover TTM 0.54 1.08 4.75 1.96 27 6.51 4.59% 4.22% 2.14% -42.76% Dividend Yield ANN Dividend Yield 5 Year Avg. 5YA Dividend Growth Rate ANN Payout Ratio ITM TTM = Trailing Twelve Months 5YA = 5-Year Average MRQ = Most Recent Quarter 34.95Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started